Question: Flipped Case study The students should run the calculation and fill the table The students should analyze the company financial position and explain the strength

Flipped Case study

- The students should run the calculation and fill the table

- The students should analyze the company financial position and explain the strength and weakness points of the company

- The students should provide some reforms, to improve the firm's financial position, if required.

- Then after calculating the ratios before coming to the lecture, the discussion of the firm's current position from both cross-sectional and time-series viewpoint will be conducted in class. The discussion will include evaluations of the firm's liquidity, activity, debt, profitability and market value.

Red Sea Manufacturing Company Balance Sheets

Assets December 31

2012 2011

Current assets

Cash US$25,000 US$24,100

Accounts receivable 805,556 763,900

Inventories 700,625 763,445

Total current assets US$1,531,181 US$1,551,445

Gross fixed assets (at cost) US$2,093,819 US$1,691,707

Less: Accumulated depreciation 500,000 348,000

Net fixed assets US$1,593,819 US$1,343,707

Total assets US$3,125,000 US$2,895,152

Liabilities and Stockholders' Equity

Current liabilities

Accounts payable US$ 230,000 US$ 400,500

Notes payable 311,000 370,000

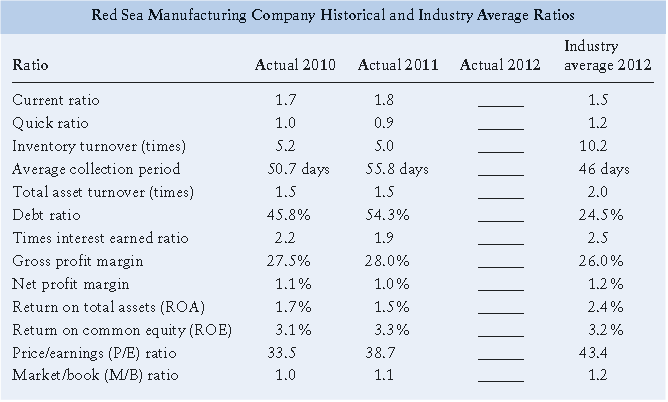

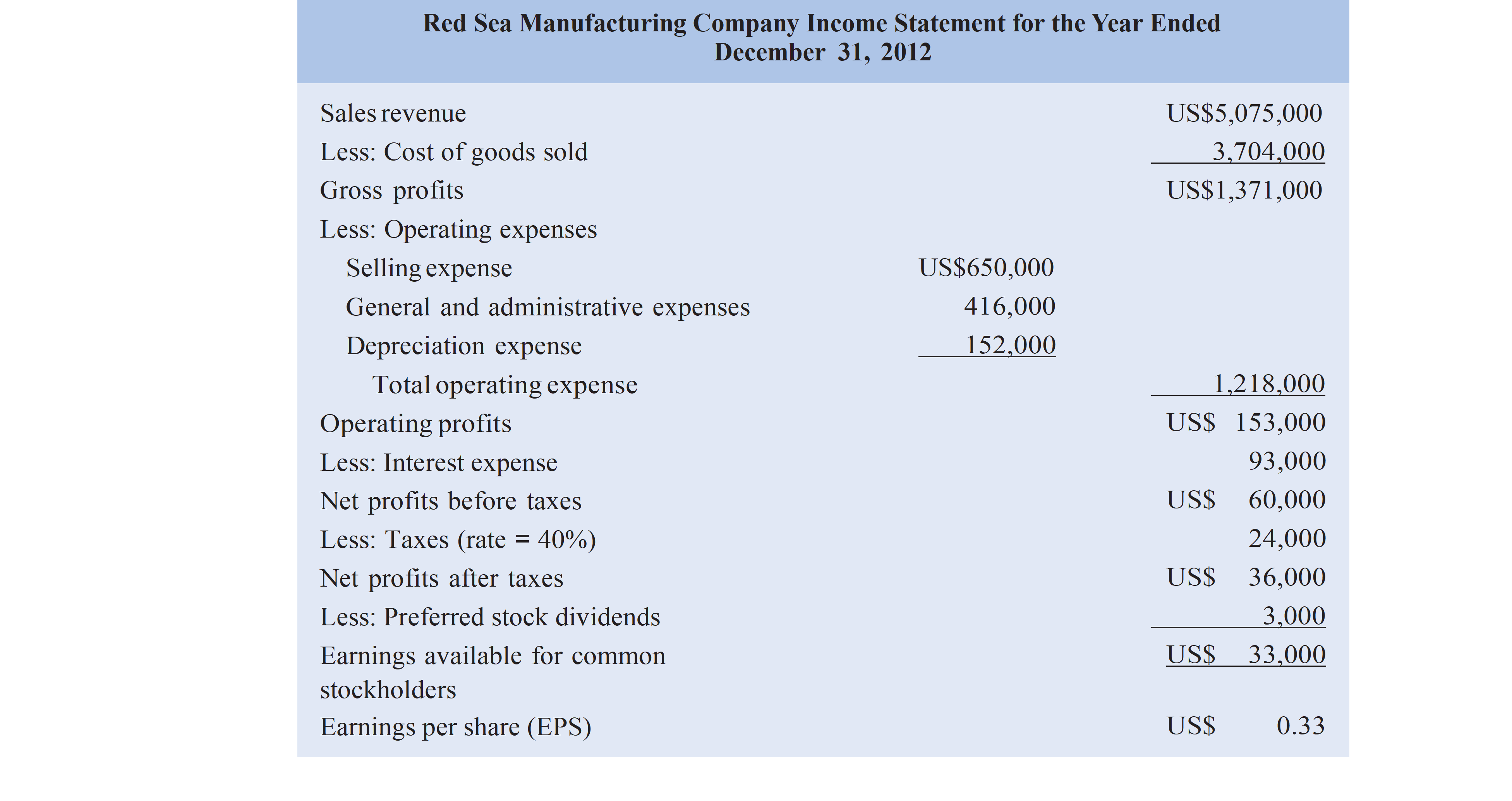

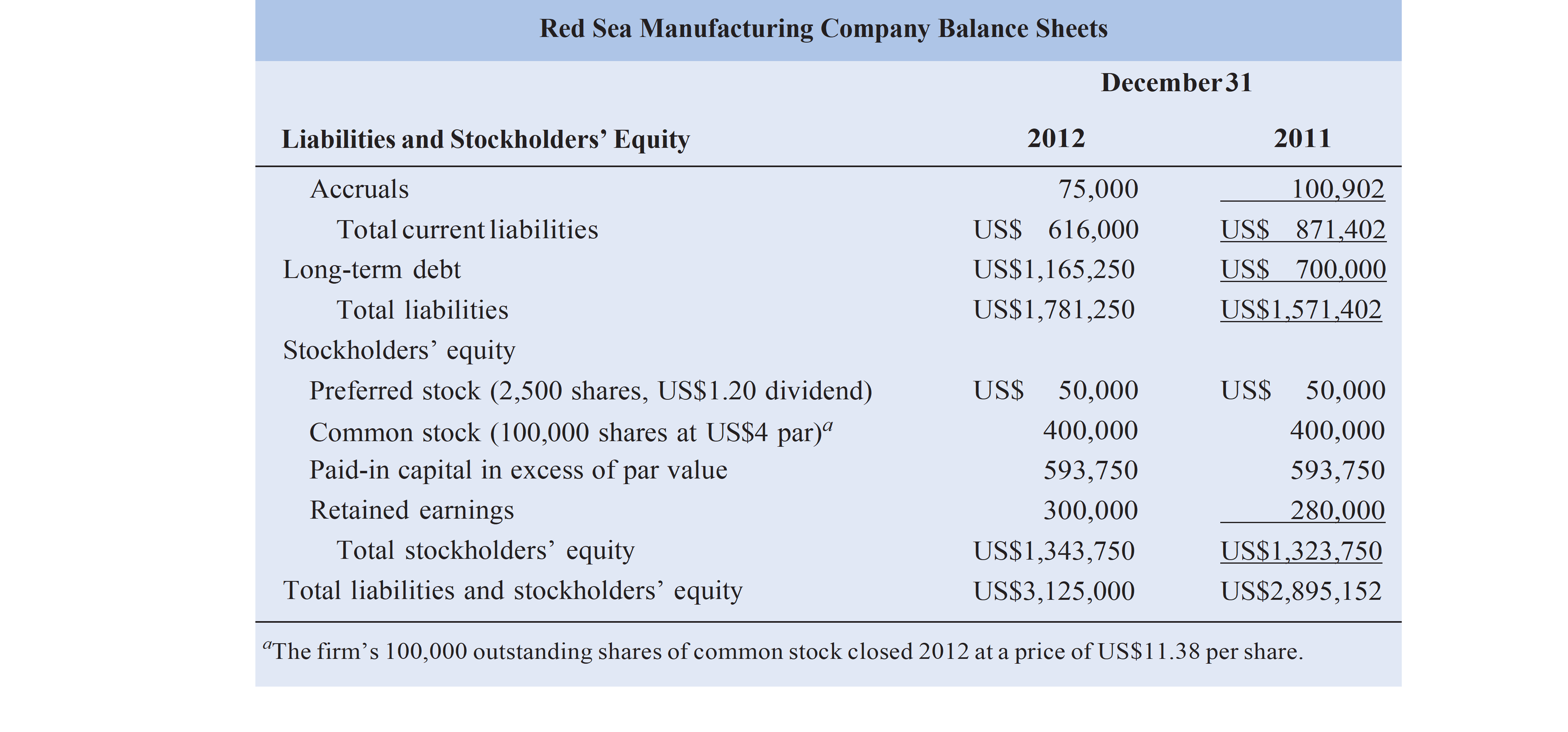

Red Sea Manufacturing Company Historical and Industry Average Ratios Industry Ratio Actual 2010 Actual 2011 Actual 2012 average 2012 Current ratio 1.7 1.8 1.5 Quick ratio 1.0 0.9 1.2 Inventory turnover (times) 5.2 5.0 10.2 Average collection period 50.7 days 55.8 days 46 days Total asset turnover (times) 1.5 1.5 2.0 Debt ratio 45.8% 54.3% 24.5% Times interest earned ratio 2.2 1.9 2.5 Gross profit margin 27.5% 28.0% 26.0% Net profit margin 1.1% 1.0% 1.2% Return on total assets (ROA) 1.7% 1.5% 2.4% Return on common equity (ROE) 3.1% 3.3% 3.2% Price/earnings (P/E) ratio 33.5 38.7 43.4 Market/book (M/B) ratio 1.0 1.1 1.2Red Sea Manufacturing Company Income Statement for the Year Ended December 31, 2012 Sales revenue US$5,075,000 Less: Cost of goods sold 3,704,000 Gross profits US$1,371,000 Less: Operating expenses Selling expense US$650,000 General and administrative expenses 416,000 Depreciation expense 152,000 Total operating expense 1,218,000 Operating profits US$ 153,000 Less: Interest expense 93,000 Net profits before taxes US$ 60,000 Less: Taxes (rate = 40%) 24,000 Net profits after taxes US$ 36,000 Less: Preferred stock dividends 3,000 Earnings available for common US$ 33,000 stockholders Earnings per share (EPS) US$ 0.33Accruals Long-term debt Liabilities and Stockholders' Equity Total current liabilities Total liabilities Stockholders' equity Preferred stock (2,500 shares, US$1.20 dividend) Common stock (100,000 shares at US$4 par)\" Paid-in capital in excess of par value Retained earnings Total stockholders' equity Total liabilities and stockholders' equity December31 2012 2011 75,000 100 902 US$ 616,000 US$ 871 402 US$1,165,250 US 700 000 US$1,781,250 US$ 50,000 400,000 593,750 300,000 US$1,343,750 US$3,125,000 \"The rm's 100,000 outstanding shares of common stock closed 2012 at a price of US$1 1.38 per share. US$1,571,402 US$ 50,000 400,000 593,750 280 000 US$1,323,750 US$2,895,152