Question: fix the red Problem 3-8B (Algo) Complete the full accounting cycle (LO3-3, 3-4, 3-5, 3-6, 3-7) The general ledger of Copper Plumbing at January 1,

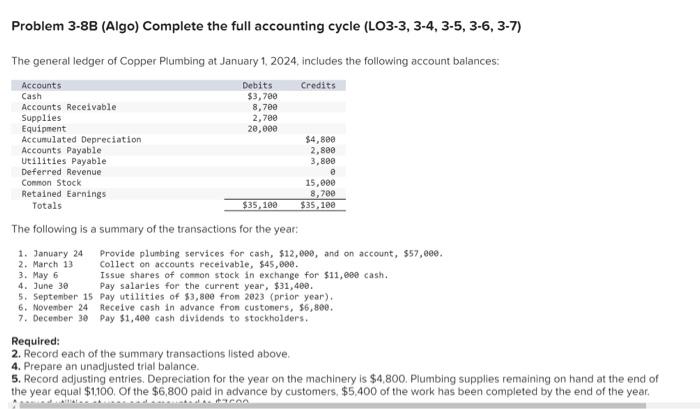

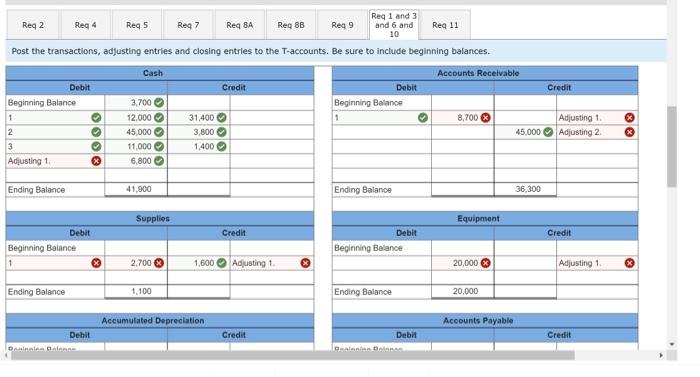

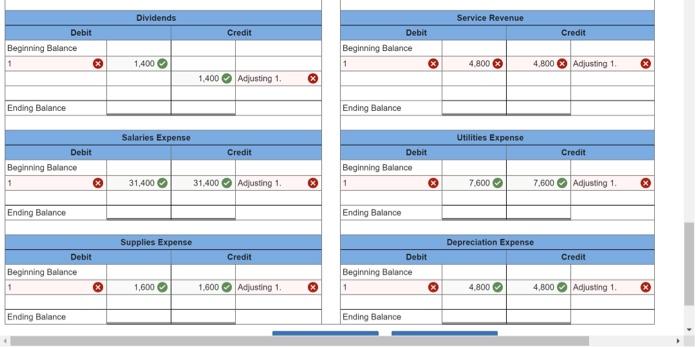

Problem 3-8B (Algo) Complete the full accounting cycle (LO3-3, 3-4, 3-5, 3-6, 3-7) The general ledger of Copper Plumbing at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year: 1. January 24 Provide plumbing services for cash, $12,0e0, and on account, $57,0e. 2. March 13 Collect on accounts recelvable, 545,080. 3. May 6 Issue shares of common stock in exchange for $11,089cash. 4. June 30 Pay salaries for the current year, $31,460. 5. September 15 Pay utilities of $3,88 fron 2823 (prior year). 6. Novenber 24 Receive cash in advance fron custoners, 56,890 . 7. December 30 Pay $1,490 cash dividends to stockholders. Required: 2. Record each of the summary transactions listed above. 4. Prepare an unadjusted trial balance. 5. Record adjusting entries. Depreciation for the year on the machinery is $4,800. Plumbing supplies remaining on hand at the end of the year equal $1,100. Of the $6,800 paid in advance by customers, $5,400 of the work has been completed by the end of the year. Post the transactions, adjusting entries and closing entries to the T-accounts. Be sure to include beginning balances. Problem 3-8B (Algo) Complete the full accounting cycle (LO3-3, 3-4, 3-5, 3-6, 3-7) The general ledger of Copper Plumbing at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year: 1. January 24 Provide plumbing services for cash, $12,0e0, and on account, $57,0e. 2. March 13 Collect on accounts recelvable, 545,080. 3. May 6 Issue shares of common stock in exchange for $11,089cash. 4. June 30 Pay salaries for the current year, $31,460. 5. September 15 Pay utilities of $3,88 fron 2823 (prior year). 6. Novenber 24 Receive cash in advance fron custoners, 56,890 . 7. December 30 Pay $1,490 cash dividends to stockholders. Required: 2. Record each of the summary transactions listed above. 4. Prepare an unadjusted trial balance. 5. Record adjusting entries. Depreciation for the year on the machinery is $4,800. Plumbing supplies remaining on hand at the end of the year equal $1,100. Of the $6,800 paid in advance by customers, $5,400 of the work has been completed by the end of the year. Post the transactions, adjusting entries and closing entries to the T-accounts. Be sure to include beginning balances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts