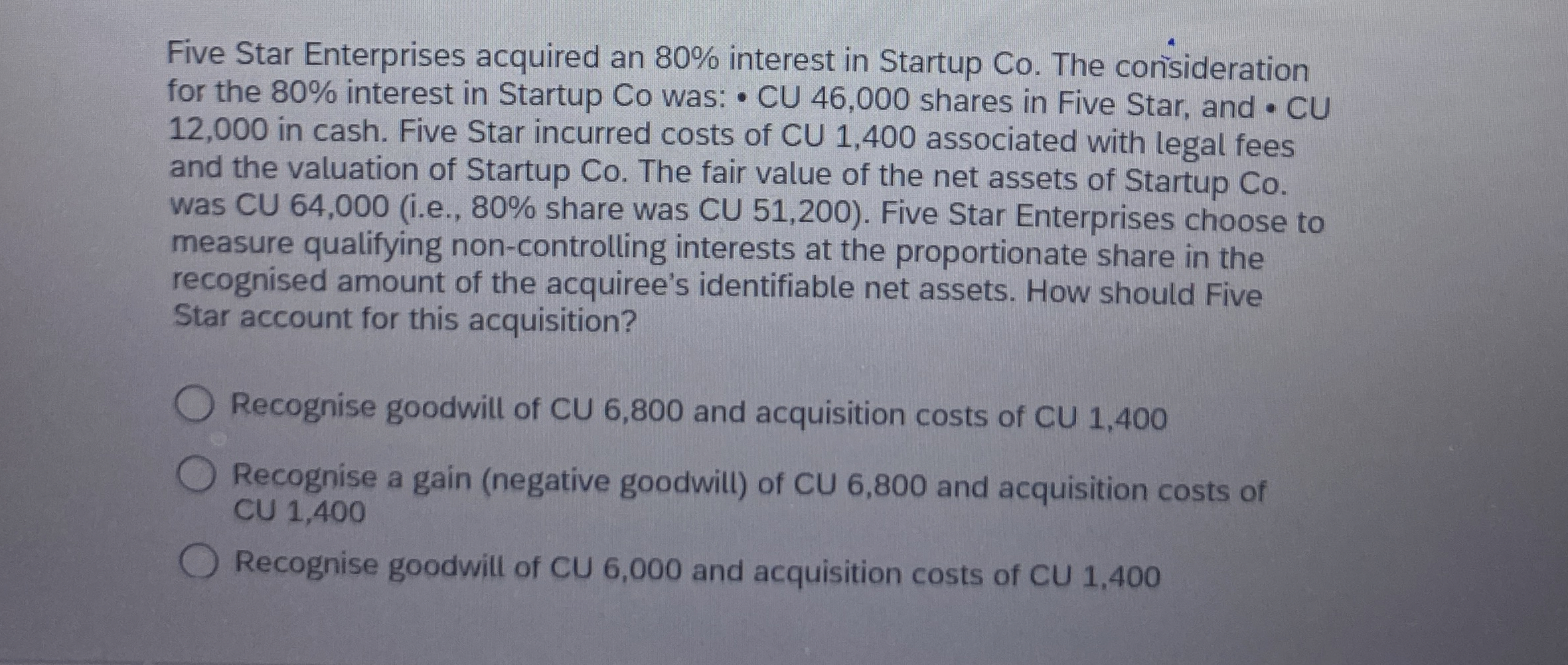

Question: Five Star Enterprises acquired an 8 0 % interest in Startup Co . The corisideration for the 8 0 % interest in Startup Co was:

Five Star Enterprises acquired an interest in Startup Co The corisideration

for the interest in Startup Co was: CU shares in Five Star, and CU

in cash. Five Star incurred costs of CU associated with legal fees

and the valuation of Startup Co The fair value of the net assets of Startup Co

was CU ie share was CU Five Star Enterprises choose to

measure qualifying noncontrolling interests at the proportionate share in the

recognised amount of the acquiree's identifiable net assets. How should Five

Star account for this acquisition?

Recognise goodwill of CU and acquisition costs of CU

Recognise a gain negative goodwill of CU and acquisition costs of

CU

Recognise goodwill of CU and acquisition costs of CU

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock