Question: FMBA Timken Case Evaluation Problem: Timken is a global leader in producing high quality bearings for a variety of industries. Timken's steel business is a

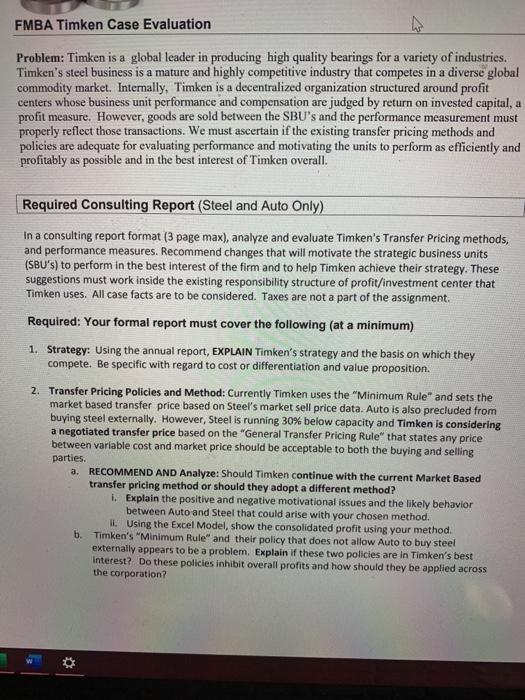

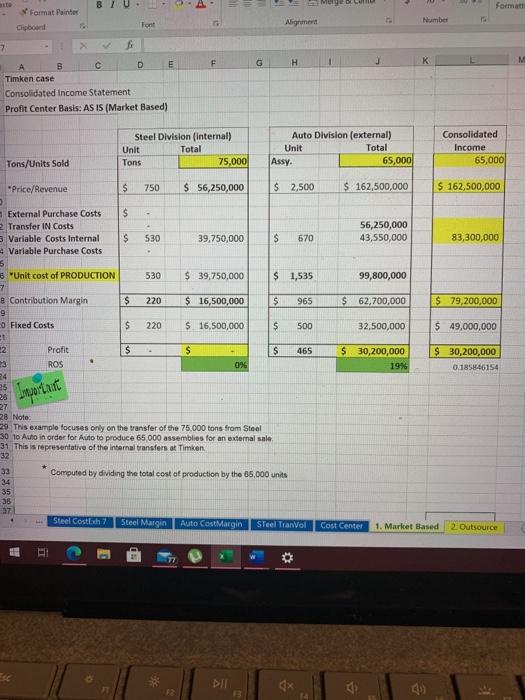

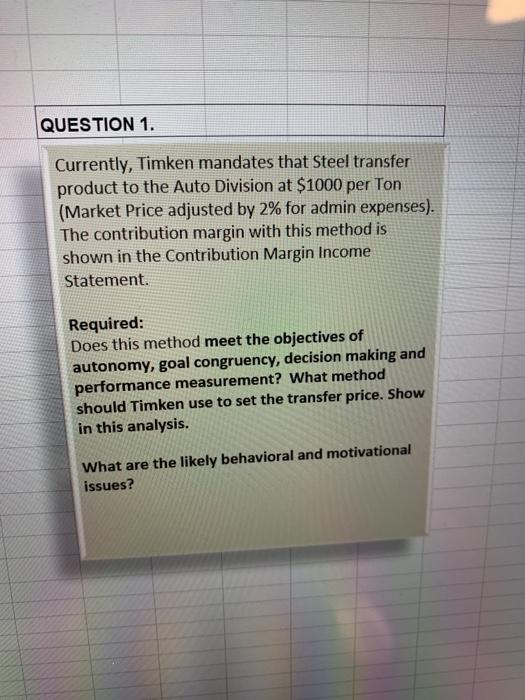

FMBA Timken Case Evaluation Problem: Timken is a global leader in producing high quality bearings for a variety of industries. Timken's steel business is a mature and highly competitive industry that competes in a diverse global commodity market. Internally, Timken is a decentralized organization structured around profit centers whose business unit performance and compensation are judged by return on invested capital, a profit measure. However, goods are sold between the SBU's and the performance measurement must properly reflect those transactions. We must ascertain if the existing transfer pricing methods and policies are adequate for evaluating performance and motivating the units to perform as efficiently and profitably as possible and in the best interest of Timken overall. Required Consulting Report (Steel and Auto Only) In a consulting report format (3 page max), analyze and evaluate Timken's Transfer Pricing methods, and performance measures. Recommend changes that will motivate the strategic business units (SBU's) to perform in the best interest of the firm and to help Timken achieve their strategy. These suggestions must work inside the existing responsibility structure of profit/investment center that Timken uses. All case facts are to be considered. Taxes are not a part of the assignment. Required: Your formal report must cover the following (at a minimum) 1. Strategy: Using the annual report, EXPLAIN Timken's strategy and the basis on which they compete. Be specific with regard to cost or differentiation and value proposition. 2. Transfer Pricing Policies and Method: Currently Timken uses the "Minimum Rule" and sets the market based transfer price based on Steel's market sell price data. Auto is also precluded from buying steel externally. However, Steel is running 30% below capacity and Timken is considering a negotiated transfer price based on the "General Transfer Pricing Rule" that states any price between variable cost and market price should be acceptable to both the buying and selling parties. a. RECOMMEND AND Analyze: Should Timken continue with the current Market Based transfer pricing method or should they adopt a different method? i. Explain the positive and negative motivational issues and the likely behavior between Auto and Steel that could arise with your chosen method. Using the Excel Model, show the consolidated profit using your method. b. Timken's "Minimum Rule" and their policy that does not allow Auto to buy steel externally appears to be a problem. Explain if these two policies are in Timken's best interest? Do these policies inhibit overall profits and how should they be applied across the corporation? 3. Performance Measures: Strategic performance measurement is complex in a decentralized firm as the transfer of goods between units affects each SBU's reported profitability. Timken is concerned that the current ROIC measure may be ineffective and not inducing the goal congruent behavior at the SBU level and non-financial measures seem to be non-existent. a. Using your transfer pricing method from question 2. Recommend a set of performance measures should be used to positively motivate manager performance at Steel and Auto and that both protects SBU autonomy while achieving congruence at the corporate level. NOTE: The questions asked are the minimum of what should be covered in the report. Going beyond the questions to show an understanding of the applicable transfer pricing and responsibility center concepts is EXPECTED. Em Mug Format Format Painter Clipboard T. Font Alignment Number F G H M A B D E Timken case Consolidated Income Statement Profit Center Basis: AS IS (Market Based) Steel Division (internal) Unit Total Tons 75,000 Auto Division (external) Unit Total Assy. 65,000 Consolidated Income 65,000 Tons/Units Sold *Price/Revenue $ 750 $ 56,250,000 $ 2,500 $ 162,500,000 $ 162,500,000 $ External Purchase Costs Transfer IN Costs 3 Variable Costs Internal Variable Purchase Costs 56,250,000 43,550,000 $ 530 39.750,000 $ 670 83,300,000 530 $ 39,750,000 $ 1,535 99,800,000 $ 220 $ 16,500,000 $ 965 $ 62,700,000 $ 79,200,000 $ 220 $ 16,500,000 $ 6. "Unit cost of PRODUCTION 7 8 Contribution Margin 9 Fixed Costs 1 22 Profit 28 ROS 24 25 $ 500 32,500,000 $ 49,000,000 $ $ s 465 $ 30,200,000 19% $ 30,200,000 0.185846154 0% important 27 28 Note 29 This example focuses only on the transfer of the 75.000 tons from Steel 30 to Auto in order for Auto to produce 65 000 assemblies for an external sale 31 This is representative of the Internal transfers at Timken 32 33 Computed by dividing the total cost of production by the 65.000 units 34 35 38 Steel Costih 7 Steel Margin Auto CostMargin Steel Tran Vol Cost Center 1. Market Based 2. Outsource 12 13 QUESTION 1. Currently, Timken mandates that Steel transfer product to the Auto Division at $1000 per Ton (Market Price adjusted by 2% for admin expenses). The contribution margin with this method is shown in the Contribution Margin Income Statement. Required: Does this method meet the objectives of autonomy, goal congruency, decision making and performance measurement? What method should Timken use to set the transfer price. Show in this analysis. What are the likely behavioral and motivational issues? FMBA Timken Case Evaluation Problem: Timken is a global leader in producing high quality bearings for a variety of industries. Timken's steel business is a mature and highly competitive industry that competes in a diverse global commodity market. Internally, Timken is a decentralized organization structured around profit centers whose business unit performance and compensation are judged by return on invested capital, a profit measure. However, goods are sold between the SBU's and the performance measurement must properly reflect those transactions. We must ascertain if the existing transfer pricing methods and policies are adequate for evaluating performance and motivating the units to perform as efficiently and profitably as possible and in the best interest of Timken overall. Required Consulting Report (Steel and Auto Only) In a consulting report format (3 page max), analyze and evaluate Timken's Transfer Pricing methods, and performance measures. Recommend changes that will motivate the strategic business units (SBU's) to perform in the best interest of the firm and to help Timken achieve their strategy. These suggestions must work inside the existing responsibility structure of profit/investment center that Timken uses. All case facts are to be considered. Taxes are not a part of the assignment. Required: Your formal report must cover the following (at a minimum) 1. Strategy: Using the annual report, EXPLAIN Timken's strategy and the basis on which they compete. Be specific with regard to cost or differentiation and value proposition. 2. Transfer Pricing Policies and Method: Currently Timken uses the "Minimum Rule" and sets the market based transfer price based on Steel's market sell price data. Auto is also precluded from buying steel externally. However, Steel is running 30% below capacity and Timken is considering a negotiated transfer price based on the "General Transfer Pricing Rule" that states any price between variable cost and market price should be acceptable to both the buying and selling parties. a. RECOMMEND AND Analyze: Should Timken continue with the current Market Based transfer pricing method or should they adopt a different method? i. Explain the positive and negative motivational issues and the likely behavior between Auto and Steel that could arise with your chosen method. Using the Excel Model, show the consolidated profit using your method. b. Timken's "Minimum Rule" and their policy that does not allow Auto to buy steel externally appears to be a problem. Explain if these two policies are in Timken's best interest? Do these policies inhibit overall profits and how should they be applied across the corporation? 3. Performance Measures: Strategic performance measurement is complex in a decentralized firm as the transfer of goods between units affects each SBU's reported profitability. Timken is concerned that the current ROIC measure may be ineffective and not inducing the goal congruent behavior at the SBU level and non-financial measures seem to be non-existent. a. Using your transfer pricing method from question 2. Recommend a set of performance measures should be used to positively motivate manager performance at Steel and Auto and that both protects SBU autonomy while achieving congruence at the corporate level. NOTE: The questions asked are the minimum of what should be covered in the report. Going beyond the questions to show an understanding of the applicable transfer pricing and responsibility center concepts is EXPECTED. Em Mug Format Format Painter Clipboard T. Font Alignment Number F G H M A B D E Timken case Consolidated Income Statement Profit Center Basis: AS IS (Market Based) Steel Division (internal) Unit Total Tons 75,000 Auto Division (external) Unit Total Assy. 65,000 Consolidated Income 65,000 Tons/Units Sold *Price/Revenue $ 750 $ 56,250,000 $ 2,500 $ 162,500,000 $ 162,500,000 $ External Purchase Costs Transfer IN Costs 3 Variable Costs Internal Variable Purchase Costs 56,250,000 43,550,000 $ 530 39.750,000 $ 670 83,300,000 530 $ 39,750,000 $ 1,535 99,800,000 $ 220 $ 16,500,000 $ 965 $ 62,700,000 $ 79,200,000 $ 220 $ 16,500,000 $ 6. "Unit cost of PRODUCTION 7 8 Contribution Margin 9 Fixed Costs 1 22 Profit 28 ROS 24 25 $ 500 32,500,000 $ 49,000,000 $ $ s 465 $ 30,200,000 19% $ 30,200,000 0.185846154 0% important 27 28 Note 29 This example focuses only on the transfer of the 75.000 tons from Steel 30 to Auto in order for Auto to produce 65 000 assemblies for an external sale 31 This is representative of the Internal transfers at Timken 32 33 Computed by dividing the total cost of production by the 65.000 units 34 35 38 Steel Costih 7 Steel Margin Auto CostMargin Steel Tran Vol Cost Center 1. Market Based 2. Outsource 12 13 QUESTION 1. Currently, Timken mandates that Steel transfer product to the Auto Division at $1000 per Ton (Market Price adjusted by 2% for admin expenses). The contribution margin with this method is shown in the Contribution Margin Income Statement. Required: Does this method meet the objectives of autonomy, goal congruency, decision making and performance measurement? What method should Timken use to set the transfer price. Show in this analysis. What are the likely behavioral and motivational issues