Question: FISV 4050 Portfolio Management & Analysis Case Study 2- Team Pro ject Choose one of the following companies to analyze: Facebook (FB) Boeing (BA) Tesla

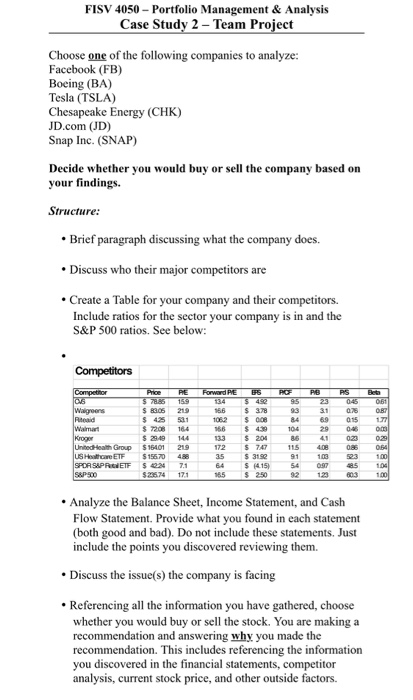

FISV 4050 Portfolio Management & Analysis Case Study 2- Team Pro ject Choose one of the following companies to analyze: Facebook (FB) Boeing (BA) Tesla (TSLA) Chesapeake Energy (CHK) JD.com (JD) Snap Inc. (SNAP) Decide whether you would buy or sell the company based on your findings Structure Brief paragraph discussing what the company does. Discuss who their major competitors are Create a Table for your company and their competitors. Include ratios for the sector your company is in S&P 500 ratios. See below: and the $830 219 $ 425 531 $7208 164 $ 2949 144 Group $16401 219 156 $ 378 1062 $ 008 166 133 204 172 74711 408 06 35 $ 3192 64 $ (415) 5 185 $ 250 1 076 69 015 29 04 41 023 84 S&P 500 $23574 17 92 123 603 1 Analyze the Balance Sheet, Income Statement, and Cash Flow Statement. Provide what you found in each statement (both good and bad). Do not include these statements. Just include the points you discovered reviewing them. Discuss the issue(s) the company is facing Referencing all the information you have gathered, choose whether you would buy or sell the stock. You are making a recommendation and answering why you made the recommendation. This includes referencing the information you discovered in the financial statements, competitor analysis, current stock price, and other outside factors. FISV 4050 Portfolio Management & Analysis Case Study 2- Team Pro ject Choose one of the following companies to analyze: Facebook (FB) Boeing (BA) Tesla (TSLA) Chesapeake Energy (CHK) JD.com (JD) Snap Inc. (SNAP) Decide whether you would buy or sell the company based on your findings Structure Brief paragraph discussing what the company does. Discuss who their major competitors are Create a Table for your company and their competitors. Include ratios for the sector your company is in S&P 500 ratios. See below: and the $830 219 $ 425 531 $7208 164 $ 2949 144 Group $16401 219 156 $ 378 1062 $ 008 166 133 204 172 74711 408 06 35 $ 3192 64 $ (415) 5 185 $ 250 1 076 69 015 29 04 41 023 84 S&P 500 $23574 17 92 123 603 1 Analyze the Balance Sheet, Income Statement, and Cash Flow Statement. Provide what you found in each statement (both good and bad). Do not include these statements. Just include the points you discovered reviewing them. Discuss the issue(s) the company is facing Referencing all the information you have gathered, choose whether you would buy or sell the stock. You are making a recommendation and answering why you made the recommendation. This includes referencing the information you discovered in the financial statements, competitor analysis, current stock price, and other outside factors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts