Question: follow the example to answer these excel problems. please show the formulas to show work. Stay in protected View. Enable Edit F H B D

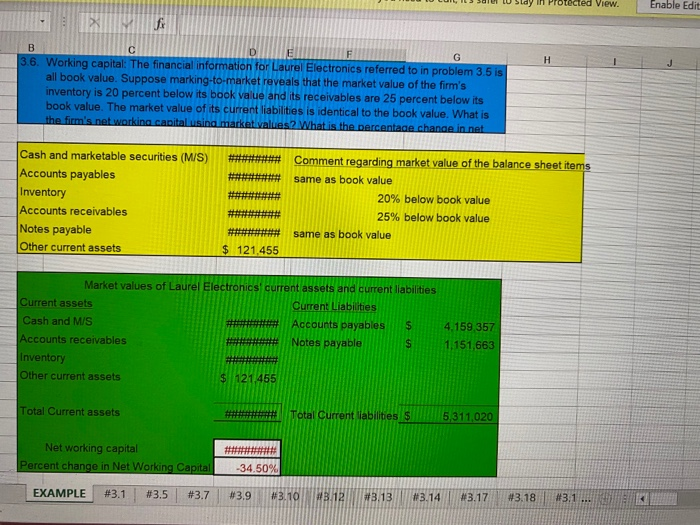

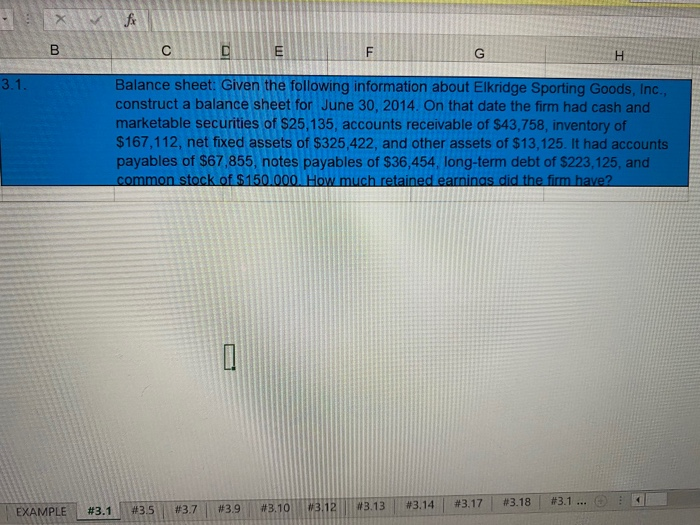

Stay in protected View. Enable Edit F H B D E G 3.6. Working capital: The financial information for Laurel Electronics referred to in problem 3.5 is all book value. Suppose marking-to-market reveals that the market value of the firm's inventory is 20 percent below its book value and its receivables are 25 percent below its book value. The market value of its current liabilities is identical to the book value. What is the firm's not working capital using market values? What is the percentage change in net Cash and marketable securities (M/S) Accounts payables Inventory Accounts receivables Notes payable Other current assets Comment regarding market value of the balance sheet items same as book value 20% below book value 25% below book value same as book value $ 121.455 Market values of Laurel Electronics current assets and current liabilities Current assets Current Liabilities Cash and M/S Accounts payables $ Accounts receivables HT Notes payable $ Inventory Other current assets $ 121,455 4.159 357 1,151,663 Total Current assets Total Current abilities $ 5,311,020 Net working capital Percent change in Net Working Capital -34.50% EXAMPLE #3.1 #3.5 #3.7 #3.9 #3.10 3.12 #3.13 #3.14 #3.17 #3.18 #3.1... fx B C OI E F G H 3.1. Balance sheet: Given the following information about Elkridge Sporting Goods, Inc., construct a balance sheet for June 30, 2014. On that date the firm had cash and marketable securities of $25,135, accounts receivable of $43,758, inventory of $167,112, net fixed assets of $325,422, and other assets of $13,125. It had accounts payables of $67,855, notes payables of $36,454, long-term debt of $223,125, and common stock of $150.000. How much retained earnings did the firm have? a #3.18 #3.1 ... EXAMPLE #3.5 #3.7 #3.13 #3.1 #3.9 #3.14 #3.17 #3.10 13.12 Home Insert Draw Page Layout Formulas Data Review View Help ECTED VIEW Be careful--files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View Enable Editing for B D E F 3.13 Cash flows: Hillman Corporation reported current assets of $3,495,055 for the year ending December 31, 2014 and current assets of $3,103,839 for the year ending December 31, 2013. Current liabiliites for the firm were $2,867,225 and $2,760,124 at the end of 2014 and 2013, respectively. Compute the cash flow invested in net working capital at Hillman Corporation during 2014 EXAMPLE #3.1 #35 #3.7 #3.9 3.10 3.12 #3.13 #3.17 23.18 231 fi B D E F G 3.24 Income statement: For its most recent fiscal year, Carmichael Hobby Shop recorded EBITDA of $512,725.20, EBIT of $362,450.20, zero interest expense, and cash flow to investors from operating activitiy of $348,461.25. Assuming there are no non-cash revenues recorded on the income statement, what is the firm's net income after taxes? 3.12 03.14 23.17 23.18 .3.19 #320 23.21 3.22 #3.23 33.24 B C D E F 3.26 Cash flows: Refer to the information given in problem 3.21. What is the cash flow for Nimitz Rental? #3.21 #3.22 #3.23 #3.24 #3.25 #3.26 #3.27 #3.28 #3.29 #3.30 #3.31 C E F G - J 3.29 Eau Claire Paper Mill, Inc., had, at the beginning of the fiscal year, April 1, 2013, retained earnings of $323,325. During the year ended March 31, 2014, the company produced net income after taxes of $713,445 and paid out 45 percent of its net income as dividends. Construct a statement of retained earnings and compute the year-end balance of retained earnings. #3.21 #3.22 #3.23 #3.24 #3.25 #3.26 #3.27 #3.28 #3.29 #3.30 #3.31 A B C D E F G 3.30 Menomonie Casino Company earned $23,458,933 before interest and taxes for the fiscal year ending March 31, 2014. If the casino had interest expenses of $1,645,123, calculate its tax burden using Exhibit 3.6. What are the marginal and the average tax rates for this company? EBIT Interest expenses 1,645,123 Tax schedule U.S. Federal Corporate Income Tax Rates for 2013 Taxable income from Upto Rate 0 $ 50,000 15% 50,001 $ 75,000 25% 75001 $ 100,000 34% 100,001 $ 335,000 39% 335,001 $ 10,000,000 34% 10,000,001 $ 15,000,000 35% 15,000,001 $ 18,333,333 38% 18,333,334 $ 35% 3 1 2 -3 #3.21 #3.22 #3.23 #3.24 #3.25 #3.26 #3.27 #3.28 #3.29 + #3.30 #3.31 Stay in protected View. Enable Edit F H B D E G 3.6. Working capital: The financial information for Laurel Electronics referred to in problem 3.5 is all book value. Suppose marking-to-market reveals that the market value of the firm's inventory is 20 percent below its book value and its receivables are 25 percent below its book value. The market value of its current liabilities is identical to the book value. What is the firm's not working capital using market values? What is the percentage change in net Cash and marketable securities (M/S) Accounts payables Inventory Accounts receivables Notes payable Other current assets Comment regarding market value of the balance sheet items same as book value 20% below book value 25% below book value same as book value $ 121.455 Market values of Laurel Electronics current assets and current liabilities Current assets Current Liabilities Cash and M/S Accounts payables $ Accounts receivables HT Notes payable $ Inventory Other current assets $ 121,455 4.159 357 1,151,663 Total Current assets Total Current abilities $ 5,311,020 Net working capital Percent change in Net Working Capital -34.50% EXAMPLE #3.1 #3.5 #3.7 #3.9 #3.10 3.12 #3.13 #3.14 #3.17 #3.18 #3.1... fx B C OI E F G H 3.1. Balance sheet: Given the following information about Elkridge Sporting Goods, Inc., construct a balance sheet for June 30, 2014. On that date the firm had cash and marketable securities of $25,135, accounts receivable of $43,758, inventory of $167,112, net fixed assets of $325,422, and other assets of $13,125. It had accounts payables of $67,855, notes payables of $36,454, long-term debt of $223,125, and common stock of $150.000. How much retained earnings did the firm have? a #3.18 #3.1 ... EXAMPLE #3.5 #3.7 #3.13 #3.1 #3.9 #3.14 #3.17 #3.10 13.12 Home Insert Draw Page Layout Formulas Data Review View Help ECTED VIEW Be careful--files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View Enable Editing for B D E F 3.13 Cash flows: Hillman Corporation reported current assets of $3,495,055 for the year ending December 31, 2014 and current assets of $3,103,839 for the year ending December 31, 2013. Current liabiliites for the firm were $2,867,225 and $2,760,124 at the end of 2014 and 2013, respectively. Compute the cash flow invested in net working capital at Hillman Corporation during 2014 EXAMPLE #3.1 #35 #3.7 #3.9 3.10 3.12 #3.13 #3.17 23.18 231 fi B D E F G 3.24 Income statement: For its most recent fiscal year, Carmichael Hobby Shop recorded EBITDA of $512,725.20, EBIT of $362,450.20, zero interest expense, and cash flow to investors from operating activitiy of $348,461.25. Assuming there are no non-cash revenues recorded on the income statement, what is the firm's net income after taxes? 3.12 03.14 23.17 23.18 .3.19 #320 23.21 3.22 #3.23 33.24 B C D E F 3.26 Cash flows: Refer to the information given in problem 3.21. What is the cash flow for Nimitz Rental? #3.21 #3.22 #3.23 #3.24 #3.25 #3.26 #3.27 #3.28 #3.29 #3.30 #3.31 C E F G - J 3.29 Eau Claire Paper Mill, Inc., had, at the beginning of the fiscal year, April 1, 2013, retained earnings of $323,325. During the year ended March 31, 2014, the company produced net income after taxes of $713,445 and paid out 45 percent of its net income as dividends. Construct a statement of retained earnings and compute the year-end balance of retained earnings. #3.21 #3.22 #3.23 #3.24 #3.25 #3.26 #3.27 #3.28 #3.29 #3.30 #3.31 A B C D E F G 3.30 Menomonie Casino Company earned $23,458,933 before interest and taxes for the fiscal year ending March 31, 2014. If the casino had interest expenses of $1,645,123, calculate its tax burden using Exhibit 3.6. What are the marginal and the average tax rates for this company? EBIT Interest expenses 1,645,123 Tax schedule U.S. Federal Corporate Income Tax Rates for 2013 Taxable income from Upto Rate 0 $ 50,000 15% 50,001 $ 75,000 25% 75001 $ 100,000 34% 100,001 $ 335,000 39% 335,001 $ 10,000,000 34% 10,000,001 $ 15,000,000 35% 15,000,001 $ 18,333,333 38% 18,333,334 $ 35% 3 1 2 -3 #3.21 #3.22 #3.23 #3.24 #3.25 #3.26 #3.27 #3.28 #3.29 + #3.30 #3.31

Step by Step Solution

There are 3 Steps involved in it

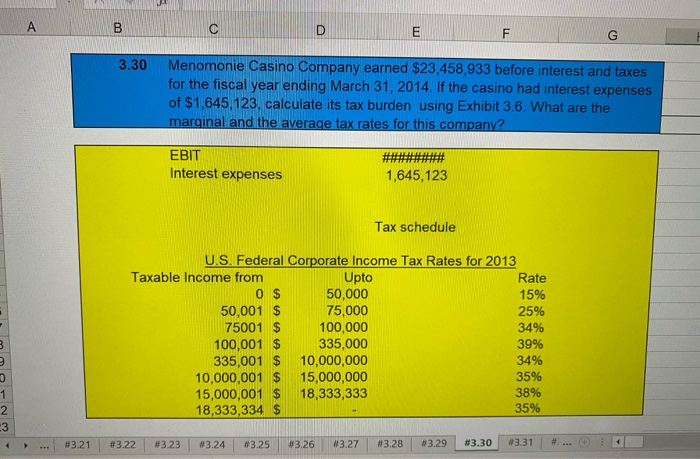

Get step-by-step solutions from verified subject matter experts