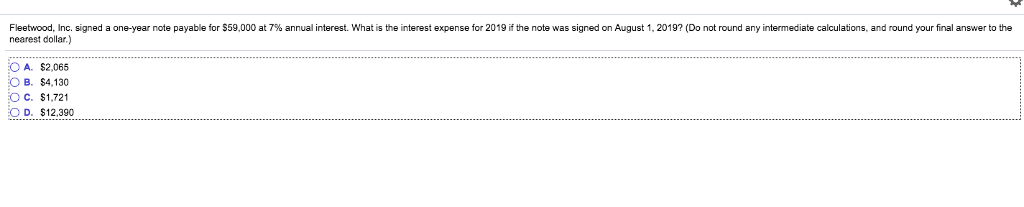

Question: Fleet d nc. signed a one-year note payable or S 59.000 at 7% annual interest. What is the terest expense for 2019 e note was

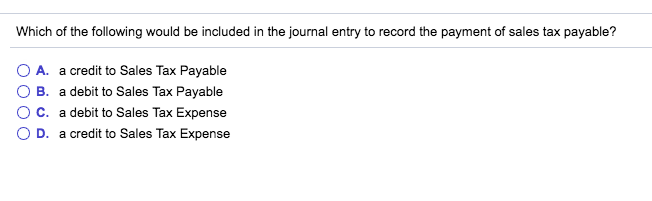

Fleet d nc. signed a one-year note payable or S 59.000 at 7% annual interest. What is the terest expense for 2019 e note was signed on August 20197 Do not und any intermediate ca ations and our our na an nearest dollar.) O A. $2,065 B. $4,130 C. $1,72 D. $12,390 Which of the following would be included in the journal entry to record the payment of sales tax payable? A, a credit to Sales Tax Payable O B. a debit to Sales Tax Payable C. a debit to Sales Tax Expense D. a credit to Sales Tax Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts