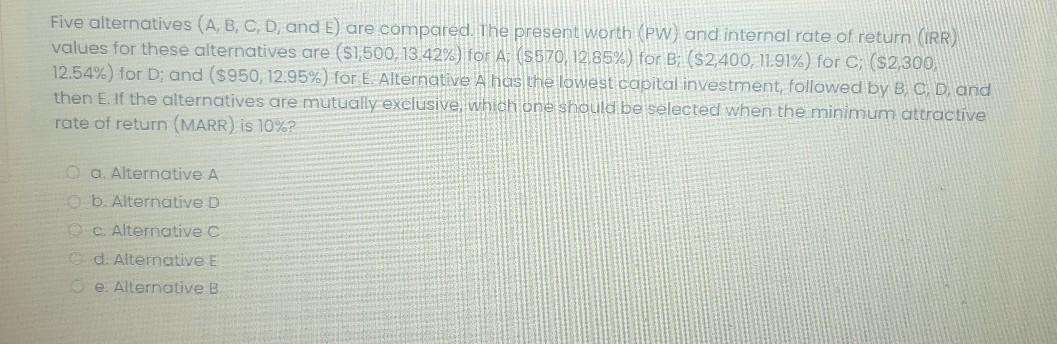

Question: Five alternatives (A, B, C, D, and E) are compared. The present worth (PW) and internal rate of return (IRR) values for these alternatives are

Five alternatives (A, B, C, D, and E) are compared. The present worth (PW) and internal rate of return (IRR) values for these alternatives are ($1500.13.42%) for A (5570, 12.85%) for B: (52,400, 11.91%) for C ($2,300) 12.54%) for D; and ($950, 12.95%) for E. Alternative A has the lowest capital investment followed by B C D and then E. If the alternatives are mutually exclusive, which one should be selected when the minimum attractive rate of return (MARR) is 10%? a. Alternative A b. Alternative D c. Alternative C Cd. Alternative E se. Alternative B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts