Question: follow the instructions below, how do i start this? and outline or step by step would be helpful please! The following information is provided regarding

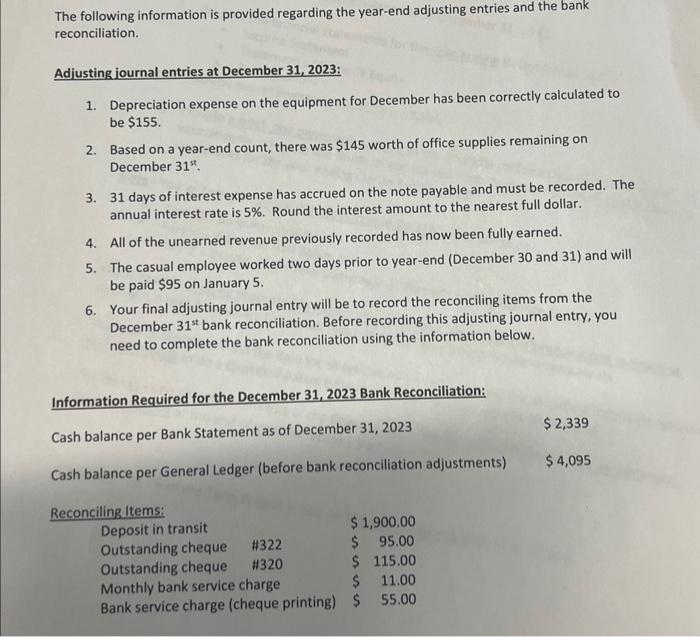

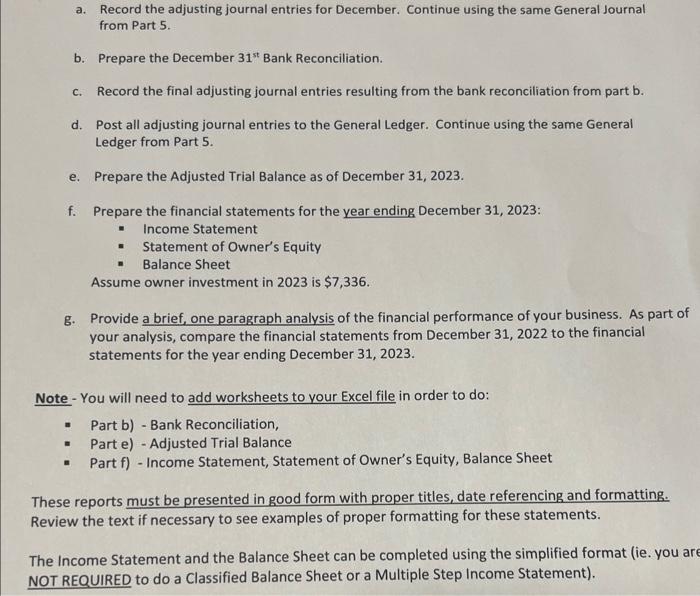

The following information is provided regarding the year-end adjusting entries and the bank reconciliation. Adjusting journal entries at December 31, 2023: 1. Depreciation expense on the equipment for December has been correctly calculated to be $155. 2. Based on a year-end count, there was $145 worth of office supplies remaining on December 31st. 3. 31 days of interest expense has accrued on the note payable and must be recorded. The annual interest rate is 5%. Round the interest amount to the nearest full dollar. 4. All of the unearned revenue previously recorded has now been fully earned. 5. The casual employee worked two days prior to year-end (December 30 and 31 ) and will be paid $95 on January 5 . 6. Your final adjusting journal entry will be to record the reconciling items from the December 31st bank reconciliation. Before recording this adjusting journal entry, you need to complete the bank reconciliation using the information below. a. Record the adjusting journal entries for December. Continue using the same General Journal from Part 5. b. Prepare the December 31st Bank Reconciliation. c. Record the final adjusting journal entries resulting from the bank reconciliation from part b. d. Post all adjusting journal entries to the General Ledger. Continue using the same General Ledger from Part 5. e. Prepare the Adjusted Trial Balance as of December 31, 2023. f. Prepare the financial statements for the year ending December 31,2023 : - Income Statement - Statement of Owner's Equity - Balance Sheet Assume owner investment in 2023 is $7,336. g. Provide a brief, one paragraph analysis of the financial performance of your business. As part of your analysis, compare the financial statements from December 31,2022 to the financial statements for the year ending December 31,2023. Note - You will need to add worksheets to your Excel file in order to do: - Part b) - Bank Reconciliation, - Part e) - Adjusted Trial Balance - Part f) - Income Statement, Statement of Owner's Equity, Balance Sheet These reports must be presented in good form with proper titles, date referencing and formatting. Review the text if necessary to see examples of proper formatting for these statements. The Income Statement and the Balance Sheet can be completed using the simplified format (ie. you are The following information is provided regarding the year-end adjusting entries and the bank reconciliation. Adjusting journal entries at December 31, 2023: 1. Depreciation expense on the equipment for December has been correctly calculated to be $155. 2. Based on a year-end count, there was $145 worth of office supplies remaining on December 31st. 3. 31 days of interest expense has accrued on the note payable and must be recorded. The annual interest rate is 5%. Round the interest amount to the nearest full dollar. 4. All of the unearned revenue previously recorded has now been fully earned. 5. The casual employee worked two days prior to year-end (December 30 and 31 ) and will be paid $95 on January 5 . 6. Your final adjusting journal entry will be to record the reconciling items from the December 31st bank reconciliation. Before recording this adjusting journal entry, you need to complete the bank reconciliation using the information below. a. Record the adjusting journal entries for December. Continue using the same General Journal from Part 5. b. Prepare the December 31st Bank Reconciliation. c. Record the final adjusting journal entries resulting from the bank reconciliation from part b. d. Post all adjusting journal entries to the General Ledger. Continue using the same General Ledger from Part 5. e. Prepare the Adjusted Trial Balance as of December 31, 2023. f. Prepare the financial statements for the year ending December 31,2023 : - Income Statement - Statement of Owner's Equity - Balance Sheet Assume owner investment in 2023 is $7,336. g. Provide a brief, one paragraph analysis of the financial performance of your business. As part of your analysis, compare the financial statements from December 31,2022 to the financial statements for the year ending December 31,2023. Note - You will need to add worksheets to your Excel file in order to do: - Part b) - Bank Reconciliation, - Part e) - Adjusted Trial Balance - Part f) - Income Statement, Statement of Owner's Equity, Balance Sheet These reports must be presented in good form with proper titles, date referencing and formatting. Review the text if necessary to see examples of proper formatting for these statements. The Income Statement and the Balance Sheet can be completed using the simplified format (ie. you are

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts