Question: Fix the incorrect answers labeled in red. Exercise 24-5 Payback period computation; even cash flows LO P1 Compute the payback period for each of these

Fix the incorrect answers labeled in red.

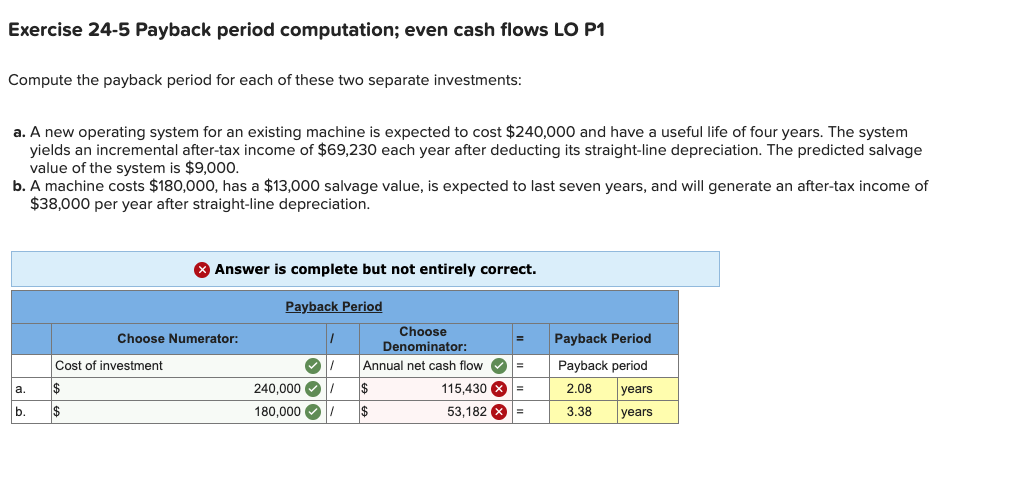

Exercise 24-5 Payback period computation; even cash flows LO P1 Compute the payback period for each of these two separate investments: a. A new operating system for an existing machine is expected to cost $240,000 and have a useful life of four years. The system yields an incremental after-tax income of $69,230 each year after deducting its straight-line depreciation. The predicted salvage value of the system is $9,000. b. A machine costs $180,000, has a $13,000 salvage value, is expected to last seven years, and will generate an after-tax income of $38,000 per year after straight-line depreciation. Answer is complete but not entirely correct. Payback Period Choose Numerator: 1 = Payback Period Cost of investment / Choose Denominator: Annual net cash flow= $ 115,430 X $ 53,182 X = Payback period 2.08 years . $ = 240,000 180,0001 b. $ 3.38 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts