Question: Five $1000 bonds with 2.2% coupons payable annually are purchased nine months after a coupon matures, to yield 1.1% compounded semi-annually. The bonds mature in

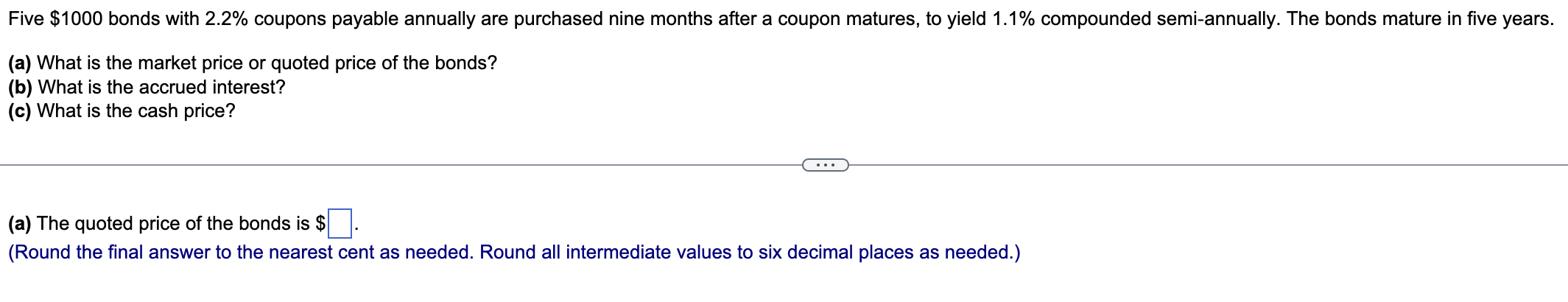

Five $1000 bonds with 2.2% coupons payable annually are purchased nine months after a coupon matures, to yield 1.1% compounded semi-annually. The bonds mature in five years. (a) What is the market price or quoted price of the bonds? (b) What is the accrued interest? (c) What is the cash price? (a) The quoted price of the bonds is $. (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock