Question: Foley Systems is considering a new project, which has the data shown below. The project would have a 4-year economic life. The project's equipment would

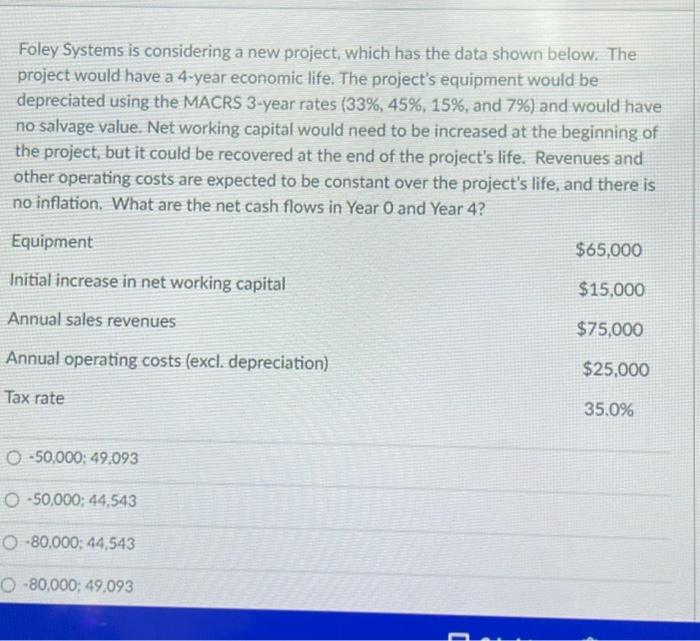

Foley Systems is considering a new project, which has the data shown below. The project would have a 4-year economic life. The project's equipment would be depreciated using the MACRS 3-year rates (33%, 45%, 15%, and 7%) and would have no salvage value. Net working capital would need to be increased at the beginning of the project, but it could be recovered at the end of the project's life. Revenues and other operating costs are expected to be constant over the project's life, and there is no inflation. What are the net cash flows in Year O and Year 4? Equipment $65,000 Initial increase in net working capital $15,000 Annual sales revenues $75,000 Annual operating costs (excl. depreciation) $25,000 Tax rate 35.0% -50,000: 49.093 0-50,000; 44,543 0 -80,000; 44,543 -80,000; 49,093

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts