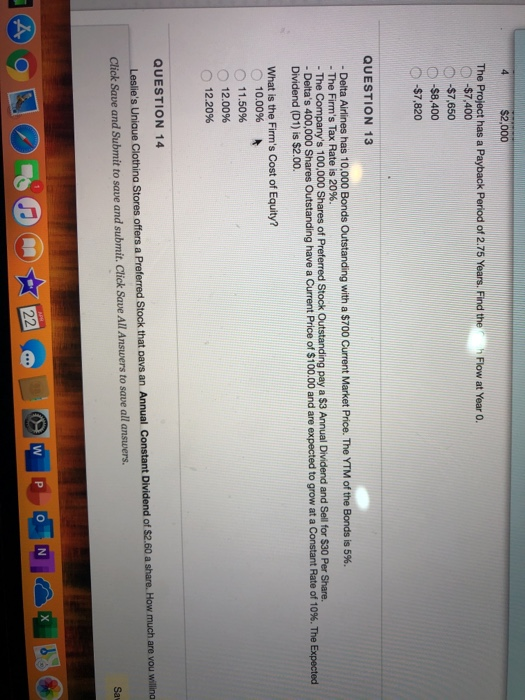

Question: Flow at Year 0. 4 $2,000 The Project has a Payback Period of 2.75 Years. Find the -$7,400 -$7,650 -$8,400 -$7,820 QUESTION 13 - Delta

Flow at Year 0. 4 $2,000 The Project has a Payback Period of 2.75 Years. Find the -$7,400 -$7,650 -$8,400 -$7,820 QUESTION 13 - Delta Airlines has 10,000 Bonds Outstanding with a $700 Current Market Price. The YTM of the Bonds is 5%. - The Firm's Tax Rate is 20%. - The Company's 100,000 Shares of Preferred Stock Outstanding pay a $3 Annual Dividend and Sell for $30 Per Share. - Delta's 400,000 Shares Outstanding have a Current Price of $100.00 and are expected to grow at a Constant Rate of 10%. The Expected Dividend (D1) is $2.00. What is the Firm's Cost of Equity? 10.00% 11.50% 12.00% 12.20% QUESTION 14 Leslie's Unique Clothing Stores offers a Preferred Stock that days an Annual Constant Dividend of $2.60 a share. How much are vou Willing Click Save and Submit to save and submit. Click Save All Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts