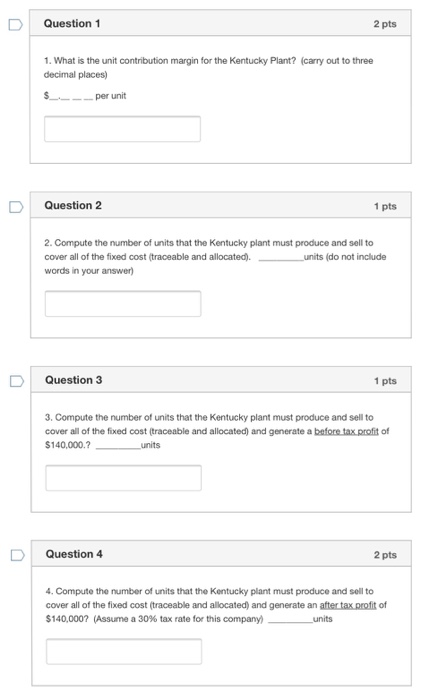

Question: Flag this Question Louisville Jar Co. has processing plants in Kentucky and Pennsylvania. Both plants use recycled glass to produce jars that a variety of

Louisville Jar Co. has processing plants in Kentucky and Pennsylvania. Both plants use recycled glass to produce jars that a variety of food processors use in food canning. The jars sell for $10 per hundred units. Budgeted revenues and costs for the year ending December 31, 2014, in thousands of dollars, are:

Kentucky | Pennsylvania | Total | |

Sales | $1,100 | $2,000 | $3,100 |

Variable production costs | |||

Direct material | 275 | 500 | 775 |

Direct labor | 330 | 500 | 830 |

Factory overhead | 220 | 350 | 570 |

Fixed factory overhead | 350 | 450 | 800 |

Fixed regional promotional costs | 50 | 50 | 100 |

Allocated home office costs | 55 | 100 | 155 |

Total costs | 1280 | 1950 | 3230 |

Operating income (loss) before tax | ($180) | $50 | ($130) |

Home office costs are fixed and are allocated to manufacturing plants on the basis of relative sales levels. Fixed regional promotional costs are discretionary advertising costs needed to obtain budgeted sales levels.

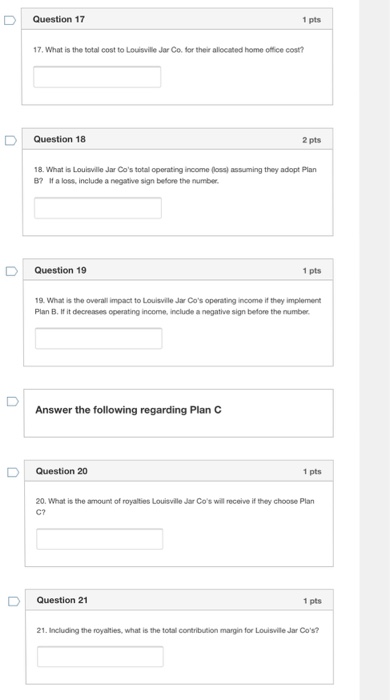

Because of the budgeted operating loss, Louisville Jar Co. is considering ceasing operations at its Kentucky plant. If it does so, proceeds from the sale of plant assets will exceed asset book values and exactly cover all termination costs; fixed factory overhead costs of $25,000 would not be eliminated. Louisville Jar Co. is considering the following three alternative plans:

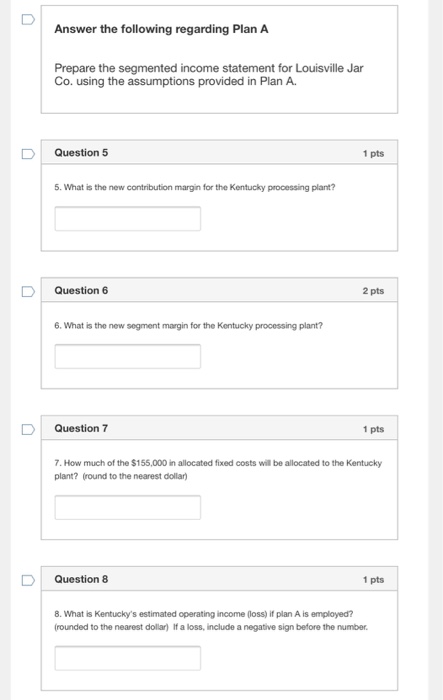

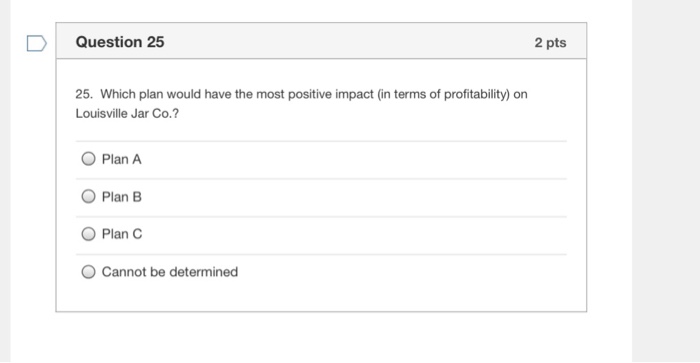

PLAN A: Expand Kentucky's operations from its budgeted 11,000,000 units to a budgeted 17,000,000 units. It is believed that this can be accomplished by increasing Kentucky's fixed regional promotional expenditures by $120,000.

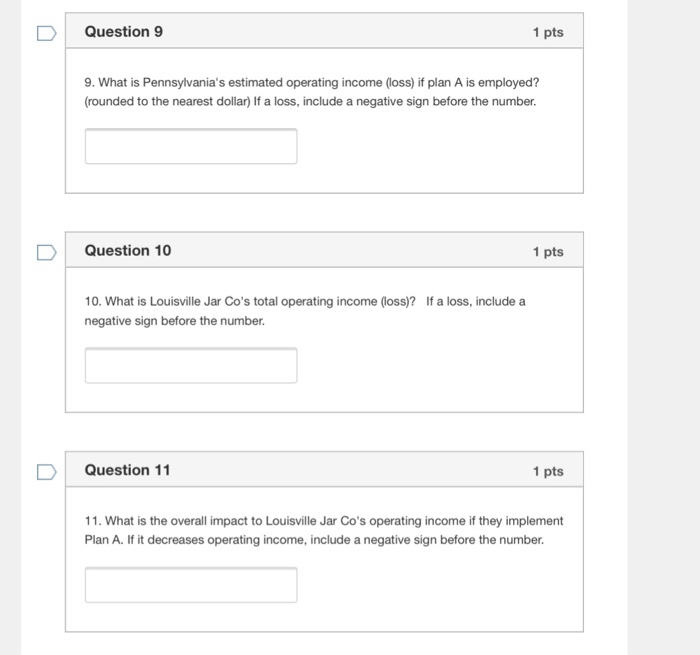

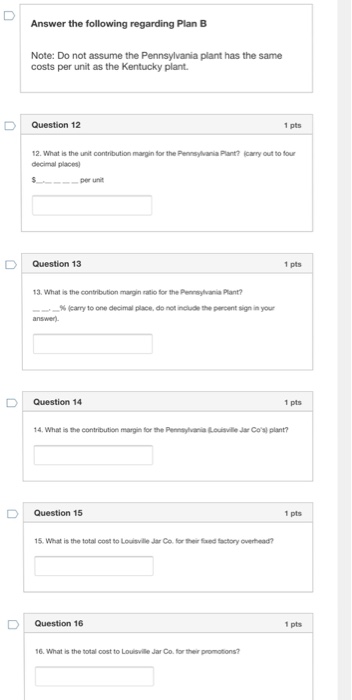

PLAN B: Close the Kentucky plant and expand the Pennsylvania operations from the current budgeted 20,000,000 to 31,000,000 units to fill Kentucky's budgeted production of 11,000,000 units. The Kentucky region would continue to incur promotional costs to sell the 11,000,000 units. All sales and costs would be budgeted by the Pennsylvania plant.

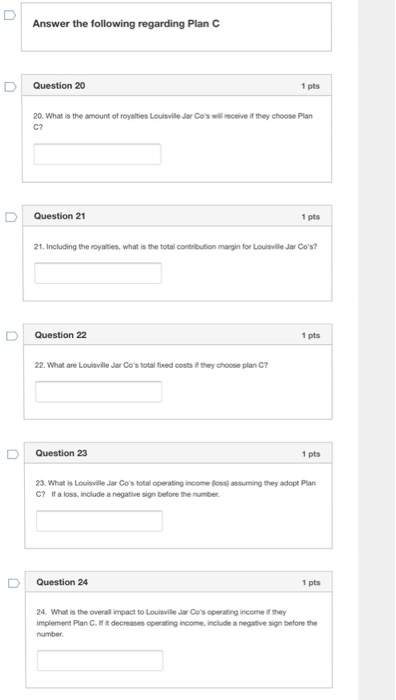

PLAN C: Close the Kentucky plant and enter into a long-term contract with a competitor to serve the Kentucky region's customers. This competitor would pay a royalty of $1.25 per 100 units sold to Louisville, which would continue to incur fixed regional promotional costs to maintain sales of 11,000,000 units in the Kentucky region.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts