Question: fjvhjvg CASE STUDY 2 Over the last decade the U.S airline industry has experienced considerable shifts in operations conditioned by economic downturns both early in

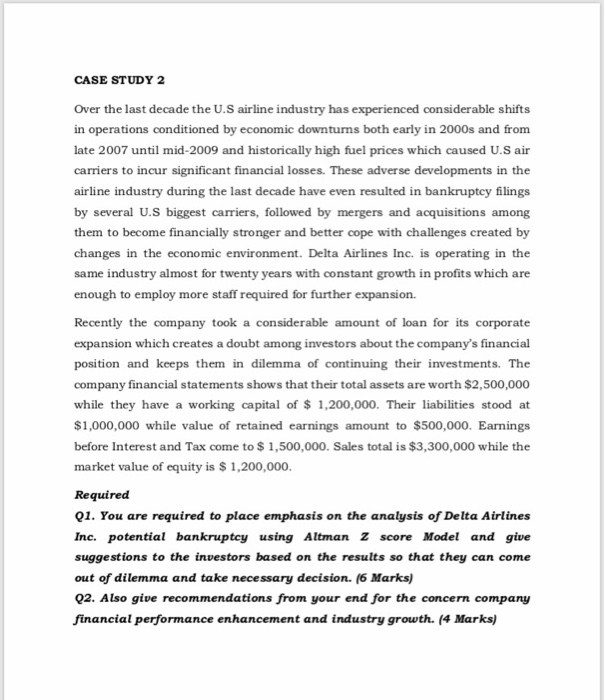

CASE STUDY 2 Over the last decade the U.S airline industry has experienced considerable shifts in operations conditioned by economic downturns both early in 2000s and from late 2007 until mid-2009 and historically high fuel prices which caused U.S air carriers to incur significant financial losses. These adverse developments in the airline industry during the last decade have even resulted in bankruptcy filings by several U.S biggest carriers, followed by mergers and acquisitions among them to become financially stronger and better cope with challenges created by changes in the economic environment. Delta Airlines Inc. is operating in the same industry almost for twenty years with constant growth in profits which are enough to employ more staff required for further expansion. Recently the company took a considerable amount of loan for its corporate expansion which creates a doubt among investors about the company's financial position and keeps them in dilemma of continuing their investments. The company financial statements shows that their total assets are worth $2,500,000 while they have a working capital of $ 1,200,000. Their liabilities stood at $1,000,000 while value of retained earnings amount to $500,000. Earnings before Interest and Tax come to $ 1,500,000. Sales total is $3,300,000 while the market value of equity is $ 1,200,000. Required Q1. You are required to place emphasis on the analysis of Delta Airlines Inc. potential bankruptcy using Altman z score Model and give suggestions to the investors based on the results so that they can come out of dilemma and take necessary decision. (6 Marks) Q2. Also give recommendations from your end for the concern company financial performance enhancement and industry growth. (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts