Question: FOLLOW THIS FORMAT PLEASE!***** Use the following information to construct basic financial statements. Develop a future budget and recommendations to improve their financial ratios. You

FOLLOW THIS FORMAT PLEASE!*****

FOLLOW THIS FORMAT PLEASE!*****

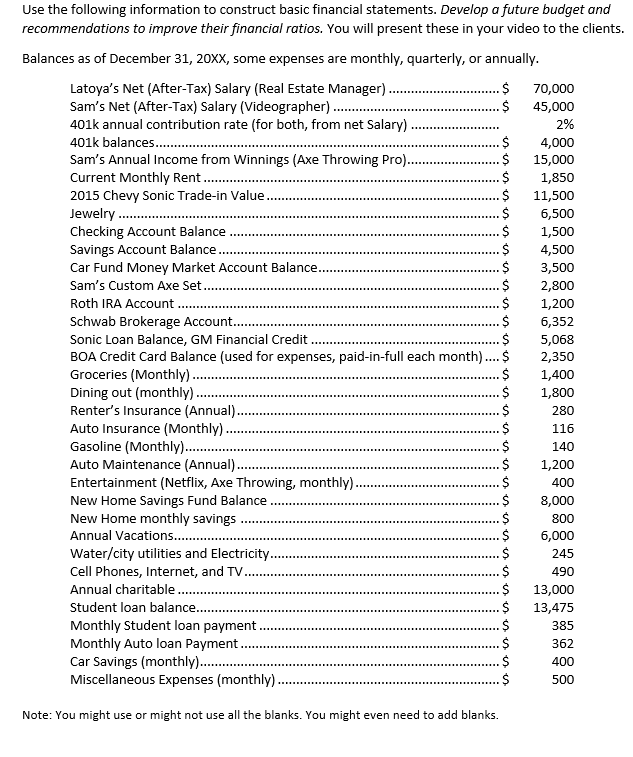

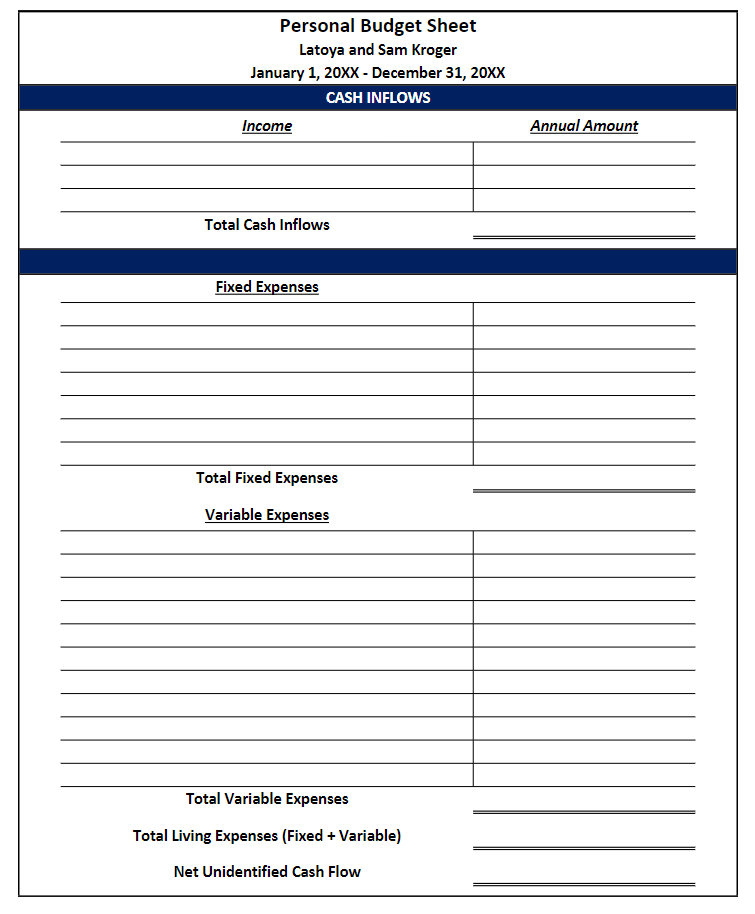

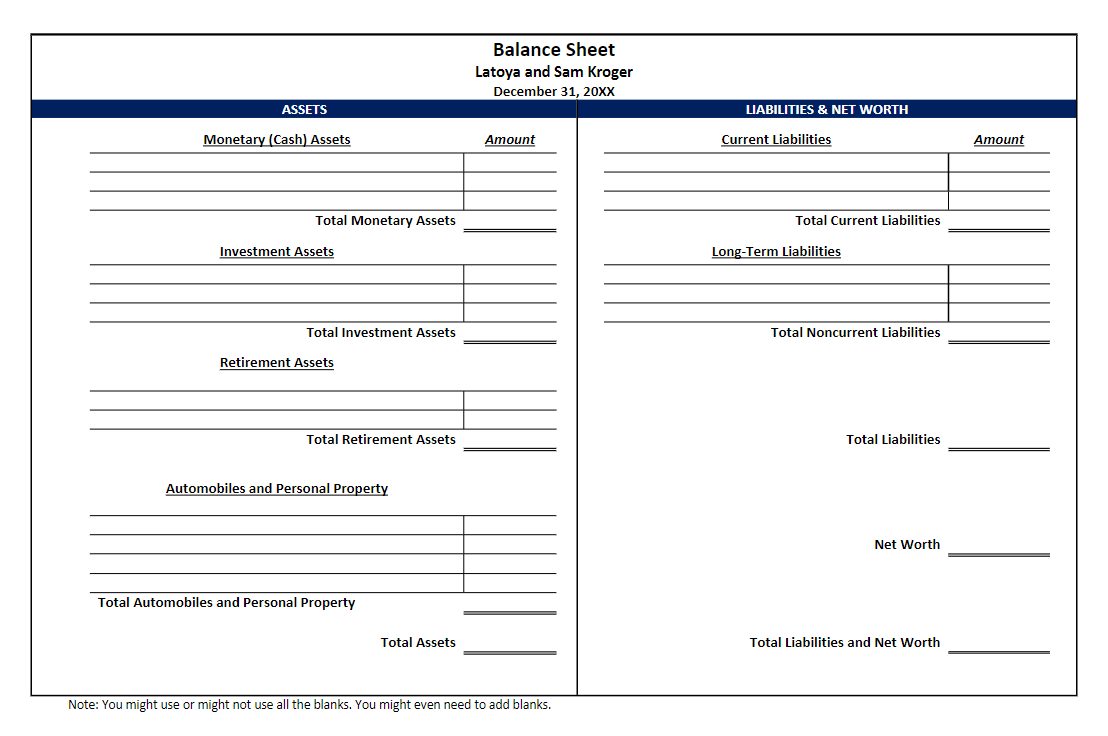

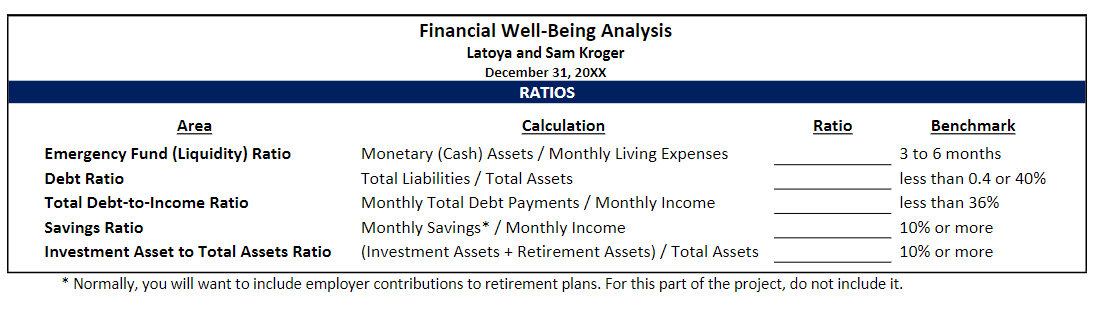

Use the following information to construct basic financial statements. Develop a future budget and recommendations to improve their financial ratios. You will present these in your video to the clients. Balances as of December 31, 20XX, some expenses are monthly, quarterly, or annually. $ Latoya's Net (After-Tax) Salary (Real Estate Manager) Sam's Net (After-Tax) Salary (Videographer). $ 401k annual contribution rate (for both, from net Salary). 401k balances......... Sam's Annual Income from Winnings (Axe Throwing Pro).. Current Monthly Rent 2015 Chevy Sonic Trade-in Value. Jewelry ........ Checking Account Balance Savings Account Balance ............... Car Fund Money Market Account Balance. Sam's Custom Axe Set. Roth IRA Account Schwab Brokerage Account... Sonic Loan Balance, GM Financial Credit $ BOA Credit Card Balance (used for expenses, paid-in-full each month).... $ Groceries (Monthly). .$ $ Dining out (monthly)... Renter's Insurance (Annual).. Auto Insurance (Monthly) Gasoline (Monthly).. Auto Maintenance (Annual)... Entertainment (Netflix, Axe Throwing, monthly) New Home Savings Fund Balance New Home monthly savings Annual Vacations......... Water/city utilities and Electricity.. Cell Phones, Internet, and TV. Annual charitable. Student loan balance......... Monthly Student loan payment. Monthly Auto loan Payment. Car Savings (monthly)... Miscellaneous Expenses (monthly). $ $ $ $ Note: You might use or might not use all the blanks. You might even need to add blanks. $ $ $ SsSsS $ $ $ $ $ $ $ $ $ .$ $ $ $ $ $ $ $ 70,000 45,000 2% 4,000 15,000 1,850 11,500 6,500 1,500 4,500 3,500 2,800 1,200 6,352 5,068 2,350 1,400 1,800 280 116 140 1,200 400 8,000 800 6,000 245 490 13,000 13,475 385 362 400 500 Personal Budget Sheet Latoya and Sam Kroger January 1, 20XX - December 31, 20XX CASH INFLOWS Income Total Cash Inflows Fixed Expenses Total Fixed Expenses Variable Expenses Total Variable Expenses Total Living Expenses (Fixed + Variable) Net Unidentified Cash Flow Annual Amount ASSETS Monetary (Cash) Assets Total Monetary Assets Investment Assets Total Investment Assets Retirement Assets Total Retirement Assets Automobiles and Personal Property Total Automobiles and Personal Property Total Assets Balance Sheet Latoya and Sam Kroger December 31, 20XX Amount Note: You might use or might not use all the blanks. You might even need to add blanks. LIABILITIES & NET WORTH Current Liabilities Total Current Liabilities Long-Term Liabilities Total Noncurrent Liabilities Total Liabilities Net Worth Total Liabilities and Net Worth Amount Financial Well-Being Analysis Latoya and Sam Kroger December 31, 20XX RATIOS Area Emergency Fund (Liquidity) Ratio Debt Ratio Total Debt-to-Income Ratio Savings Ratio Investment Asset to Total Assets Ratio Calculation Monetary (Cash) Assets/ Monthly Living Expenses Total Liabilities / Total Assets Monthly Total Debt Payments / Monthly Income Monthly Savings* / Monthly Income (Investment Assets + Retirement Assets) / Total Assets * Normally, you will want to include employer contributions to retirement plans. For this part of the project, do not include it. Ratio Benchmark 3 to 6 months less than 0.4 or 40% less than 36% 10% or more 10% or more

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts