Question: Fix all the Terms and Numbers boxed in Red. The Oriole Company opened for business on May 1, 2022. Its trial balance before adjustment on

Fix all the Terms and Numbers boxed in Red.

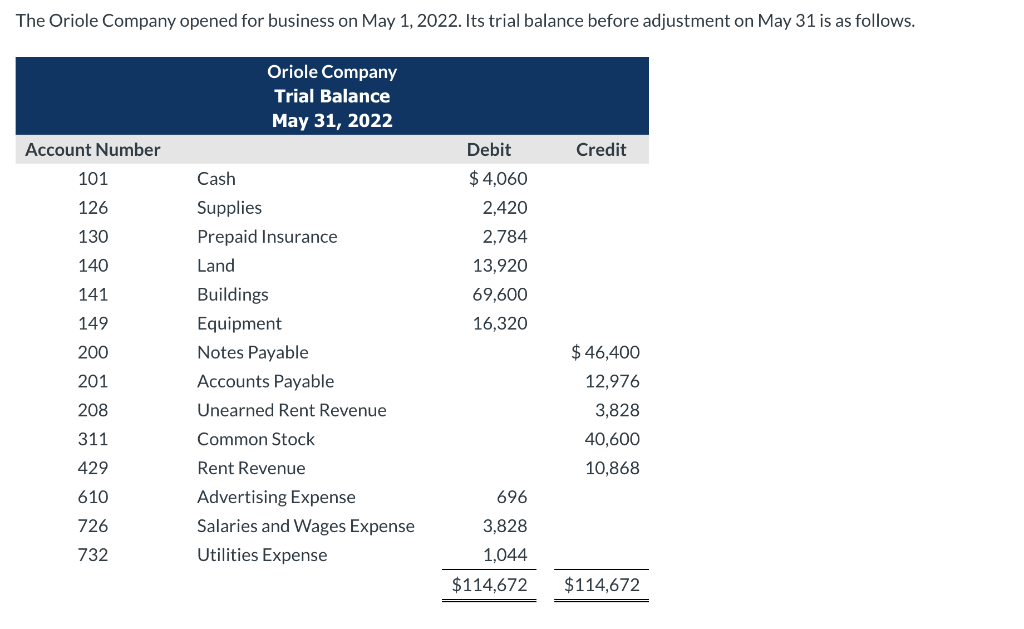

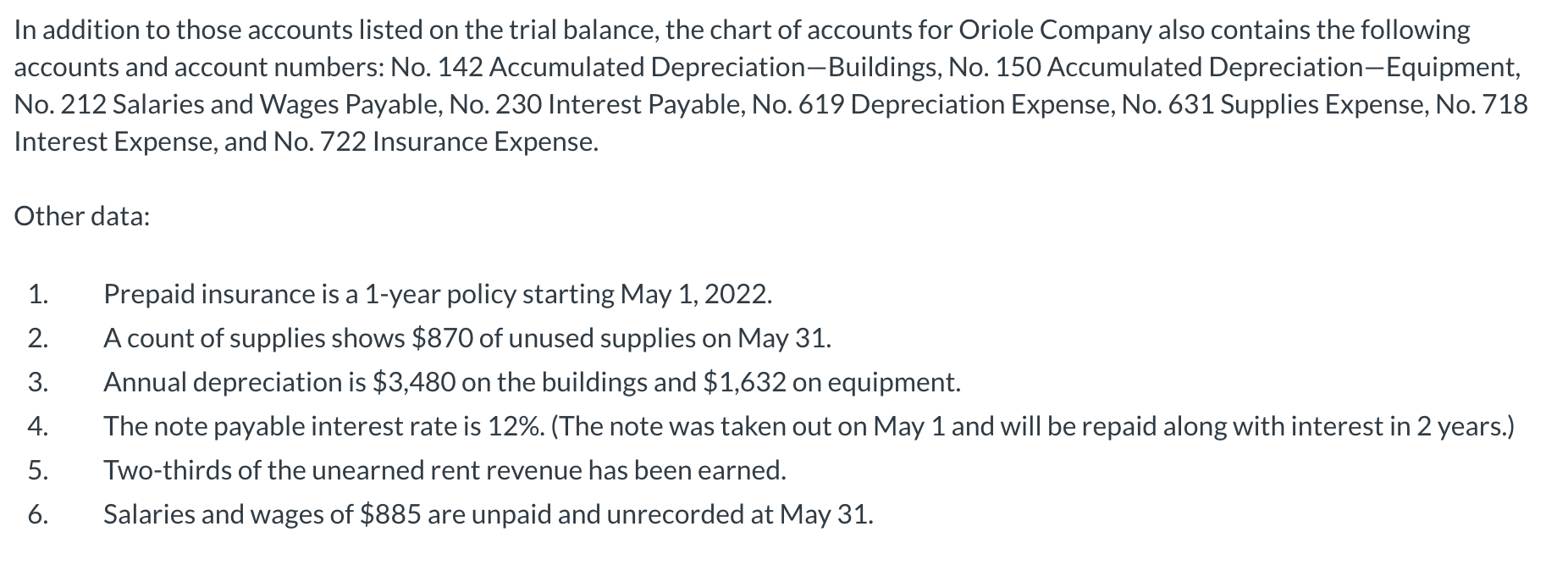

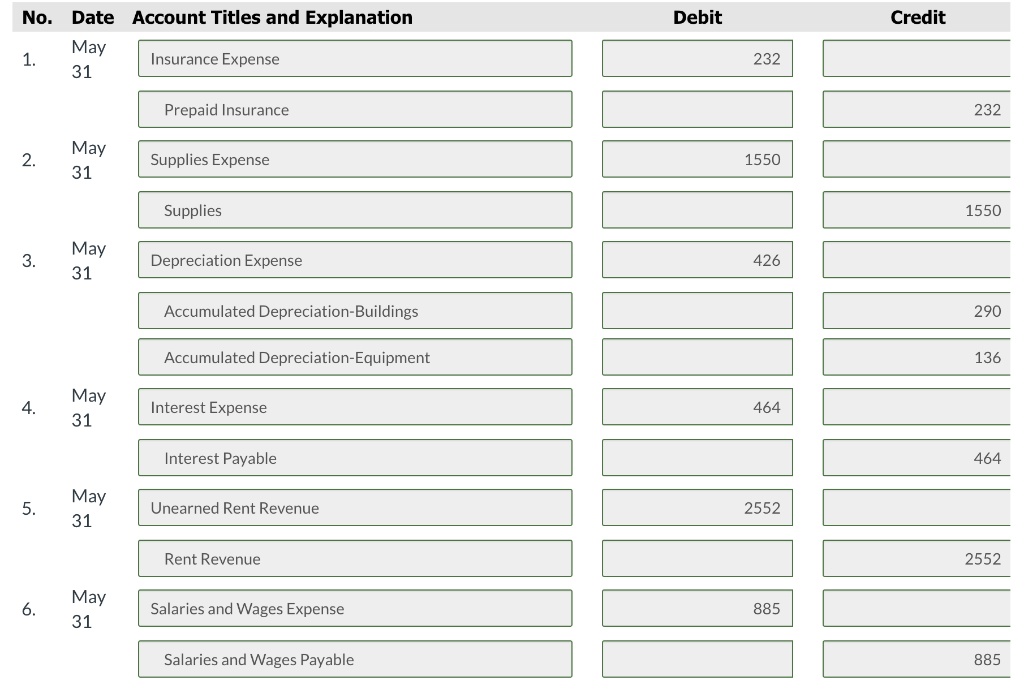

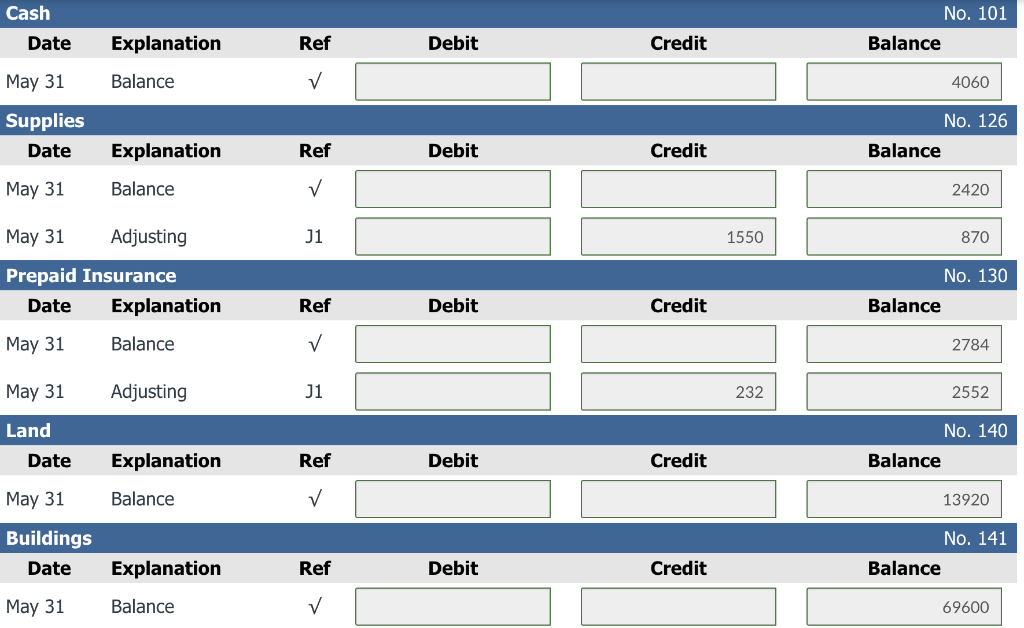

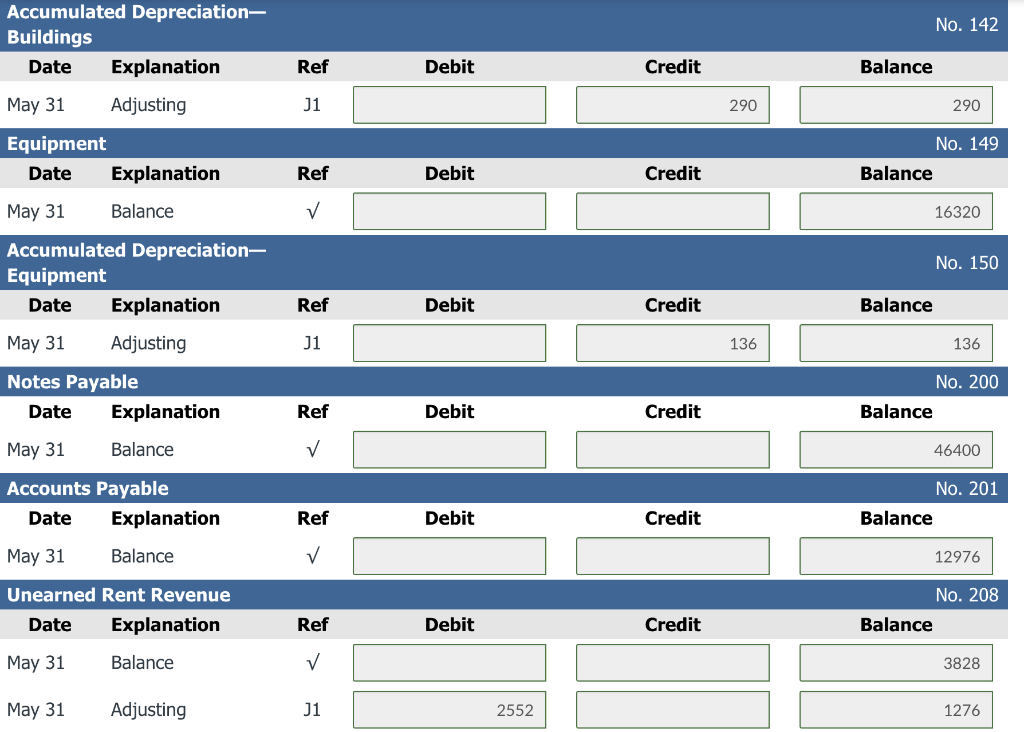

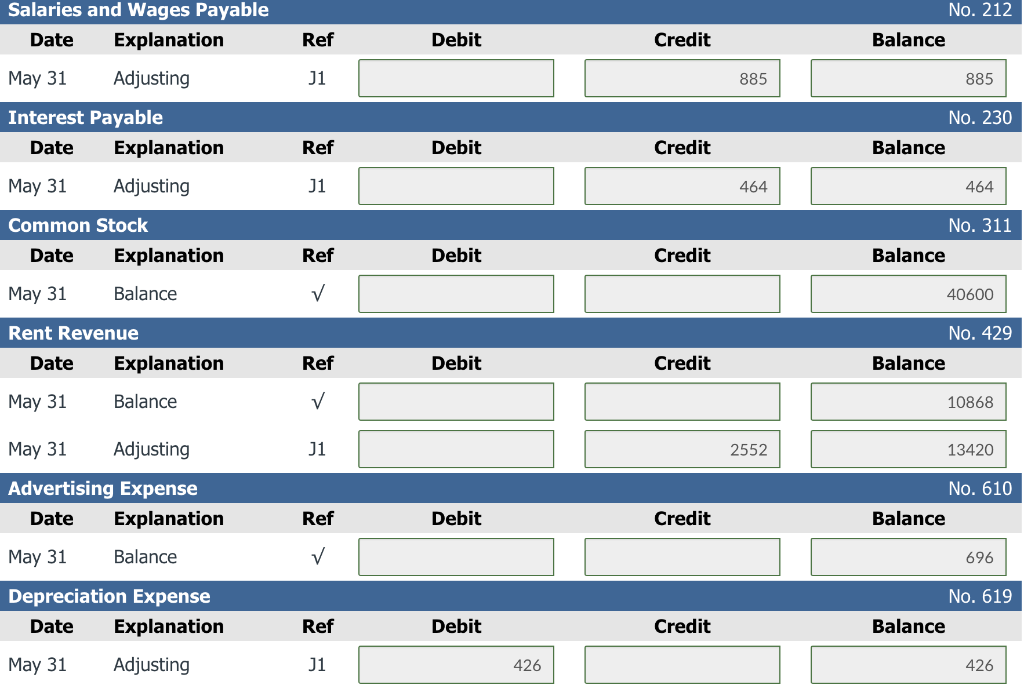

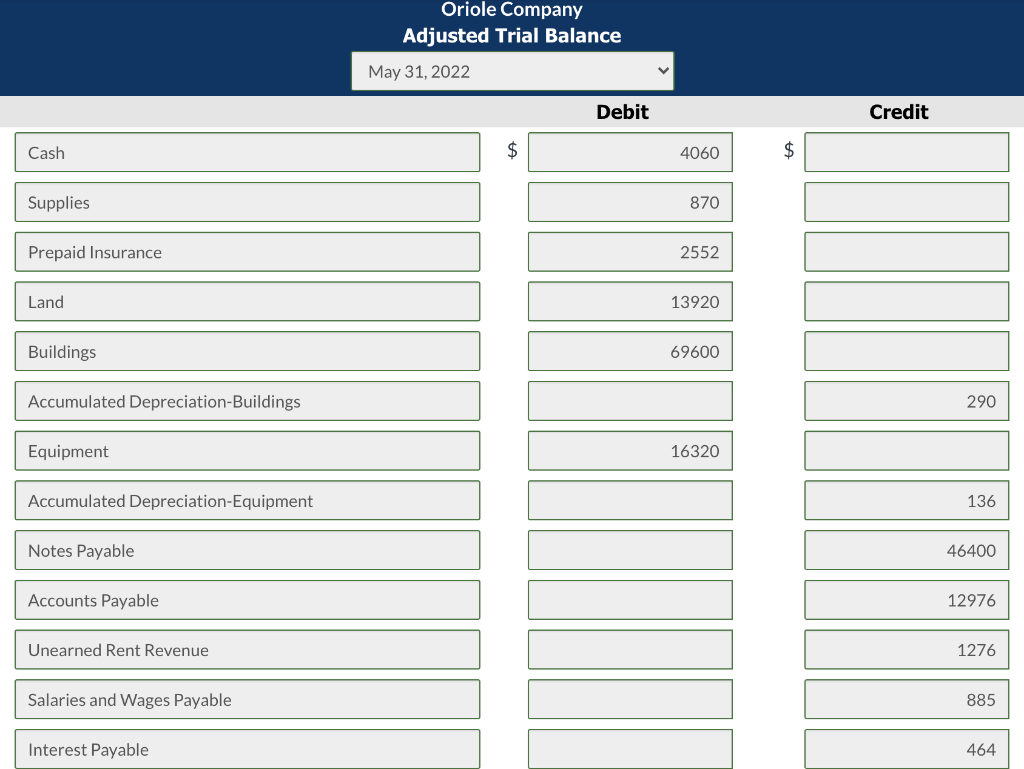

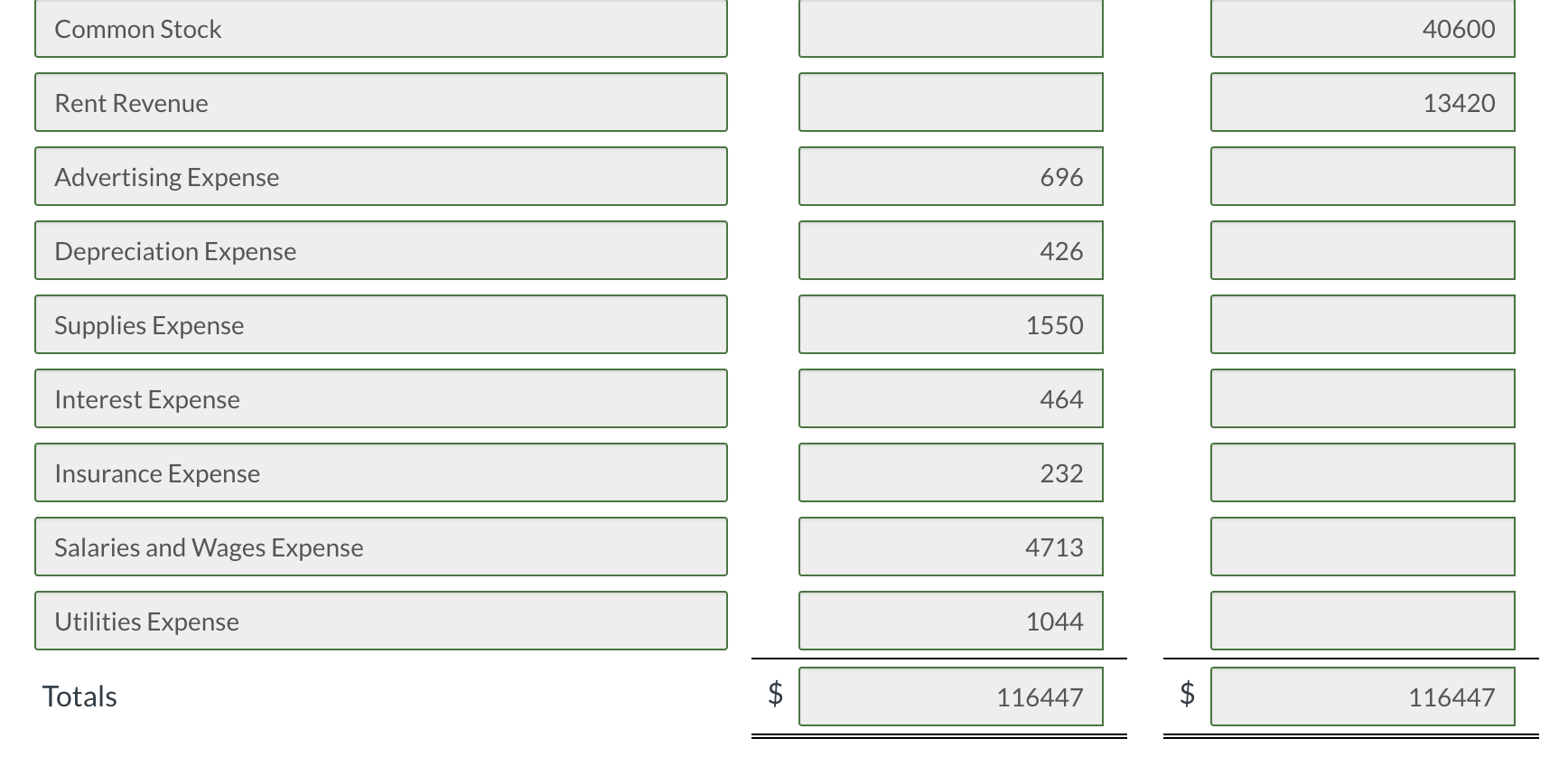

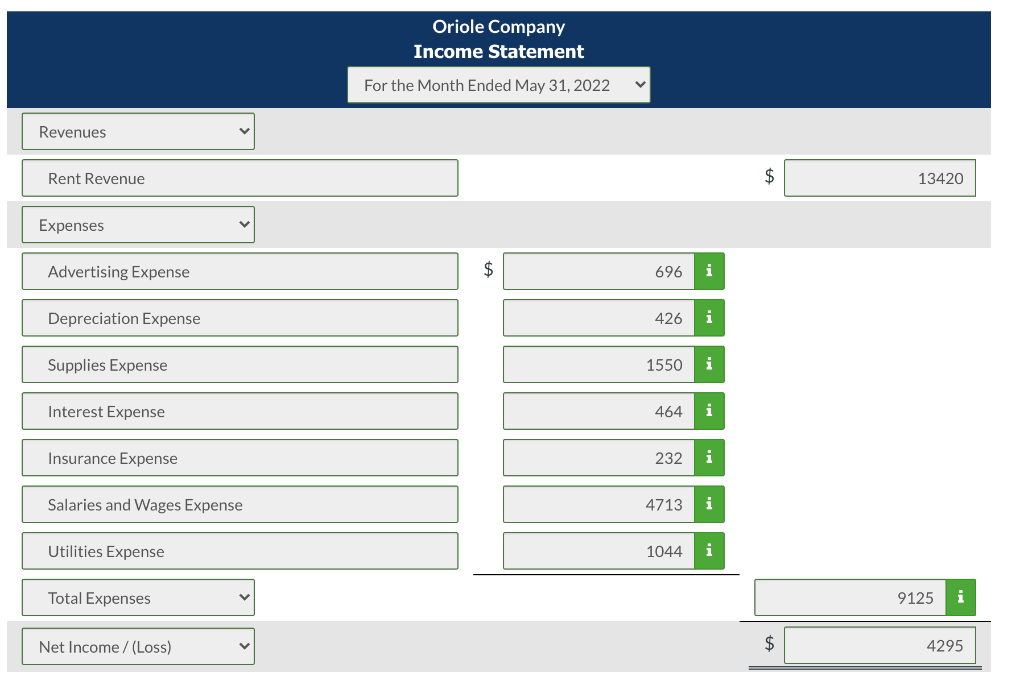

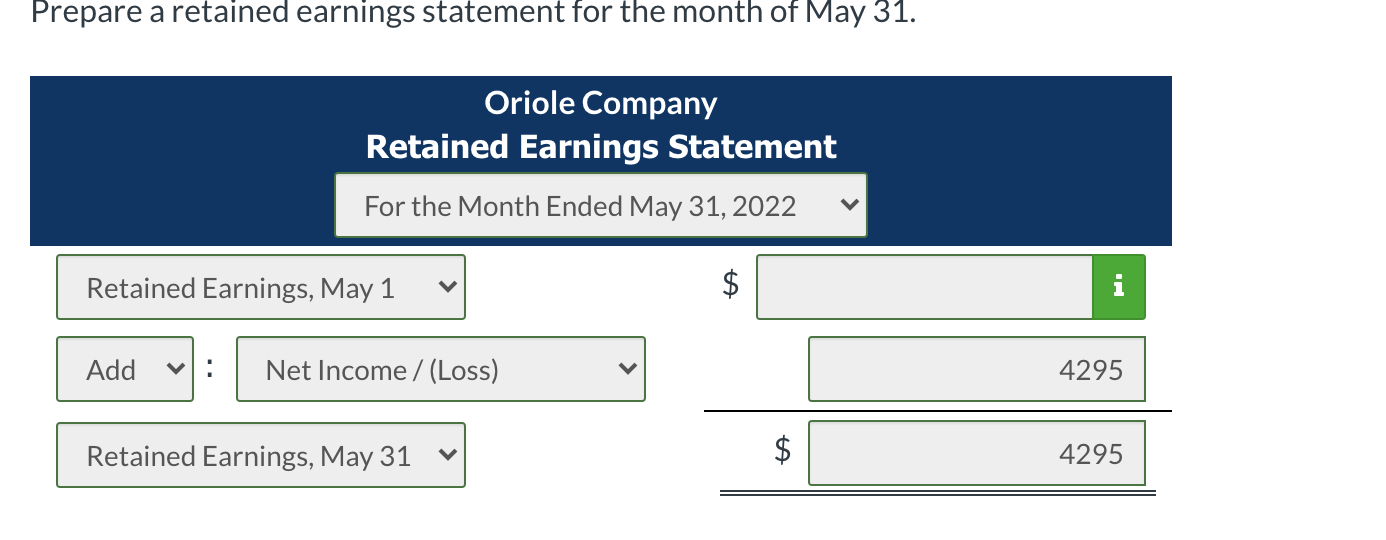

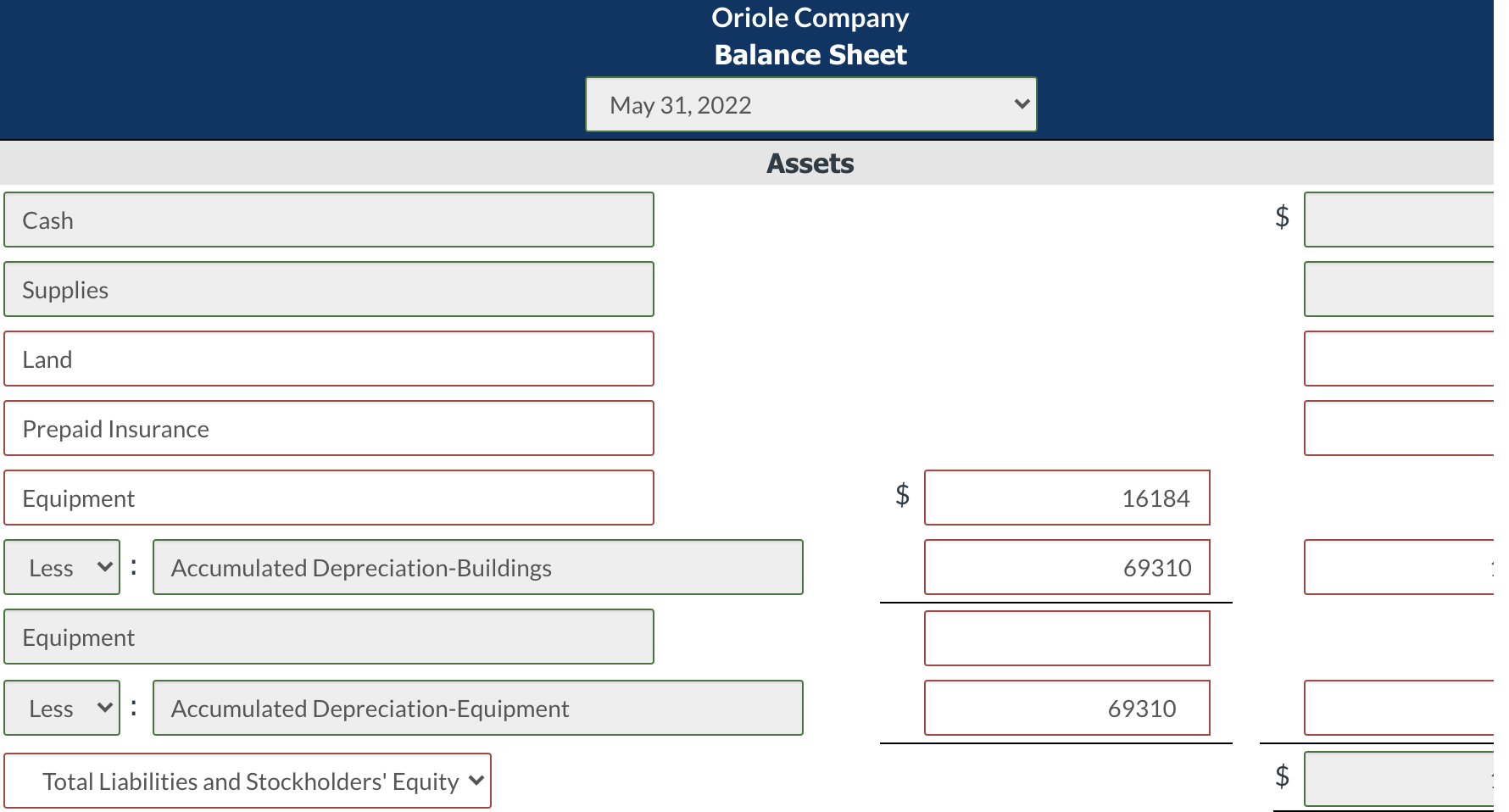

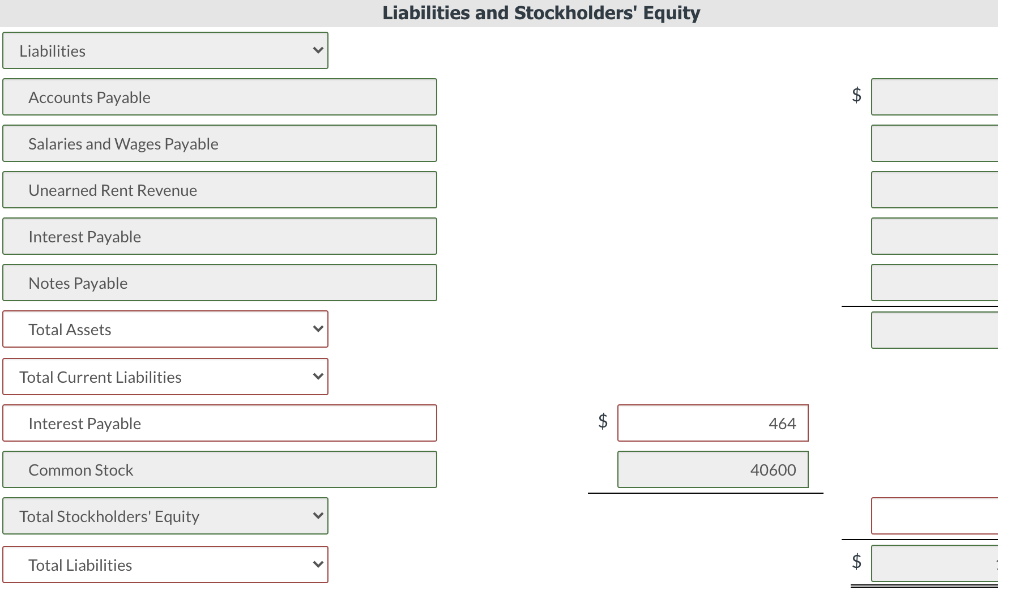

The Oriole Company opened for business on May 1, 2022. Its trial balance before adjustment on May 31 is as follows. Oriole Company Trial Balance May 31, 2022 Debit Credit Account Number 101 126 $ 4,060 2,420 2.784 130 140 13,920 69,600 141 149 16,320 200 201 Cash Supplies Prepaid Insurance Land Buildings Equipment Notes Payable Accounts Payable Unearned Rent Revenue Common Stock Rent Revenue Advertising Expense Salaries and Wages Expense Utilities Expense 208 $ 46,400 12,976 3,828 40,600 10,868 311 696 429 610 726 732 3,828 1.044 $114,672 $114,672 In addition to those accounts listed on the trial balance, the chart of accounts for Oriole Company also contains the following accounts and account numbers: No. 142 Accumulated Depreciation-Buildings, No. 150 Accumulated Depreciation-Equipment, No. 212 Salaries and Wages Payable, No. 230 Interest Payable, No. 619 Depreciation Expense, No. 631 Supplies Expense, No. 718 Interest Expense, and No. 722 Insurance Expense. Other data: 1. 2. 3. Prepaid insurance is a 1-year policy starting May 1, 2022. A count of supplies shows $870 of unused supplies on May 31. Annual depreciation is $3,480 on the buildings and $1,632 on equipment. The note payable interest rate is 12%. (The note was taken out on May 1 and will be repaid along with interest in 2 years.) Two-thirds of the unearned rent revenue has been earned. Salaries and wages of $885 are unpaid and unrecorded at May 31. 4. 5. 6. Debit Credit No. Date Account Titles and Explanation May 1. Insurance Expense 31 232 Prepaid Insurance 232 2. May 31 Supplies Expense 1550 Supplies 1550 3. May 31 Depreciation Expense 426 Accumulated Depreciation-Buildings 290 Accumulated Depreciation-Equipment 136 4. May 31 Interest Expense 464 Interest Payable 464 5. May 31 Unearned Rent Revenue 2552 Rent Revenue 2552 6. May 31 Salaries and Wages Expense 885 Salaries and Wages Payable 885 Cash No. 101 Balance Date Explanation Ref Debit Credit May 31 Balance 4060 Supplies Date No. 126 Balance Explanation Ref Debit Credit May 31 Balance 2420 May 31 Adjusting J1 1550 870 Prepaid Insurance Date Explanation May 31 Balance No. 130 Balance Ref Debit Credit 2784 May 31 Adjusting J1 232 2552 Land No. 140 Balance Date Explanation Ref Debit Credit May 31 Balance 13920 Buildings Date No. 141 Balance Explanation Ref Debit Credit May 31 Balance 69600 No. 142 Accumulated Depreciation- Buildings Date Explanation Ref Debit Credit Balance J1 290 290 May 31 Adjusting Equipment Date Explanation No. 149 Ref Debit Credit Balance May 31 Balance 16320 No. 150 Accumulated Depreciation- Equipment Date Explanation May 31 Adjusting Ref Debit Credit Balance J1 136 136 Notes Payable Date Explanation No. 200 Balance Ref Debit Credit May 31 Balance 46400 Accounts Payable Date Explanation No. 201 Balance Ref Debit Credit May 31 Balance 12976 Unearned Rent Revenue Date Explanation No. 208 Balance Ref Debit Credit May 31 Balance 3828 May 31 Adjusting 31 2552 1276 Salaries and Wages Payable Date Explanation No. 212 Balance Ref Debit Credit May 31 Adjusting J1 885 885 Interest Payable Date Explanation No. 230 Balance Ref Debit Credit May 31 Adjusting J1 464 464 Common Stock Date Explanation No. 311 Balance Ref Debit Credit May 31 Balance 40600 Rent Revenue Date Explanation No. 429 Balance Ref Debit Credit May 31 Balance v 10868 May 31 Adjusting J1 2552 13420 Advertising Expense Date Explanation No. 610 Balance Ref Debit Credit May 31 Balance 696 Depreciation Expense Date Explanation May 31 Adjusting No. 619 Balance Ref Debit Credit J1 426 426 No. 631 Supplies Expense Date Explanation Ref Debit Credit Balance May 31 Adjusting J1 1550 1550 Interest Expense Date Explanation No. 718 Balance Ref Debit Credit May 31 Adjusting J1 464 464 No. 722 Insurance Expense Date Explanation Ref Debit Credit Balance May 31 Adjusting J1 232 232 Salaries and Wages Expense Date Explanation No. 726 Balance Ref Debit Credit May 31 Balance 3828 May 31 Adjusting J1 885 4713 Utilities Expense Date Explanation No. 732 Balance Ref Debit Credit May 31 Balance 1044 Oriole Company Adjusted Trial Balance May 31, 2022 Debit Credit Cash $ 4060 $ Supplies 870 Prepaid Insurance 2552 Land 13920 Buildings 69600 Accumulated Depreciation-Buildings 290 Equipment 16320 Accumulated Depreciation-Equipment 136 Notes Payable 46400 Accounts Payable 12976 Unearned Rent Revenue 1276 Salaries and Wages Payable 885 Interest Payable 464 Common Stock 40600 Rent Revenue 13420 Advertising Expense 696 Depreciation Expense 426 Supplies Expense 1550 Interest Expense 464 Insurance Expense 232 Salaries and Wages Expense 4713 Utilities Expense 1044 Totals $ 116447 $ 116447 Oriole Company Income Statement For the Month Ended May 31, 2022 Revenues Rent Revenue $ 13420 Expenses Advertising Expense $ 696 i Depreciation Expense 426 i Supplies Expense 1550 i Interest Expense 464 i Insurance Expense 232 i Salaries and Wages Expense 4713 i Utilities Expense 1044 i Total Expenses 9125 Net Income /(Loss) $ 4295 Prepare a retained earnings statement for the month of May 31. Oriole Company Retained Earnings Statement For the Month Ended May 31, 2022 Retained Earnings, May 1 ta P. Add Net Income / (Loss) 4295 Retained Earnings, May 31 $ 4295 Oriole Company Balance Sheet May 31, 2022 Assets Cash Supplies Land Prepaid Insurance Equipment $ 16184 Less Accumulated Depreciation-Buildings 69310 Equipment Less Accumulated Depreciation-Equipment 69310 Total Liabilities and Stockholders' Equity Liabilities and Stockholders' Equity Liabilities Accounts Payable $ Salaries and Wages Payable Unearned Rent Revenue Interest Payable Notes Payable Total Assets Total Current Liabilities Interest Payable $ 464 Common Stock 40600 Total Stockholders' Equity Total Liabilities $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts