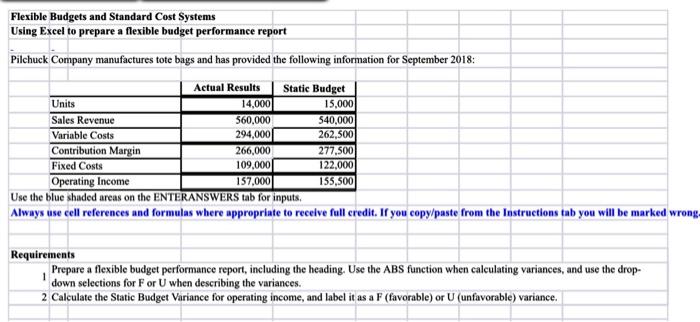

Question: Flexible Budgets and Standard Cost Systems Using Excel to prepare a flexible budget performance report. Company manufactures tote bags and has provided the following information

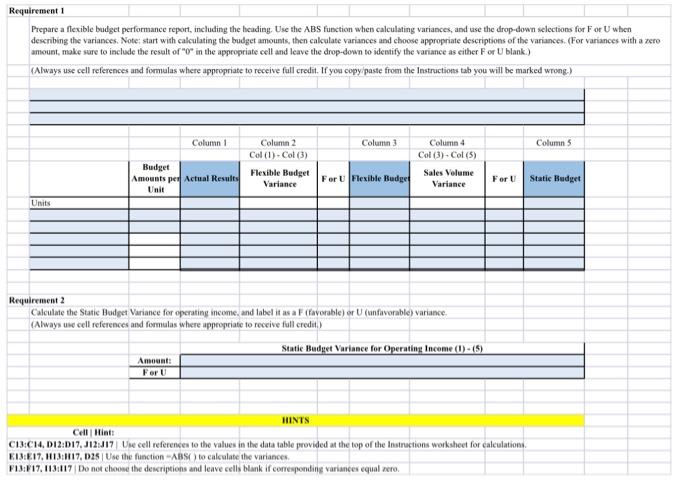

Units Flexible Budgets and Standard Cost Systems Using Excel to prepare a flexible budget performance report Pilchuck Company manufactures tote bags and has provided the following information for September 2018: Actual Results Static Budget 14,000 15,000 Sales Revenue 560,000 540,000 Variable Costs 294,000 262,500 Contribution Margin 266,000 277.500 Fixed Costs 109,000 122.000 Operating Income 157,000 155,500 Use the blue shaded areas on the ENTERANSWERS tab for inputs, Always use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instructions tab you will be marked wrong Requirements Prepare a flexible budget performance report, including the heading. Use the ABS function when calculating variances, and use the drop- down selections for For U when describing the variances. 2 Calculate the Static Budget Variance for operating income, and label it as a F (favorable) or (unfavorable) variance. 1 Requirement 1 Prepare a flexible budget performance report, including the heading, Use the ABS function when calculating variances, and use the drop-down selections for ForU when describing the variances. Note: start with calculating the budget amounts, then calculate variances and choose appropriate descriptions of the variances. (For variances with a nero amount, make sure to include the result of " in the appropriate cell and leave the drop-down to identify the variance as either For U blank.) (Always use cell references and formulas where appropriate to receive full credit. If you copy paste from the Instructions tab you will be marked wrong.) Column Column 3 Columns Budget Column 2 Col (1) - Col (3) Flexible Budget Variance Column 4 Col(3) - Col (5) Sales Volume Variance Foru For Flexible Budget Amounts per Actual Results Unit Static Budget Units Requirement 2 Calculate the Static Budget Variance for operating income, and label it as a F (favorable) or U(unfavorable) variance (Always use cell references and formulas where appropriate to receive full credit) Statie Budget Variance for Operating Income (1)-(5) Amount: For U HINTS Cell Hints C13:C14, D12:17. J12:J17 Une cell references to the values in the datatable provided at the top of the Instruction worksheet for calculations E13:17. H13:H17, D25 Use the function ABS() to calculate the variances F13:17. 113:17 Do not choose the descriptions and leave cells blank if corresponding variances equal zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts