Question: flow-to-equity Based on the information below, calculate the flow-to-equity for year 1-3 and use the Flow-to-Equity method to calculate the value of the equity in

flow-to-equity

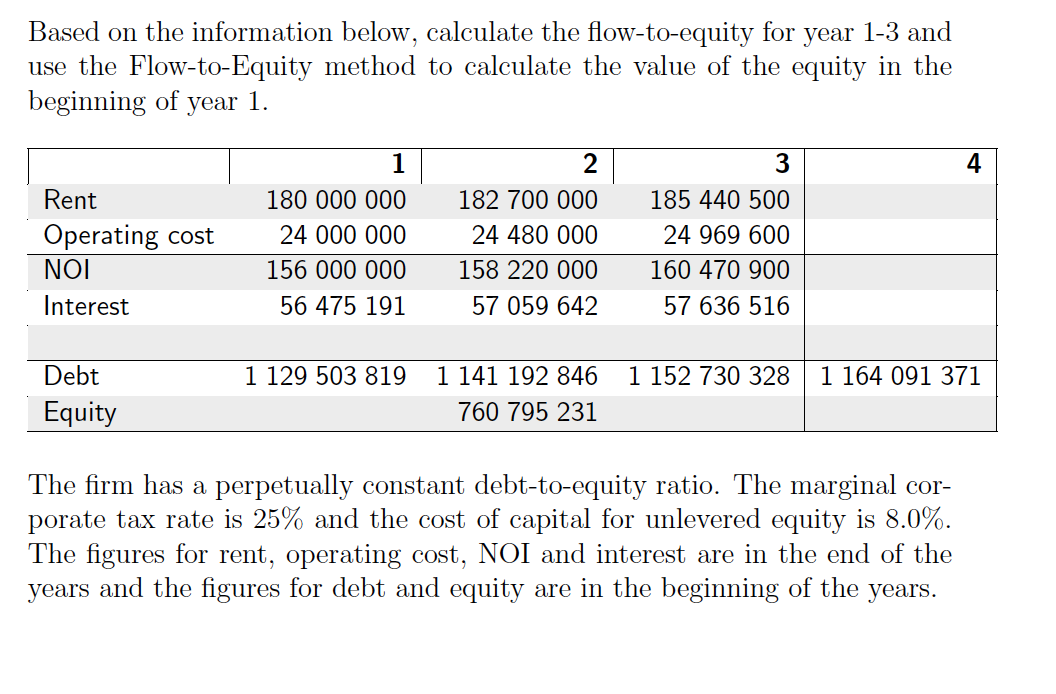

Based on the information below, calculate the flow-to-equity for year 1-3 and use the Flow-to-Equity method to calculate the value of the equity in the beginning of year 1. 1 2 3 Rent Operating cost NOI Interest 180 000 000 24 000 000 156 000 000 56 475 191 182 700 000 24 480 000 158 220 000 57 059 642 185 440 500 24 969 600 160 470 900 57 636 516 1 129 503 819 1 152 730 328 1 164 091 371 Debt Equity 1 141 192 846 760 795 231 The firm has a perpetually constant debt-to-equity ratio. The marginal cor- porate tax rate is 25% and the cost of capital for unlevered equity is 8.0%. The figures for rent, operating cost, NOI and interest are in the end of the years and the figures for debt and equity are in the beginning of the years. Based on the information below, calculate the flow-to-equity for year 1-3 and use the Flow-to-Equity method to calculate the value of the equity in the beginning of year 1. 1 2 3 Rent Operating cost NOI Interest 180 000 000 24 000 000 156 000 000 56 475 191 182 700 000 24 480 000 158 220 000 57 059 642 185 440 500 24 969 600 160 470 900 57 636 516 1 129 503 819 1 152 730 328 1 164 091 371 Debt Equity 1 141 192 846 760 795 231 The firm has a perpetually constant debt-to-equity ratio. The marginal cor- porate tax rate is 25% and the cost of capital for unlevered equity is 8.0%. The figures for rent, operating cost, NOI and interest are in the end of the years and the figures for debt and equity are in the beginning of the years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts