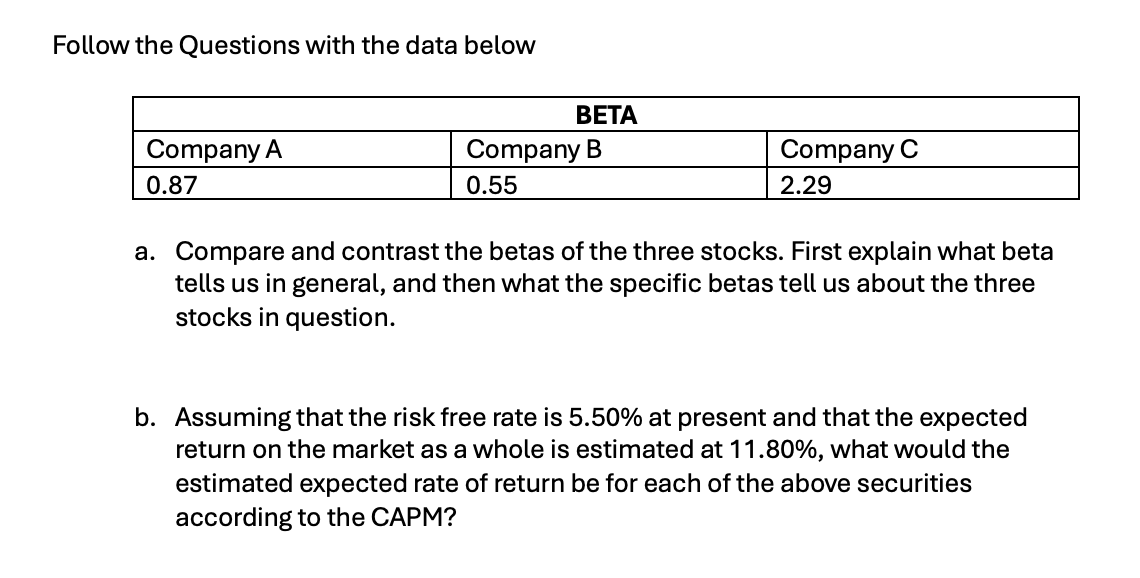

Question: Follow the Questions with the data below a . Compare and contrast the betas of the three stocks. First explain what beta tells us in

Follow the Questions with the data below

a Compare and contrast the betas of the three stocks. First explain what beta

tells us in general, and then what the specific betas tell us about the three

stocks in question.

b Assuming that the risk free rate is at present and that the expected

return on the market as a whole is estimated at what would the

estimated expected rate of return be for each of the above securities

according to the CAPM?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock