Question: Five years ago, you bought a house using a $500,000 30-year fixed rate loan with an interest rate of 4.5%. Your monthly payments for

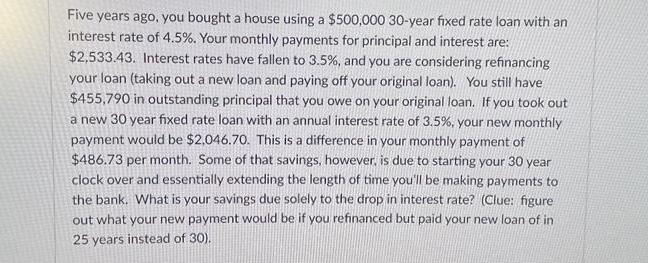

Five years ago, you bought a house using a $500,000 30-year fixed rate loan with an interest rate of 4.5%. Your monthly payments for principal and interest are: $2,533.43. Interest rates have fallen to 3.5%, and you are considering refinancing your loan (taking out a new loan and paying off your original loan). You still have $455,790 in outstanding principal that you owe on your original loan. If you took out a new 30 year fixed rate loan with an annual interest rate of 3.5%, your new monthly payment would be $2,046.70. This is a difference in your monthly payment of $486.73 per month. Some of that savings, however, is due to starting your 30 year clock over and essentially extending the length of time you'll be making payments to the bank. What is your savings due solely to the drop in interest rate? (Clue: figure out what your new payment would be if you refinanced but paid your new loan of in 25 years instead of 30).

Step by Step Solution

3.38 Rating (142 Votes )

There are 3 Steps involved in it

To calculate the savings solely due to the drop in interest rate we need to determine the new monthl... View full answer

Get step-by-step solutions from verified subject matter experts