Question: folder. There are 10 questions, each worth 5 points for a total of 50 points. You get 5 attempts. The problem is due no later

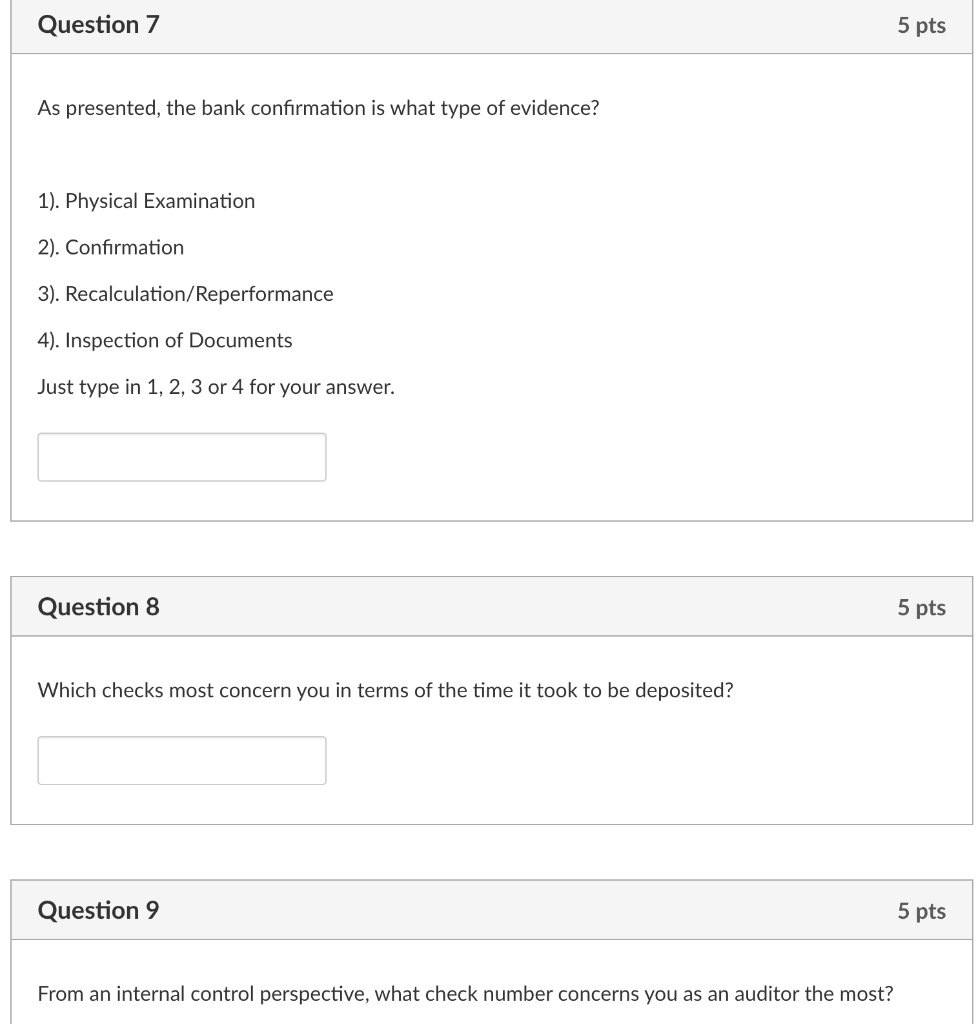

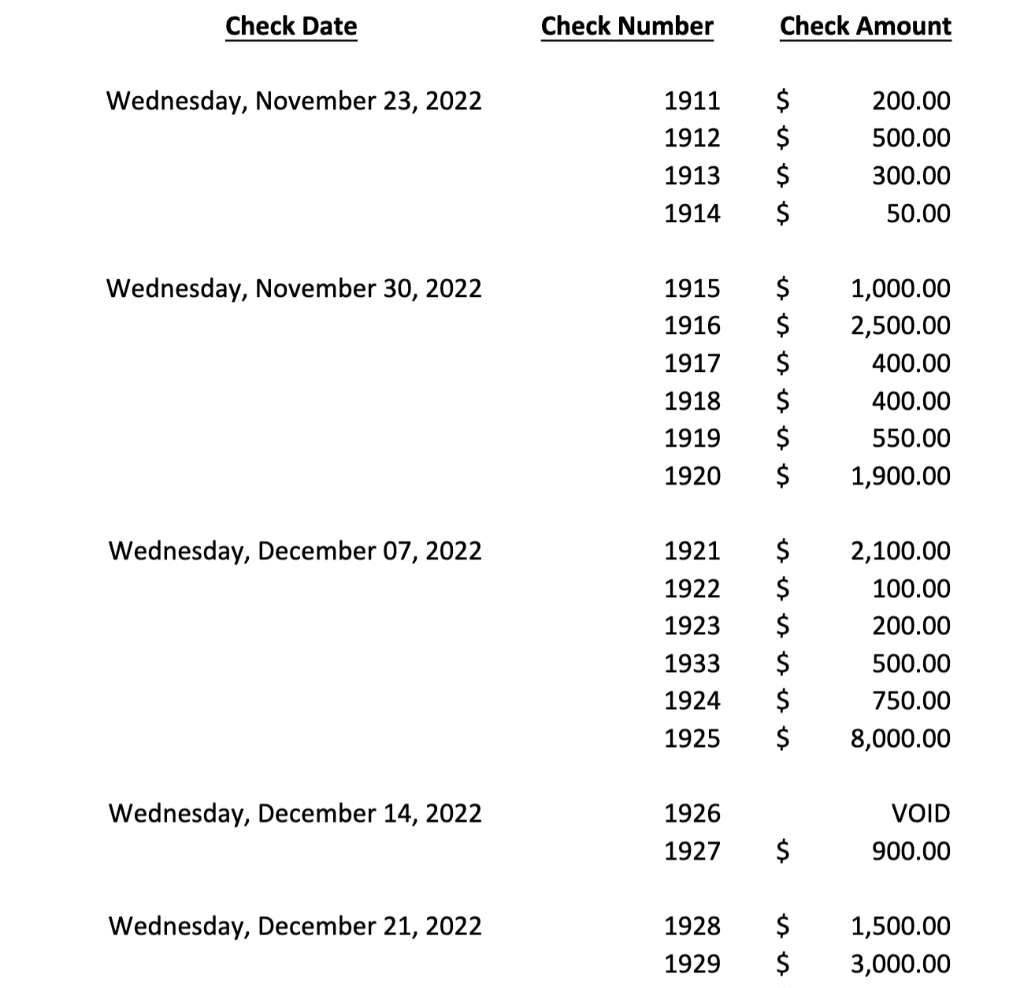

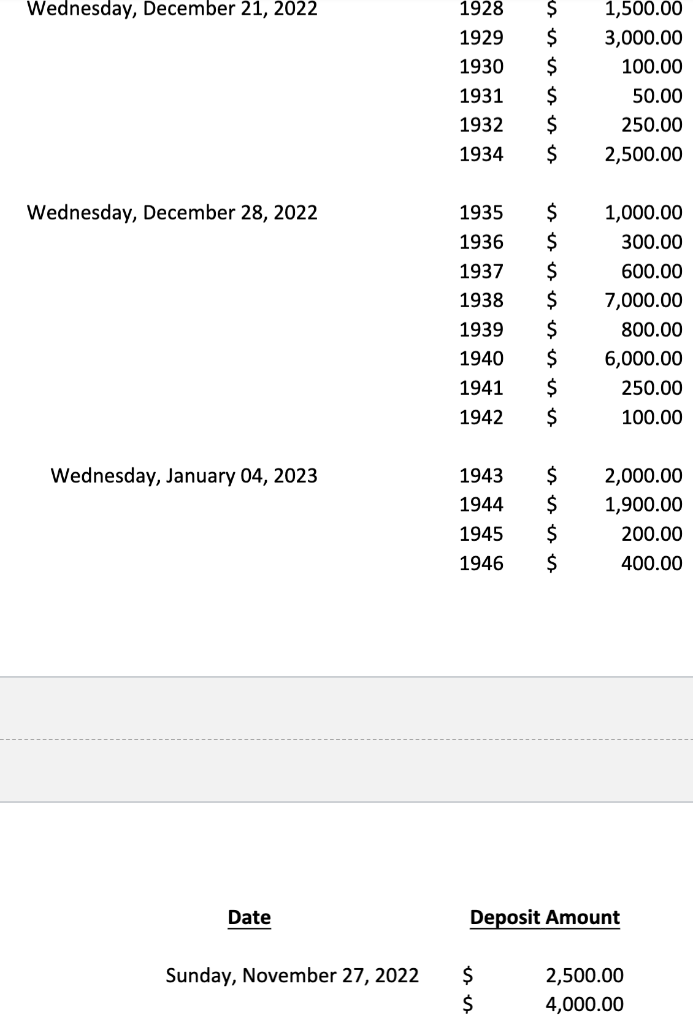

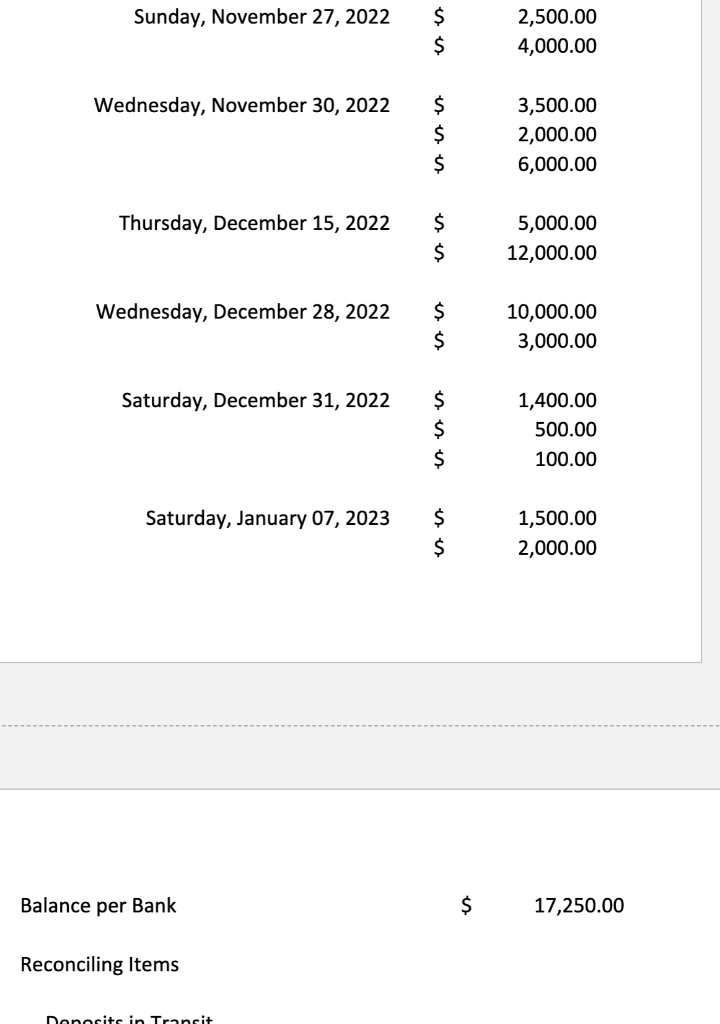

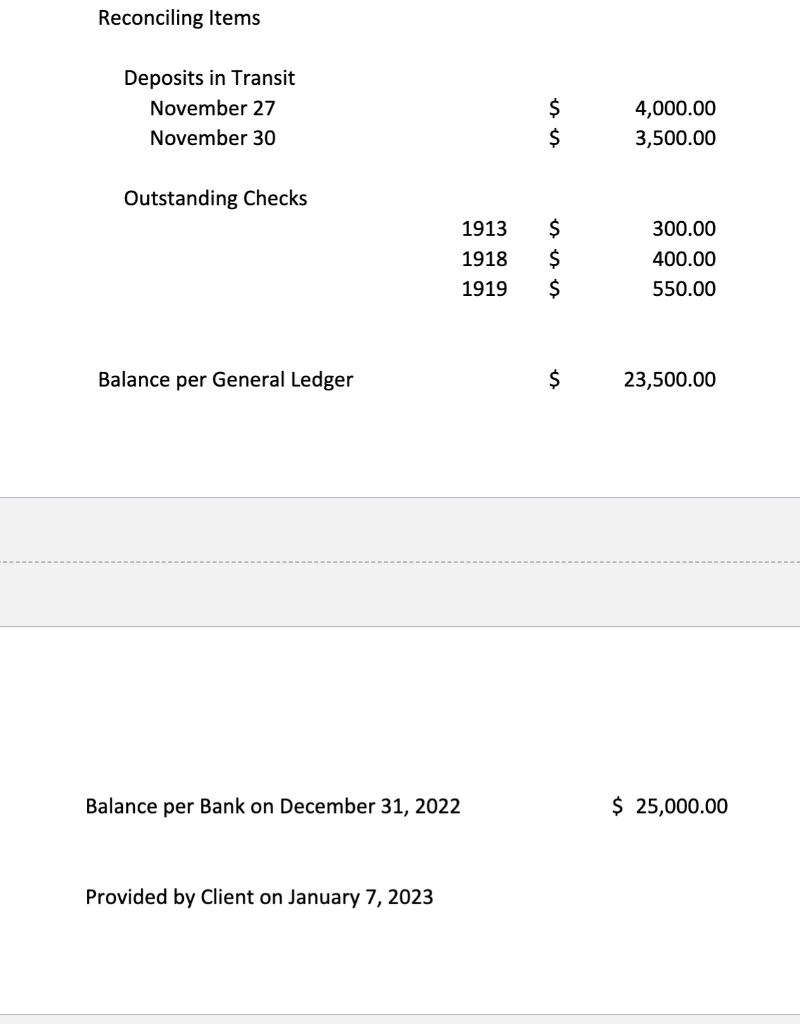

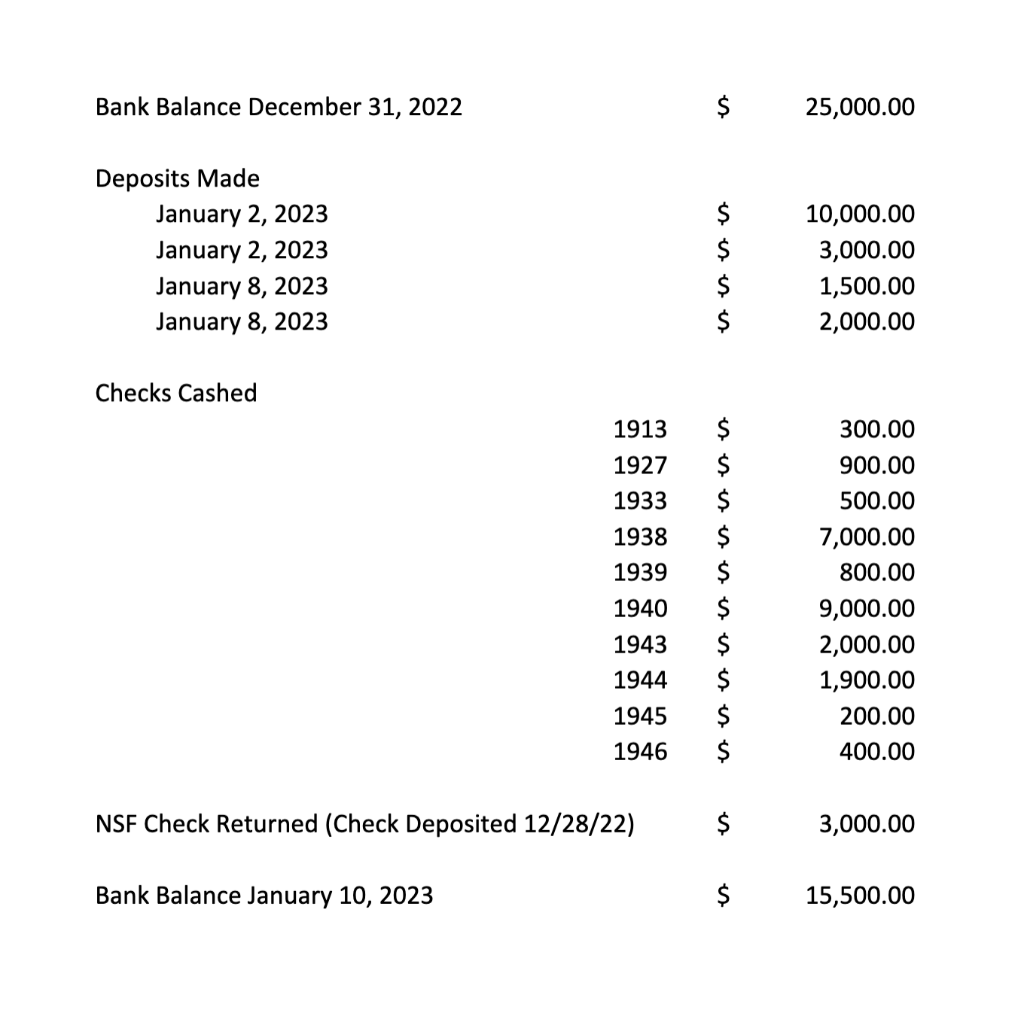

folder. There are 10 questions, each worth 5 points for a total of 50 points. You get 5 attempts. The problem is due no later than 4 pm. on Thursday, February 23. DO NOT ENTER NEGATIVE AMOUNTS OR COMMAS. IF THE ANSWER IS -\$12,000, SIMPLY ENTER 12000. DO NOT INCLUDE ANY NEGATIVES OR COMMAS OR DOLLAR SIGNS. ASSUME THAT ALL CHECKS CLEAR AND DEPOSITS RECORDED AT THE BANK IN THE SAME MONTH OTHER THAN AS INDICATED. IF AN ANSWER IS "NONE OF THE ABOVE" OR "NONE" OR "ZERO", ENTER THE WORD NONE. Question 1 5 pts What is the balance per bank that should be on the top line of the bank reconciliation? Question 2 5pts What is the total amount of Deposits in Transit that should be included on the December 31 bank reconciliation? What is the total amount of outstanding checks that should be included in the December 31 bank reconciliation? Question 4 If there are any other adjustments to the bank reconciliation, what is that amount? Question 5 What balance does the client show on the G/L (or face of balance sheet) on December 31 ? As presented, the bank confirmation is what type of evidence? 1). Physical Examination 2). Confirmation 3). Recalculation/Reperformance 4). Inspection of Documents Just type in 1, 2,3 or 4 for your answer. Question 8 Which checks most concern you in terms of the time it took to be deposited? Question 9 From an internal control perspective, what check number concerns you as an auditor the most? Check Date Check Number Check Amount Wednesday,November23,2022Wednesday,November30,2022Wednesday,December07,202219111912191319141915191619171918191919201921192219231933192419251926192719281929$$$$$$$$$$$$$$$$$$$200.00500.00300.0050.001,000.002,500.00400.00400.00550.001,900.002,100.00100.00200.00500.00750.008,000.00volD900.001,500.003,000.00 Wednesday,December21,2022Wednesday,December28,2022192819291930193119321934193519361937193819391940194119421943194419451946$$$$$$$$$$$$$$$$$$1,500.003,000.00100.0050.00250.002,500.001,000.00300.00600.007,000.00800.006,000.00250.00100.002,000.001,900.00200.00400.00 Date Deposit Amount Sunday,November27,2022$$2,500.004,000.00 Sunday,November27,2022$$2,500.004,000.00 Wednesday,November30,2022$$$3,500.002,000.006,000.00 Thursday,December15,2022$$5,000.0012,000.00 Saturday,December31,2022$$$1,400.00500.00100.00 Saturday,January07,2023$$1,500.002,000.00 Balance per Bank $17,250.00 Reconciling Items Balance per Bank on December 31, 2022 Provided by Client on January 7, 2023 Bank Balance December 31, 2022 $25,000.00 Deposits Made January2,2023January2,2023January8,2023January8,2023$$$$10,000.003,000.001,500.002,000.00 Checks Cashed 1913192719331938193919401943194419451946$$$$$$$$$$300.00900.00500.007,000.00800.009,000.002,000.001,900.00200.00400.00 NSF Check Returned (Check Deposited 12/28/22) \$ $3,000.00 Bank Balance January 10, 2023 $15,500.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts