Question: Fly Kite classifies the lease as a...? What is the amount of lease liability Fly Kite has on Jan 1, 2019 after making the first

Fly Kite classifies the lease as a...? What is the amount of lease liability Fly Kite has on Jan 1, 2019 after making the first lease payment? What is the amount of interest expense recognized by Fly Kite on Dec 31, 2019? What is the reduction in the lease liability recorded with the second lease payment? What is the amortization of the right-of-use asset recorded in 2019?

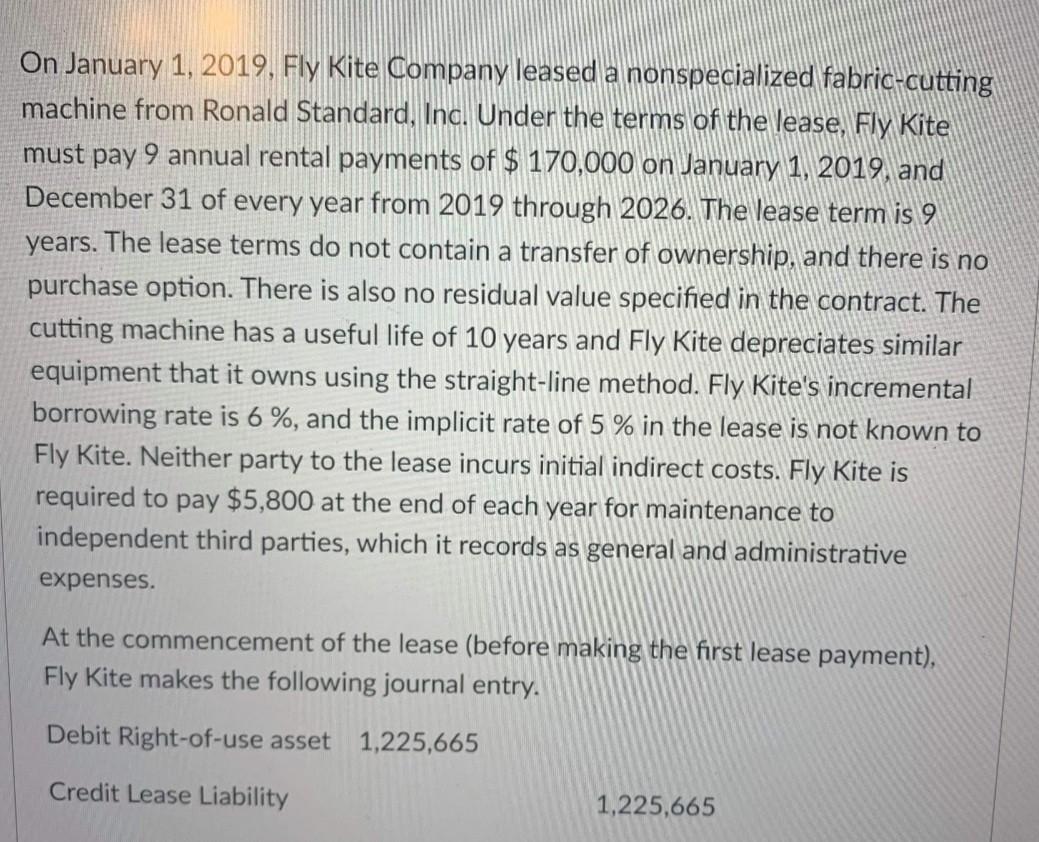

On January 1, 2019, Fly Kite Company leased a nonspecialized fabric-cutting machine from Ronald Standard, Inc. Under the terms of the lease, Fly Kite must pay 9 annual rental payments of $ 170,000 on January 1, 2019 and December 31 of every year from 2019 through 2026. The lease term is 9 years. The lease terms do not contain a transfer of ownership, and there is no purchase option. There is also no residual value specified in the contract. The cutting machine has a useful life of 10 years and Fly Kite depreciates similar equipment that it owns using the straight-line method. Fly Kite's incremental borrowing rate is 6 %, and the implicit rate of 5 % in the lease is not known to Fly Kite. Neither party to the lease incurs initial indirect costs. Fly Kite is required to pay $5,800 at the end of each year for maintenance to independent third parties, which it records as general and administrative expenses. At the commencement of the lease (before making the first lease payment), Fly Kite makes the following journal entry. Debit Right-of-use asset 1,225,665 Credit Lease Liability 1,225,665

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts