Question: FNCE 6 2 3 - FINAL EXAM - SUMMER 2 0 2 4 1 - Open one blank excel file and record all your workings

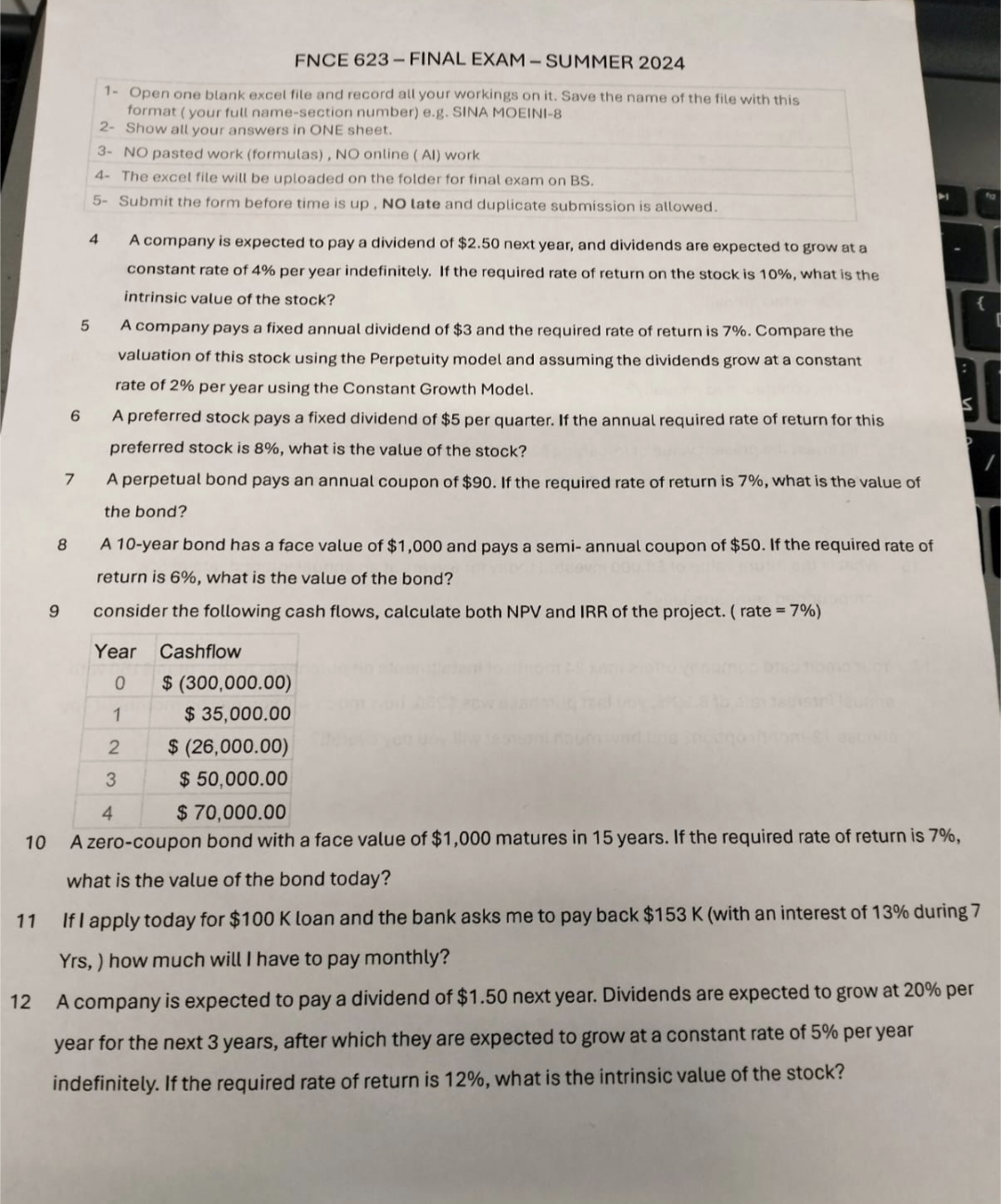

FNCE FINAL EXAM SUMMER

Open one blank excel file and record all your workings on it Save the name of the file with this

format your full namesection number eg SINA MOEINI

Show all your answers in ONE sheet.

NO pasted work formulas NO ontine AI work

The excel file will be uploaded on the folder for final exam on BS

Submit the form before time is up NO tate and duplicate submission is allowed.

A company is expected to pay a dividend of $ next year, and dividends are expected to grow at a

constant rate of per year indefinitely. If the required rate of return on the stock is what is the

intrinsic value of the stock?

A company pays a fixed annual dividend of $ and the required rate of return is Compare the

valuation of this stock using the Perpetuity model and assuming the dividends grow at a constant

rate of per year using the Constant Growth Model.

A preferred stock pays a fixed dividend of $ per quarter. If the annual required rate of return for this

preferred stock is what is the value of the stock?

A perpetual bond pays an annual coupon of $ If the required rate of return is what is the value of

the bond?

A year bond has a face value of $ and pays a semiannual coupon of $ If the required rate of

return is what is the value of the bond?

consider the following cash flows, calculate both NPV and IRR of the project. rate

A zerocoupon bond with a face value of $ matures in years. If the required rate of return is

What is the value of the bond today?

If I apply today for $ loan and the bank asks me to pay back $with an interest of during

Yrs how much will I have to pay monthly?

A company is expected to pay a dividend of $ next year. Dividends are expected to grow at per

year for the next years, after which they are expected to grow at a constant rate of per year

indefinitely. If the required rate of return is what is the intrinsic value of the stock?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock