Question: Five years ago, ABC, Incorporated granted Ms. Lu a qualified incentive stock option (ISO) to purchase 1,000 shares of ABC stock at $60 per share.

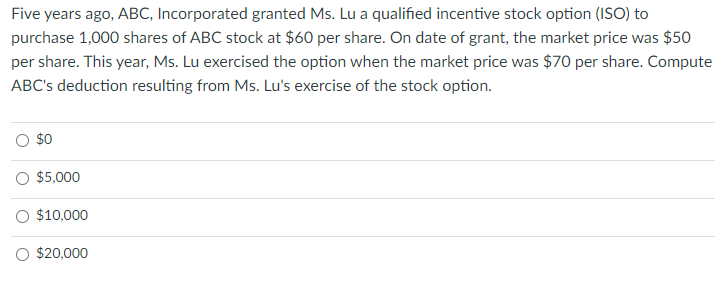

Five years ago, ABC, Incorporated granted Ms. Lu a qualified incentive stock option (ISO) to purchase 1,000 shares of ABC stock at $60 per share. On date of grant, the market price was $50 per share. This year, Ms. Lu exercised the option when the market price was $70 per share. Compute ABC's deduction resulting from Ms. Lu's exercise of the stock option. $0 O $5,000 O $10,000 $20,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts