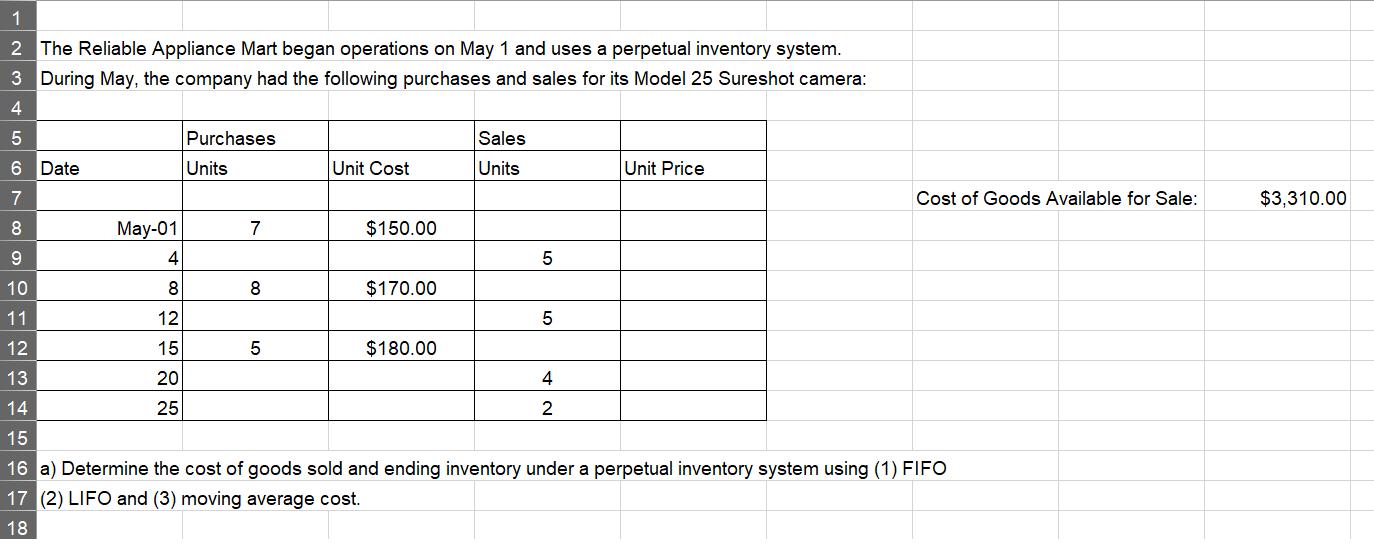

Question: 1 2 The Reliable Appliance Mart began operations on May 1 and uses a perpetual inventory system. 3 During May, the company had the

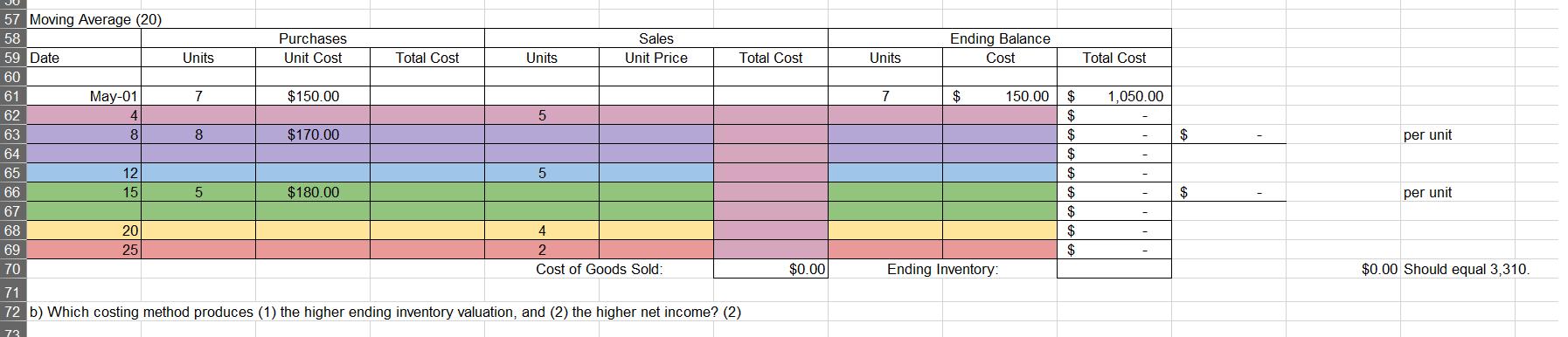

1 2 The Reliable Appliance Mart began operations on May 1 and uses a perpetual inventory system. 3 During May, the company had the following purchases and sales for its Model 25 Sureshot camera: 4 5 6 Date Purchases Units Sales Unit Cost Units Unit Price 7 8 May-01 7 $150.00 9 4 5 10 8 8 $170.00 11 12 5 12 15 5 $180.00 13 20 4 14 25 2 15 Cost of Goods Available for Sale: $3,310,00 16 a) Determine the cost of goods sold and ending inventory under a perpetual inventory system using (1) FIFO 17 (2) LIFO and (3) moving average cost. 18 18 19 FIFO (20) 20 21 Date Units Purchases Sales Unit Cost Total Cost Units Unit Price Total Cost Units Ending Balance Cost Total Cost 7 $ 150.00 22 23 May-01 7 $150.00 24 4 5 25 8 8 $170.00 26 27 12 5 28 29 15 5 $180.00 30 31 20 4 32 33 25 2 34 35 36 $0.00 Cost of Goods Sold: $0.00 Ending Inventory: $0.00 Should equal 3,310. 57 Moving Average (20) 58 59 Date Purchases Sales Units Unit Cost Total Cost Units Unit Price Total Cost Units Ending Balance Cost Total Cost 60 61 May-01 7 $150.00 7 $ 62 4 5 150.00 $ $ 1,050.00 63 8 8 $170.00 $ $ per unit 64 $ 65 12 5 $ 66 15 5 $180.00 $ per unit 67 $ 68 20 69 25 70 4 2 Cost of Goods Sold: $ $ $0.00 Ending Inventory: $0.00 Should equal 3,310. 71 72 b) Which costing method produces (1) the higher ending inventory valuation, and (2) the higher net income? (2) 73

Step by Step Solution

There are 3 Steps involved in it

To answer the question about determining the cost of goods sold and ending inventory under a perpetual inventory system using FIFO LIFO and moving ave... View full answer

Get step-by-step solutions from verified subject matter experts