Question: FIU FIU | Login X MindTap - Cengage Learning *Homework Help - Q&A from Onl x + X C ng.cengage.com/staticb/ui/evo/index.html?deploymentld=593314221960140805465244290098leISBN=9781337911009&id=10437455768snapshotld=21707298 Update : > > CENGAGE

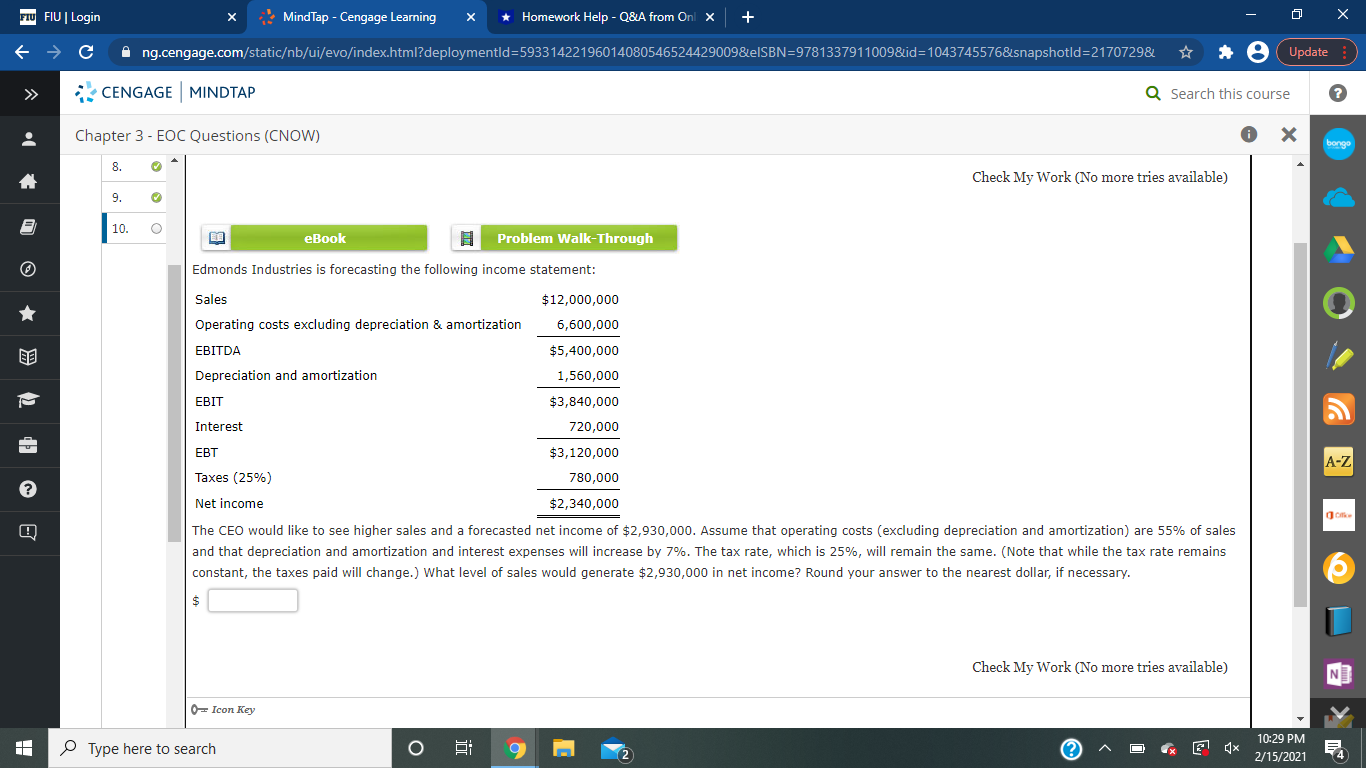

FIU FIU | Login X MindTap - Cengage Learning *Homework Help - Q&A from Onl x + X C ng.cengage.com/staticb/ui/evo/index.html?deploymentld=593314221960140805465244290098leISBN=9781337911009&id=10437455768snapshotld=21707298 Update : > > CENGAGE |MINDTAP Q Search this course ? Chapter 3 - EOC Questions (CNOW) X ongo 8. Check My Work (No more tries available) 9 10 O eBook Problem Walk-Through Edmonds Industries is forecasting the following income statement: Sales $12,000,000 Operating costs excluding depreciation & amortization 6,600,000 EBITDA $5,400,000 Depreciation and amortization 1,560,000 EBIT $3,840,000 Interest 720,000 EBT $3,120,000 A-Z Taxes (25%) 780,000 ? Net income $2,340,000 on. The CEO would like to see higher sales and a forecasted net income of $2,930,000. Assume that operating costs (excluding depreciation and amortization) are 55% of sales and that depreciation and amortization and interest expenses will increase by 7%. The tax rate, which is 25%, will remain the same. (Note that while the tax rate remains constant, the taxes paid will change.) What level of sales would generate $2,930,000 in net income? Round your answer to the nearest dollar, if necessary. $ Check My Work (No more tries available) N Of Icon Key Type here to search 10:29 PM O 9 m 2 2/15/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts