Question: Follow methods presented in excel spreadsheet examples 1) Rank alternatives by increasing initial cost as you set up data table and net cash flow table

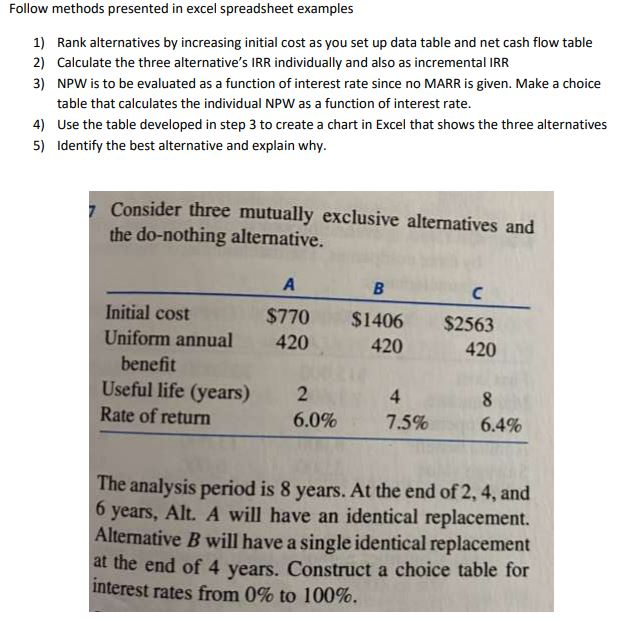

Follow methods presented in excel spreadsheet examples 1) Rank alternatives by increasing initial cost as you set up data table and net cash flow table 2) Calculate the three alternative's IRR individually and also as incremental IRR 3) NPW is to be evaluated as a function of interest rate since no MARR is given. Make a choice table that calculates the individual NPW as a function of interest rate. 4) Use the table developed in step 3 to create a chart in Excel that shows the three alternatives 5) Identify the best alternative and explain why. 7 Consider three mutually exclusive alternatives and the do-nothing alternative. B. $770 420 $1406 420 $2563 420 Initial cost Uniform annual benefit Useful life (years) Rate of return 2 6.0% 4 7.5% 8 6.4% The analysis period is 8 years. At the end of 2, 4, and 6 years, Alt. A will have an identical replacement. Alternative B will have a single identical replacement at the end of 4 years. Construct a choice table for interest rates from 0% to 100%. Follow methods presented in excel spreadsheet examples 1) Rank alternatives by increasing initial cost as you set up data table and net cash flow table 2) Calculate the three alternative's IRR individually and also as incremental IRR 3) NPW is to be evaluated as a function of interest rate since no MARR is given. Make a choice table that calculates the individual NPW as a function of interest rate. 4) Use the table developed in step 3 to create a chart in Excel that shows the three alternatives 5) Identify the best alternative and explain why. 7 Consider three mutually exclusive alternatives and the do-nothing alternative. B. $770 420 $1406 420 $2563 420 Initial cost Uniform annual benefit Useful life (years) Rate of return 2 6.0% 4 7.5% 8 6.4% The analysis period is 8 years. At the end of 2, 4, and 6 years, Alt. A will have an identical replacement. Alternative B will have a single identical replacement at the end of 4 years. Construct a choice table for interest rates from 0% to 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts