Question: Five years ago, Marcus bought a house. He secured a mortgage from his bank for $1,900,000 . The mortgage had monthly payments for 20

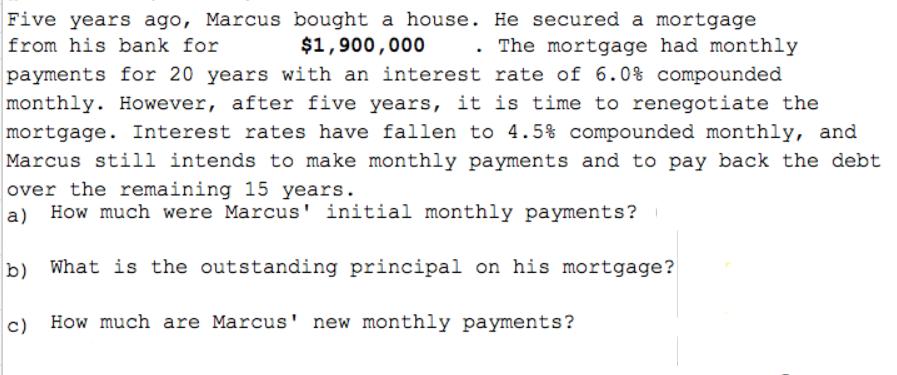

Five years ago, Marcus bought a house. He secured a mortgage from his bank for $1,900,000 . The mortgage had monthly payments for 20 years with an interest rate of 6.0% compounded monthly. However, after five years, it is time to renegotiate the mortgage. Interest rates have fallen to 4.5% compounded monthly, and Marcus still intends to make monthly payments and to pay back the debt over the remaining 15 years. a) How much were Marcus' initial monthly payments? b) What is the outstanding principal on his mortgage? c) How much are Marcus' new monthly payments?

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

a To calculate the initial monthly payments we need to use the formula for the present value of an a... View full answer

Get step-by-step solutions from verified subject matter experts