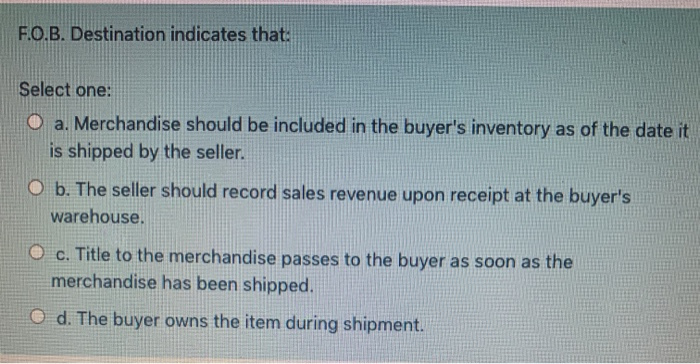

Question: F.O.B. Destination indicates that: Select one: O a. Merchandise should be included in the buyer's inventory as of the date it is shipped by the

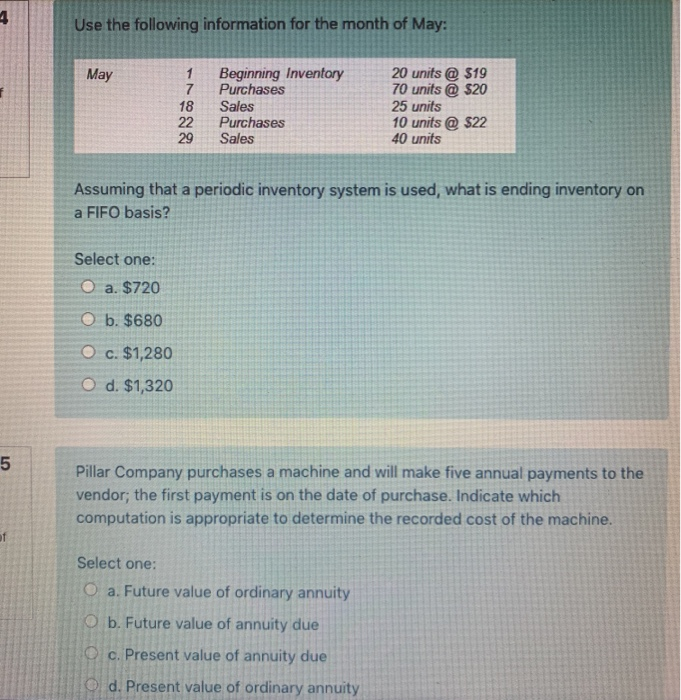

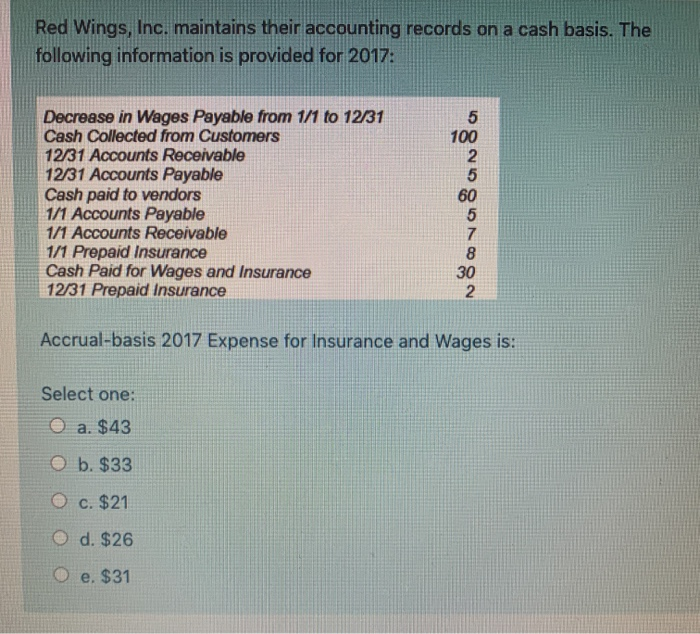

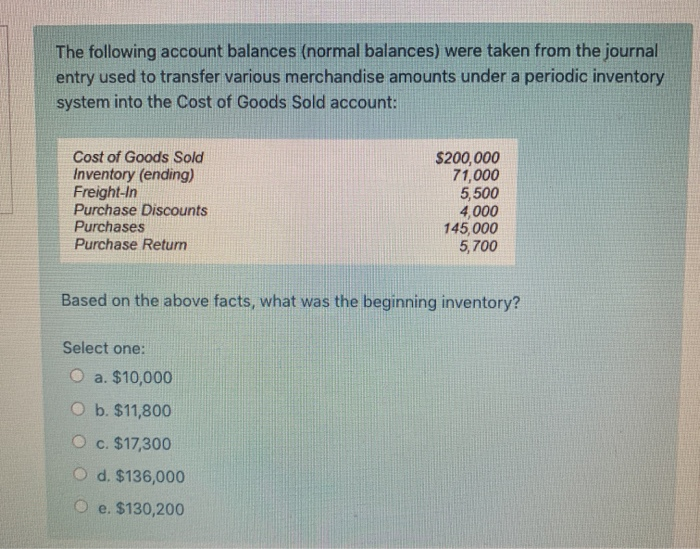

F.O.B. Destination indicates that: Select one: O a. Merchandise should be included in the buyer's inventory as of the date it is shipped by the seller. O b. The seller should record sales revenue upon receipt at the buyer's warehouse c. Title to the merchandise passes to the buyer as soon as the merchandise has been shipped. O d. The buyer owns the item during shipment. Use the following information for the month of May: May 1 7 18 22 29 Beginning Inventory Purchases Sales Purchases Sales 20 units @ $19 70 units @ $20 25 units 10 units @ $22 40 units Assuming that a periodic inventory system is used, what is ending inventory on a FIFO basis? Select one: O a. $720 O b. $680 O c. $1,280 O d. $1,320 5 Pillar Company purchases a machine and will make five annual payments to the vendor; the first payment is on the date of purchase. Indicate which computation is appropriate to determine the recorded cost of the machine. of Select one: O a. Future value of ordinary annuity O b. Future value of annuity due c. Present value of annuity due O d. Present value of ordinary annuity Red Wings, Inc. maintains their accounting records on a cash basis. The following information is provided for 2017: Decrease in Wages Payable from 1/1 to 12/31 Cash Collected from Customers 12/31 Accounts Receivable 12/31 Accounts Payable Cash paid to vendors 1/1 Accounts Payable 1/1 Accounts Receivable 1/1 Prepaid Insurance Cash Paid for Wages and Insurance 12/31 Prepaid Insurance 5 100 2 5 60 5 7 8 30 2 Accrual-basis 2017 Expense for Insurance and Wages is: Select one: O a. $43 b. $33 O c. $21 d. $26 O e. $31 The following account balances (normal balances) were taken from the journal entry used to transfer various merchandise amounts under a periodic inventory system into the Cost of Goods Sold account: Cost of Goods Sold Inventory (ending) Freight-in Purchase Discounts Purchases Purchase Return $200,000 71,000 5,500 4,000 145,000 5,700 Based on the above facts, what was the beginning inventory? Select one: O a. $10,000 O b. $11,800 O c. $17,300 O d. $136,000 O e. $130,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts