Question: Flex ble Budgets, Overhead Cost Variances, and Management Control fixed manufacturing overhead variance analysis The Sourdough Bread Company bakes baguettes for distribution to upscale grocery

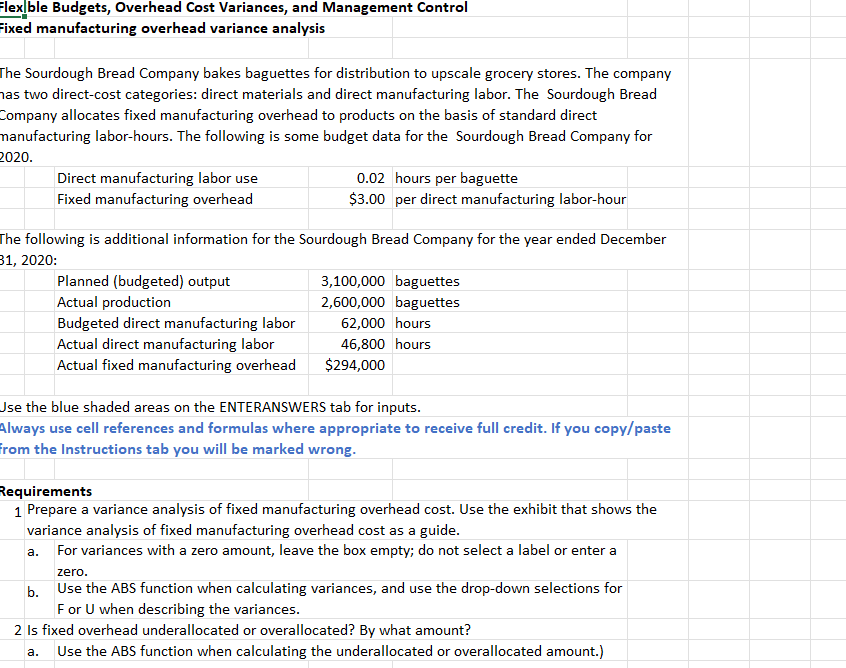

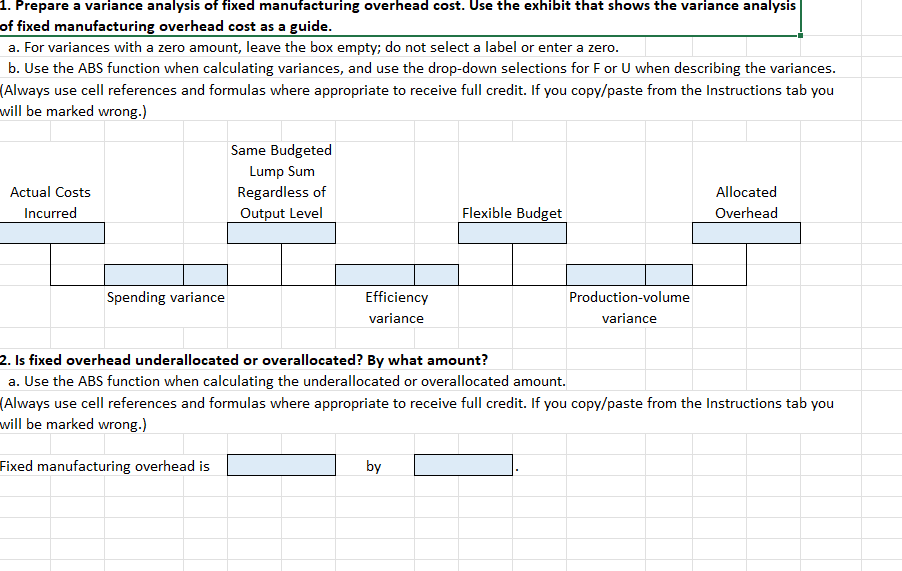

Flex ble Budgets, Overhead Cost Variances, and Management Control fixed manufacturing overhead variance analysis The Sourdough Bread Company bakes baguettes for distribution to upscale grocery stores. The company nas two direct-cost categories: direct materials and direct manufacturing labor. The Sourdough Bread Company allocates fixed manufacturing overhead to products on the basis of standard direct nanufacturing labor-hours. The following is some budget data for the Sourdough Bread Company for 2020. \begin{tabular}{|l|r|l|} \hline Direct manufacturing labor use & 0.02 & hours per baguette \\ \hline Fixed manufacturing overhead & $3.00 & per direct manufacturing labor-hour \\ \hline \end{tabular} The following is additional information for the Sourdough Bread Company for the year ended December 31, 2020: \begin{tabular}{|l|r|l|} \hline Planned (budgeted) output & 3,100,000 & baguettes \\ \hline Actual production & 2,600,000 & baguettes \\ \hline Budgeted direct manufacturing labor & 62,000 & hours \\ \hline Actual direct manufacturing labor & 46,800 hours \\ \hline Actual fixed manufacturing overhead & $294,000 & \\ \hline \end{tabular} Jse the blue shaded areas on the ENTERANSWERS tab for inputs. Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you will be marked wrong. Requirements 1 Prepare a variance analysis of fixed manufacturing overhead cost. Use the exhibit that shows the variance analysis of fixed manufacturing overhead cost as a guide. a. For variances with a zero amount, leave the box empty; do not select a label or enter a zero. b. Use the ABS function when calculating variances, and use the drop-down selections for F or U when describing the variances. 2 Is fixed overhead underallocated or overallocated? By what amount? a. Use the ABS function when calculating the underallocated or overallocated amount.) L. Prepare a variance analysis of fixed manufacturing overhead cost. Use the exhibit that shows the variance analysis of fixed manufacturing overhead cost as a guide. a. For variances with a zero amount, leave the box empty; do not select a label or enter a zero. b. Use the ABS function when calculating variances, and use the drop-down selections for F or U when describing the variances. Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you vill he marked wrong.l 2. Is fixed overhead underallocated or overallocated? By what amount? a. Use the ABS function when calculating the underallocated or overallocated amount. Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you will be marked wrong.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts