Question: FNC 345 Project (2) Mallings Review View Aalbcode Aasbcodee AaBbCCD AaBbCcDdE Normal No Spacing Heading 1 Heading 2 1. (5 points) ABC Inc.'s capital structure

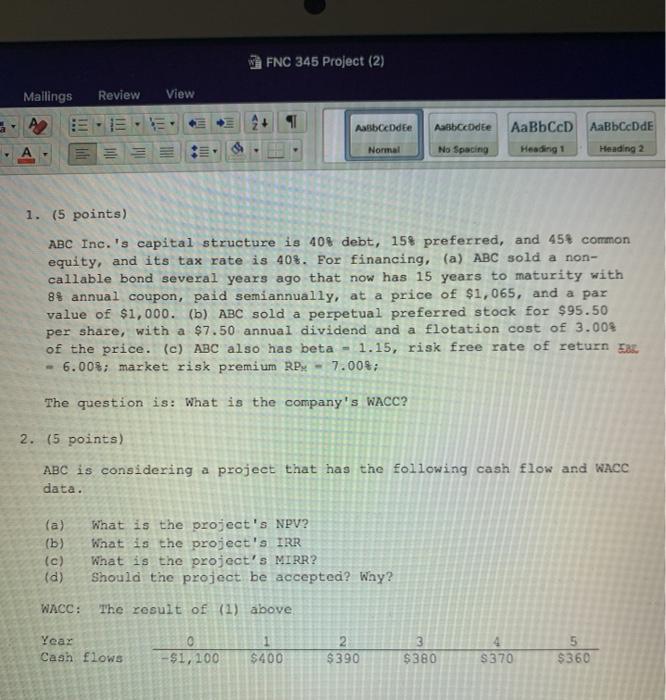

FNC 345 Project (2) Mallings Review View Aalbcode Aasbcodee AaBbCCD AaBbCcDdE Normal No Spacing Heading 1 Heading 2 1. (5 points) ABC Inc.'s capital structure is 40% debt, 15% preferred, and 45% common equity, and its tax rate is 40%. For financing, (a) ABC sold a non- callable bond several years ago that now has 15 years to maturity with 89 annual coupon, paid semiannually, at a price of $1,065, and a par value of $1,000. (b) ABC sold a perpetual preferred stock for $95.50 per share, with a $7.50 annual dividend and a flotation cost of 3.000 of the price. (c) ABC also has beta 1.15, risk free rate of return E - 6.00%; market risk premium RPM - 7.008: The question is: What is the company's WACC? 2. (5 points) ABC is considering a project that has the following cash flow and WACC data. (a) (b) (c) What is the project's NPV? What is the project's IRR What is the project's MIRR? Should the project be accepted? Why? WACC: The result of (1) above Yeaz Cash flows -$1,100 2 $390 3 $380 5 $360 $400 S370

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts