Question: 2. Fitbit Ltd has leased a machine on the following terms: Date of entering lease 1 July 2019 Duration of lease 5 years Life

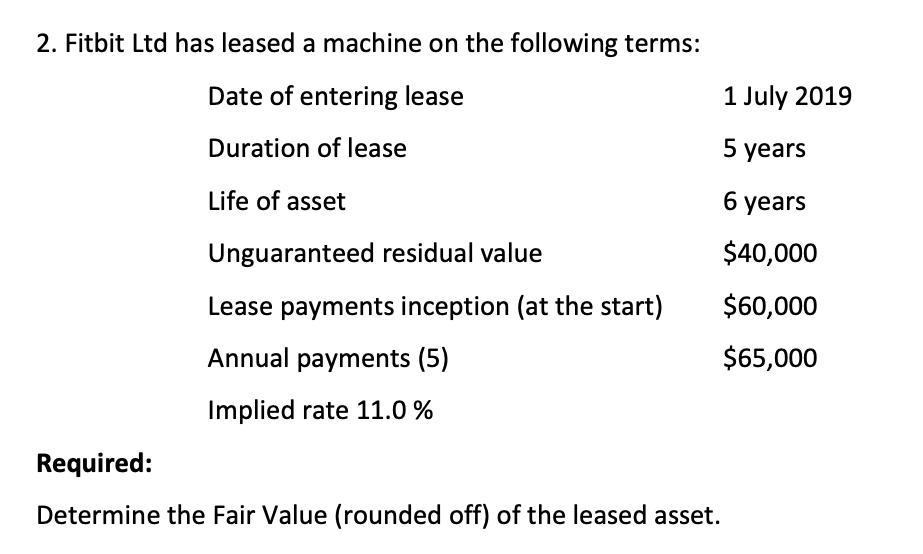

2. Fitbit Ltd has leased a machine on the following terms: Date of entering lease 1 July 2019 Duration of lease 5 years Life of asset 6 years Unguaranteed residual value $40,000 Lease payments inception (at the start) $60,000 Annual payments (5) $65,000 Implied rate 11.0 % Required: Determine the Fair Value (rounded off) of the leased asset.

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts