Question: Flynn Corporation is debating whether to purchase a new computerized production system. The system will cost $450,000, and have an estimated 10-year life with a

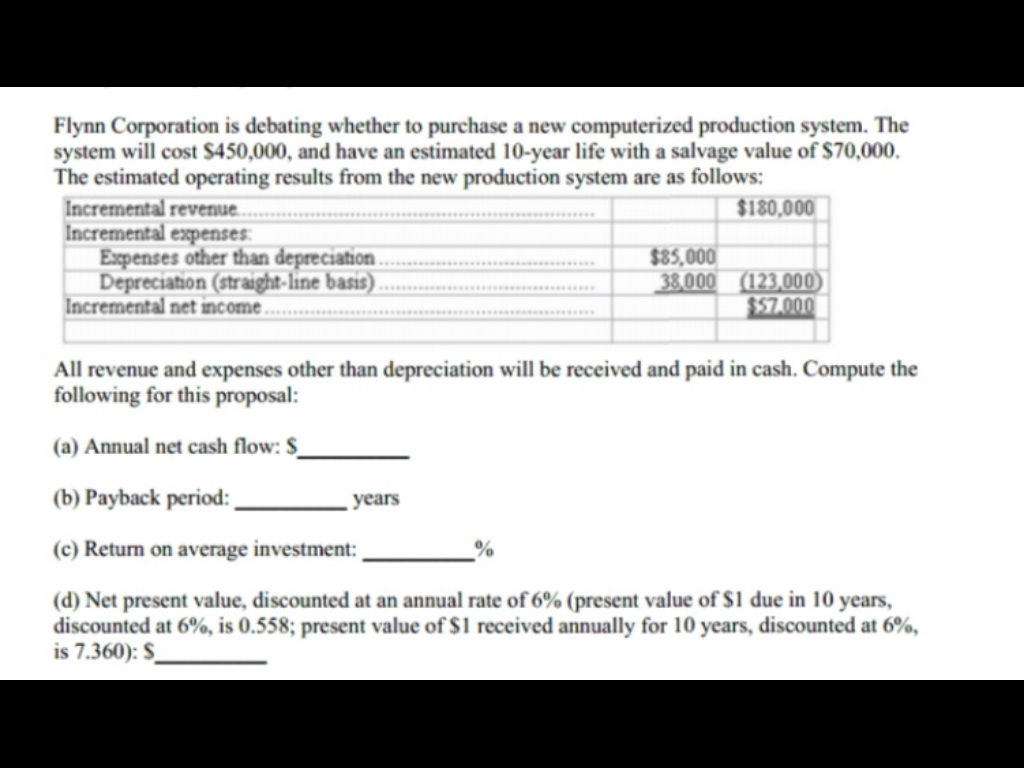

Flynn Corporation is debating whether to purchase a new computerized production system. The system will cost $450,000, and have an estimated 10-year life with a salvage value of $70,000. The estimated operating results from the new production system are as follows:

Incremental revenue.................................................................. $180,000

Incremental expenses:

Expenses other than depreciation................................... $85,000

Depreciation (straight line basis)..................................... 38,000 (123,000)

Incemental net income............................................................ $57,000

All revenue and expenses other than depreciation will be received and paid in cash. Compute the following for this proposal:

(a) Annual net cash flow: $__________

(b) Payback period: __________ years

(c) Return on average investment: __________%

(d) Net present value, discounted at an annual rate of 6% (present value of $1 due in 10 years, discounted at 6%, is 0.558; present value of $1 received annually for 10 years, discounted at 6%, is 7.360): $__________

I added a picture of the problem since it won't save the question in a grid form. Hopefully that helps!

Flynn Corporation is debating whether to purchase a new computerized production system. The system will cost $450,000, and have an estimated 10-year life with a salvage value of $70,000. The estimated operating results from the new production system are as follows: All revenue and expenses other than depreciation will be received and paid in cash. Compute the following for this proposal: Annual net cash flow: $ ____ Payback period:_____ years Return on average investment: ______ % Net present value, discounted at an annual rate of 6% (present value of $1 due in 10 years, discounted at 6%, is 0. 558; present value of $1 received annually for 10 years, discounted at 6%, is 7. 360): $ ______

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts