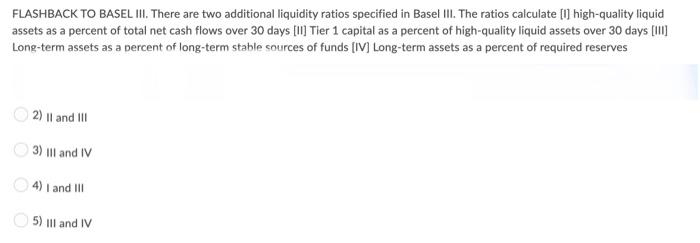

Question: FLASHBACK TO BASEL III. There are two additional liquidity ratios specified in Basel III. The ratios calculate [I] high-quality liquid assets as a percent of

![in Basel III. The ratios calculate [I] high-quality liquid assets as a](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67020cd0a57ea_60067020cd04530e.jpg)

FLASHBACK TO BASEL III. There are two additional liquidity ratios specified in Basel III. The ratios calculate [I] high-quality liquid assets as a percent of total net cash flows over 30 days [] Tier 1 capital as a percent of high-quality liquid assets over 30 days [III] Long-term assets as a percent of long-term stable sources of funds [IV] Long-term assets as a percent of required reserves 2) I and III 3) ill and IV 4) I and III 5) ill and IV One problem with income gap analysis is that it 1) is calculated assuming interest rates on all maturities are equal. 3) does not measure the sensitivity of income to interest rate changes. 4) applies only to financial institutions. 5) assumes interest rates on all maturities change by the same amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts