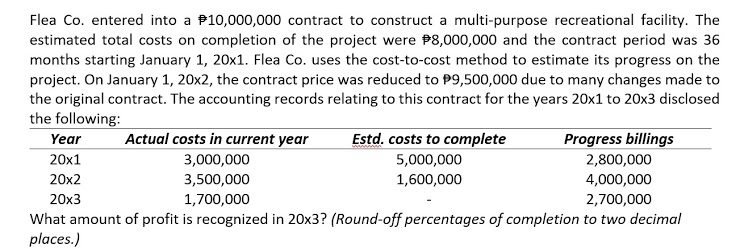

Question: Flea Co. entered into a 10,000,000 contract to construct a multi-purpose recreational facility. The estimated total costs on completion of the project were P8,000,000 and

Flea Co. entered into a 10,000,000 contract to construct a multi-purpose recreational facility. The estimated total costs on completion of the project were P8,000,000 and the contract period was 36 months starting January 1, 20x1. Flea Co. uses the cost-to-cost method to estimate its progress on the project. On January 1, 20x2, the contract price was reduced to P9,500,000 due to many changes made to the original contract. The accounting records relating to this contract for the years 20x1 to 20x3 disclosed the following: Year Actual costs in current year Estd. costs to complete Progress billings 20x1 3,000,000 5,000,000 2,800,000 20x2 3,500,000 1,600,000 4,000,000 20x3 1,700,000 2,700,000 What amount of profit is recognized in 20x3? (Round-off percentages of completion to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts