Question: FMATOUS INDIVIDUAL ASSIGNMENT I DUE DATE 01/10/2021 QUESTION 1 (20 marks) a) You are considering starting and running a small gym in your community. You

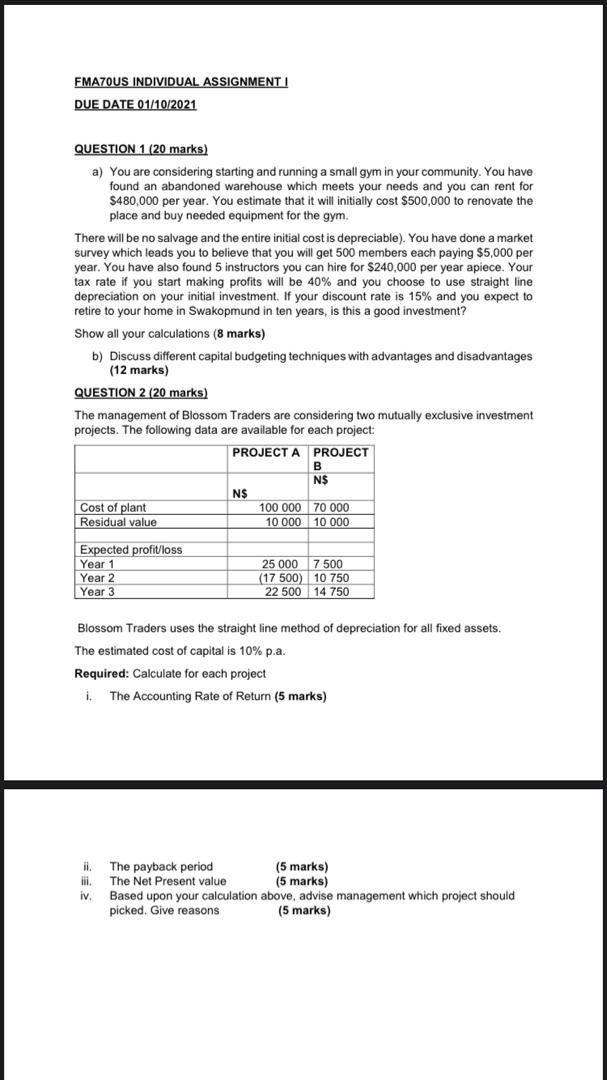

FMATOUS INDIVIDUAL ASSIGNMENT I DUE DATE 01/10/2021 QUESTION 1 (20 marks) a) You are considering starting and running a small gym in your community. You have found an abandoned warehouse which meets your needs and you can rent for $480,000 per year. You estimate that it will initially cost $500,000 to renovate the place and buy needed equipment for the gym. There will be no salvage and the entire initial cost is depreciable). You have done a market survey which leads you to believe that you will get 500 members each paying $5,000 per year. You have also found 5 instructors you can hire for $240,000 per year apiece. Your tax rate if you start making profits will be 40% and you choose to use straight line depreciation on your initial investment. If your discount rate is 15% and you expect to retire to your home in Swakopmund in ten years, is this a good investment? Show all your calculations (8 marks) b) Discuss different capital budgeting techniques with advantages and disadvantages (12 marks) QUESTION 2 (20 marks) The management of Blossom Traders are considering two mutually exclusive investment projects. The following data are available for each project: PROJECT A PROJECT B N$ N$ Cost of plant 100 000 70 000 Residual value 10 000 10 000 Expected profit loss Year 1 Year 2 Year 3 25 000 7500 (17 500) 10 750 22 500 14 750 Blossom Traders uses the straight line method of depreciation for all fixed assets. The estimated cost of capital is 10% p.a. Required: Calculate for each project i. The Accounting Rate of Return (5 marks) il. iii. iv. The payback period (5 marks) The Net Present value (5 marks) Based upon your calculation above, advise management which project should picked. Give reasons

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts