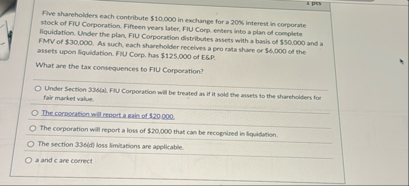

Question: Five shareholders each contribute $ 1 0 , 0 0 0 in exchange for a 2 0 $ , interent in corporate stock of FIU

Five shareholders each contribute $ in exchange for a $ interent in corporate stock of FIU Corporation. Fifteen years later, FIU Corp. erters into a plan of complete liquidation. Under the plan, FIU Corporation distribuites assets with a basls of $ and a FMY of $ As such, each shareholder necelves a pro rata share or $ of the assets upon liquidation. FIU Corp, has $ of ESP

What are the tax conneguences to FIU Corporation?

Under Section dal. FIU Comporation will be treated as if it wold the ansets to the shareholders for fair market value.

The cormoramion wit etport a gain of $

The corporation will report a lows of $ that can be recognired in liquidation.

The section loss limieations are applicable.

a and c are correct

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock