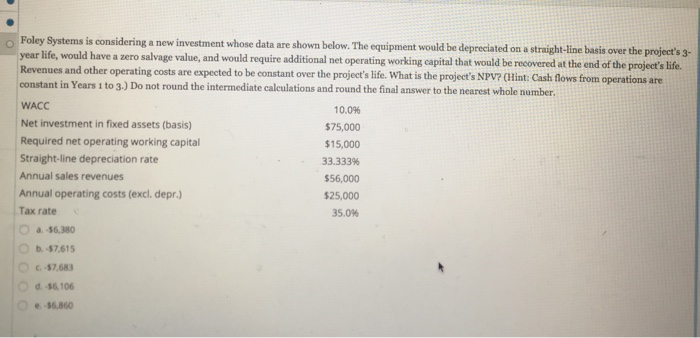

Question: Foley Systems is considering a new investment whose data are shown below. The equipment would be depreciated on a straight-line basis over the project's 3-

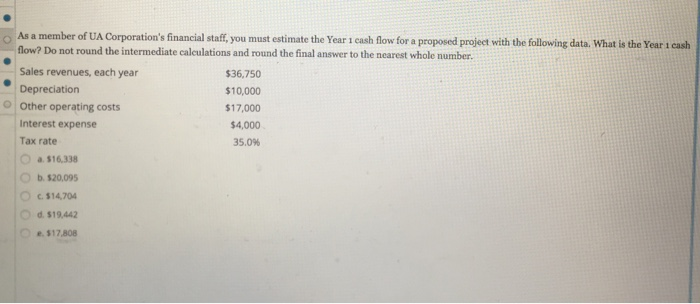

Foley Systems is considering a new investment whose data are shown below. The equipment would be depreciated on a straight-line basis over the project's 3- year life, would have a zero salvage value, and would require additional net operating working capital that would be recovered at the end of the project's life. Revenues and other operating costs are expected to be constant over the project's life. What is the project's NPV? (Hint: Cash flows from operations are constant in Years 1 to 3.) Do not round the intermediate calculations and round the final answer to the nearest whole number, WACC 10.0% Net investment in fixed assets (basis) $75,000 Required net operating working capital $15,000 Straight-line depreciation rate 33.333% Annual sales revenues $56,000 Annual operating costs (excl. depr.) $25,000 Tax rate 35.0% 56,380 -57,615 57,683 4.56,106 36.860 As a member of UA Corporation's financial staff, you must estimate the Year 1 cash flow for a proposed project with the following data. What is the Year 1 cash flow? Do not round the intermediate calculations and round the final answer to the nearest whole number. Sales revenues, each year $36,750 Depreciation $10,000 Other operating costs $17,000 Interest expense $4,000 Tax rate 35.0% a $16,338 b. 520.095 C514704 d. 519,442 $17.808

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts