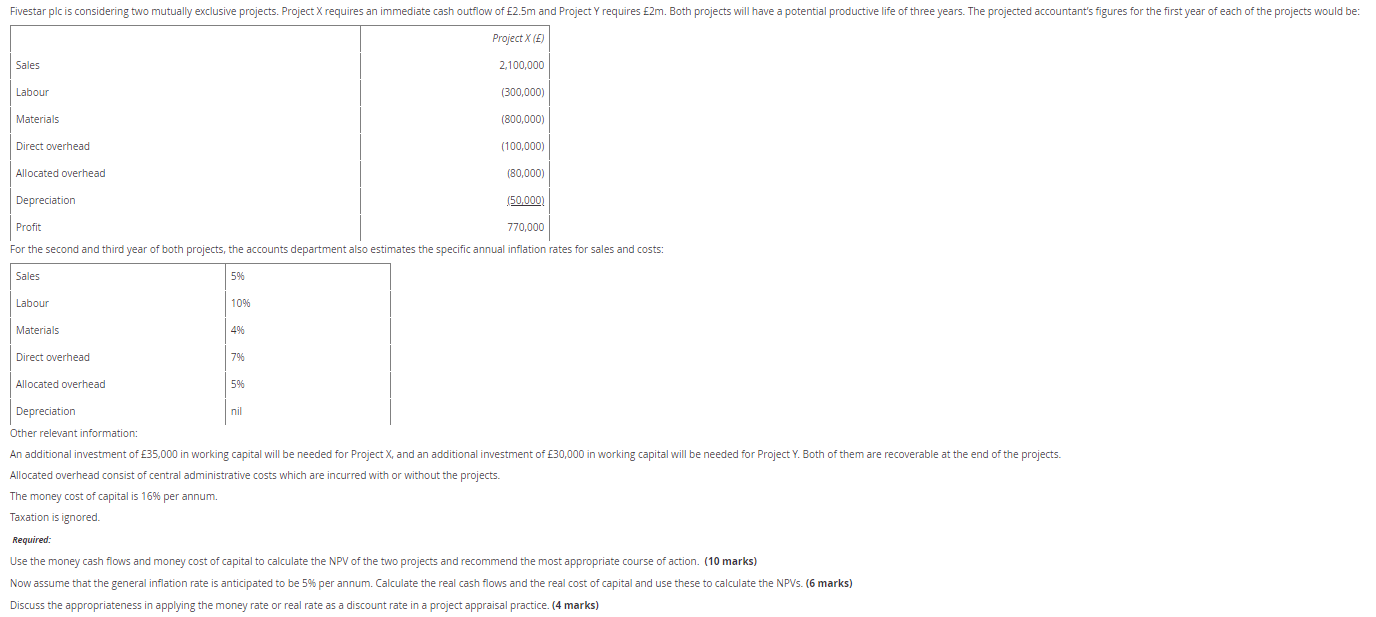

Question: Fivestar plc is considering two mutually exclusive projects. Project X requires an immediate cash outflow of 2.5m and Project Y requires 2m. Both projects will

Fivestar plc is considering two mutually exclusive projects. Project X requires an immediate cash outflow of 2.5m and Project Y requires 2m. Both projects will have a potential productive life of three years. The projected accountant's figures for the first year of each of the projects would be: Project X () 2,100,000 (300.000) Sales Labour Materials Direct overhead (800,000) (100,000) Allocated overhead (80,000) Depreciation (50,000) Profit 770,000 For the second and third year of both projects, the accounts department also estimates the specific annual inflation rates for sales and costs: Sales 5% Labour 10% Materials 4% Direct overhead 7% Allocated overhead 5% Depreciation nil Other relevant information: An additional investment of 35,000 in working capital will be needed for Project X, and an additional investment of 30,000 in working capital will be needed for Project Y. Both of them are recoverable at the end of the projects. Allocated overhead consist of central administrative costs which are incurred with or without the projects. The money cost of capital is 16% per annum. Taxation is ignored. Required: Use the money cash flows and money cost of capital to calculate the NPV of the two projects and recommend the most appropriate course of action. (10 marks) Now assume that the general inflation rate is anticipated to be 5% per annum. Calculate the real cash flows and the real cost of capital and use these to calculate the NPVs. (6 marks) Discuss the appropriateness in applying the money rate or real rate as a discount rate in a project appraisal practice. (4 marks) Fivestar plc is considering two mutually exclusive projects. Project X requires an immediate cash outflow of 2.5m and Project Y requires 2m. Both projects will have a potential productive life of three years. The projected accountant's figures for the first year of each of the projects would be: Project X () 2,100,000 (300.000) Sales Labour Materials Direct overhead (800,000) (100,000) Allocated overhead (80,000) Depreciation (50,000) Profit 770,000 For the second and third year of both projects, the accounts department also estimates the specific annual inflation rates for sales and costs: Sales 5% Labour 10% Materials 4% Direct overhead 7% Allocated overhead 5% Depreciation nil Other relevant information: An additional investment of 35,000 in working capital will be needed for Project X, and an additional investment of 30,000 in working capital will be needed for Project Y. Both of them are recoverable at the end of the projects. Allocated overhead consist of central administrative costs which are incurred with or without the projects. The money cost of capital is 16% per annum. Taxation is ignored. Required: Use the money cash flows and money cost of capital to calculate the NPV of the two projects and recommend the most appropriate course of action. (10 marks) Now assume that the general inflation rate is anticipated to be 5% per annum. Calculate the real cash flows and the real cost of capital and use these to calculate the NPVs. (6 marks) Discuss the appropriateness in applying the money rate or real rate as a discount rate in a project appraisal practice. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts