Question: FNB 100 Topic 1 Practi Yahoo x e G are traded in capital m self-test%20A.pdf gov premium c, k = pure rate + inflation adjustment

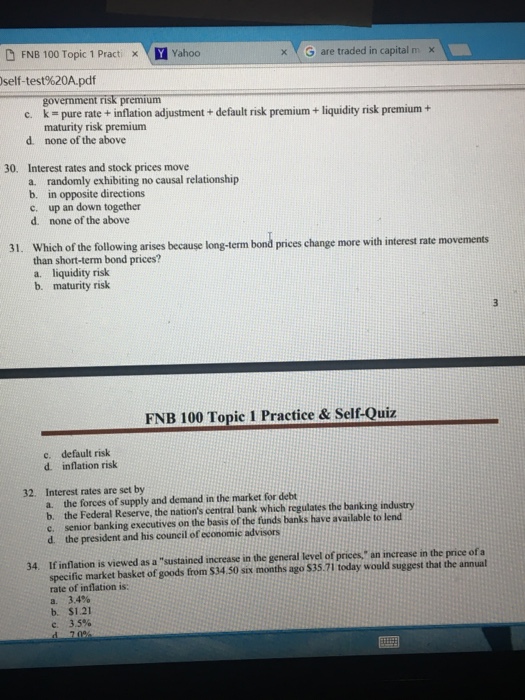

FNB 100 Topic 1 Practi Yahoo x e G are traded in capital m self-test%20A.pdf gov premium c, k = pure rate + inflation adjustment + default risk premium + liquidity risk premium + maturity risk premium d none of the above 30. Interest rates and stock prices move a. randomly exhibiting no causal relationship b. in opposite directions c. up an down together d. none of the above 31. Which of the following arises because long-term bond prices change more with interest rate movements than short-term bond prices? a. liquidity risk b. maturity risk FNB 100 Topic 1 Practice & Self-Quiz c. default risk d. inflation risk Interest rates are set by a. the forces of supply and demand in the market for debt b. the Federal Reserve, the nation's central bank which regulates the banking industry c. senior banking executives on the basis of the funds banks have available to lend d. the president and his council of economic advisors 32. 34. If inflation is viewed as a "sustained increase in the general level of prices, an increase in the price ofa specific market basket of goods from $34.50 six months ago $35.71 today would suggest that the annual rate of inflation is: a. 3.4% b. $1.21 c. 3.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts