Question: Fisher's optimal capital structure is 65.0 % equity and 35.0 % percent debt. This year, Fisher expects to have retained earnings of $6,000,000. Fisher can

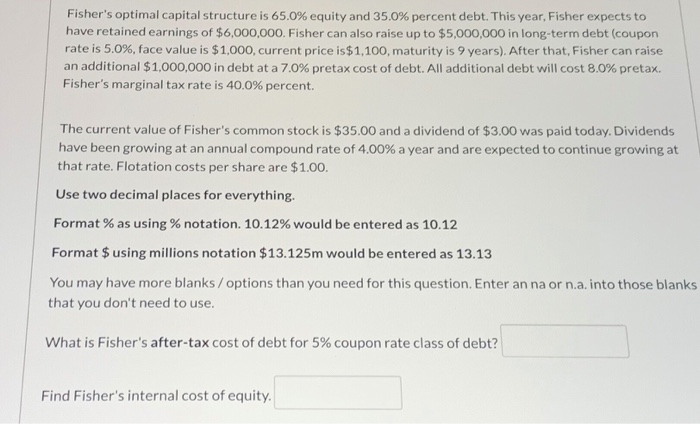

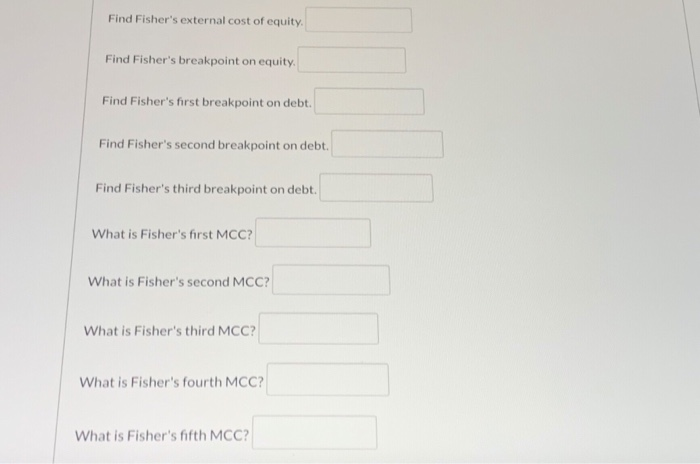

Fisher's optimal capital structure is 65.0 % equity and 35.0 % percent debt. This year, Fisher expects to have retained earnings of $6,000,000. Fisher can also raise up to $5,000,000 in long-term debt (coupon rate is 5.0%, face value is $1,000, current price is$1,100, maturity is 9 years). After that, Fisher can raise an additional $1,000,000 in debt at a 7.0 % pretax cost of debt. All additional debt will cost 8.0 % pretax . Fisher's marginal tax rate is 40.0% percent. The current value of Fisher's common stock is $35.00 and a dividend of $3.00 was paid today. Dividends have been growing at an annual compound rate of 4.00% a year and are expected to continue growing at that rate. Flotation costs per share are $1.00. Use two decimal places for everything Format % as using % notation. 10.12% would be entered as 10.12 Format $ using millions notation $13.125m would be entered as 13.13 You may have more blanks /options than you need for this question. Enter an na or n.a. into those blanks that you don't need to use. What is Fisher's after-tax cost of debt for 5% coupon rate class of debt? Find Fisher's internal cost of equity Find Fisher's external cost of equity. Find Fisher's breakpoint on equity Find Fisher's first breakpoint on debt. Find Fisher's second breakpoint on debt. Find Fisher's third breakpoint on debt. What is Fisher's first MCC? What is Fisher's second MCC? What is Fisher's third MCC? What is Fisher's fourth MCC? What is Fisher's fifth MCC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts