Question: Fixed Asset Purchases with Note On June 30, Collins Management Company purchased land for $560,000 and a building for $840,000, paying $700,000 cash and issuing

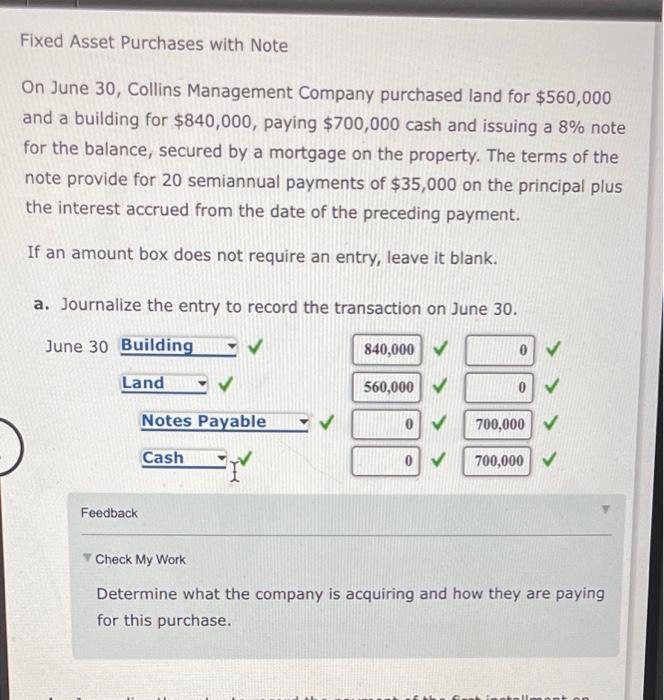

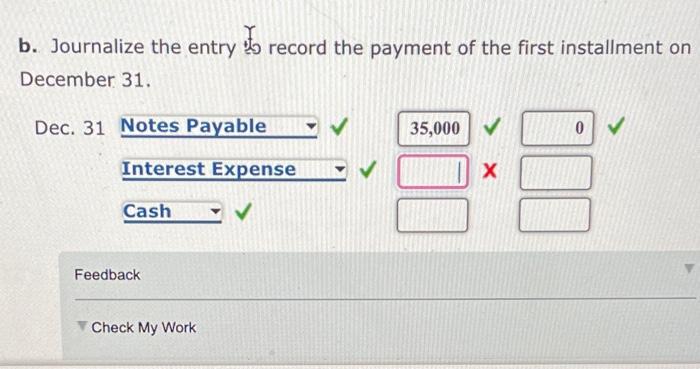

Fixed Asset Purchases with Note On June 30, Collins Management Company purchased land for $560,000 and a building for $840,000, paying $700,000 cash and issuing a 8% note for the balance, secured by a mortgage on the property. The terms of the note provide for 20 semiannual payments of $35,000 on the principal plus the interest accrued from the date of the preceding payment. If an amount box does not require an entry, leave it blank. a. Journalize the entry to record the transaction on June 30. June 30 Building 840,000 Land 560,000 Notes Payable 700,000 Cash Fry 0 700,000 Feedback Check My Work Determine what the company is acquiring and how they are paying for this purchase. ant on . b. Journalize the entry to record the payment of the first installment on December 31. Dec. 31 Notes Payable 35,000 0 Interest Expense Cash Feedback Check My Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts