Question: Fixed costs will be $5 million in 2019, increasing by 46 per year. Both buildings and plant/equipment will again be depreciated straight line to zero

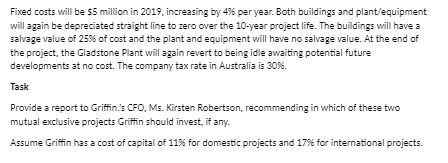

Fixed costs will be $5 million in 2019, increasing by 46 per year. Both buildings and plant/equipment will again be depreciated straight line to zero over the 10-year project life. The buildings will have a salvage value of 256 of cost and the plant and equipment will have no salvage value. At the end of the project, the Gladstone Plant will again revert to being idle awaiting potential future developments at no cost. The company tax rate in Australia is 30%. Task Provide a report to Griffin.'s CFO, Ms. Kirsten Robertson, recommending in which of these two mutual exclusive projects Griffin should invest, if any. Assume Griffin has a cost of capital of 11% for domestic projects and 17% for international projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts