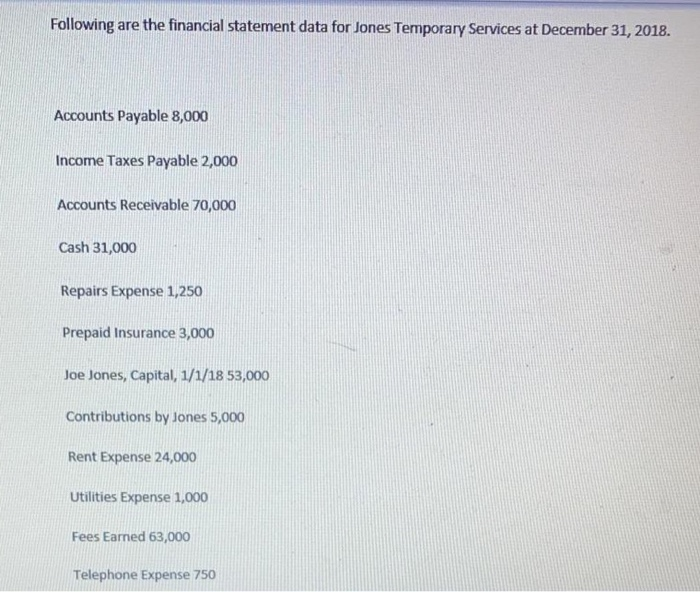

Question: Following are the financial statement data for Jones Temporary Services at December 31, 2018. Accounts Payable 8,000 Income Taxes Payable 2,000 Accounts Receivable 70,000 Cash

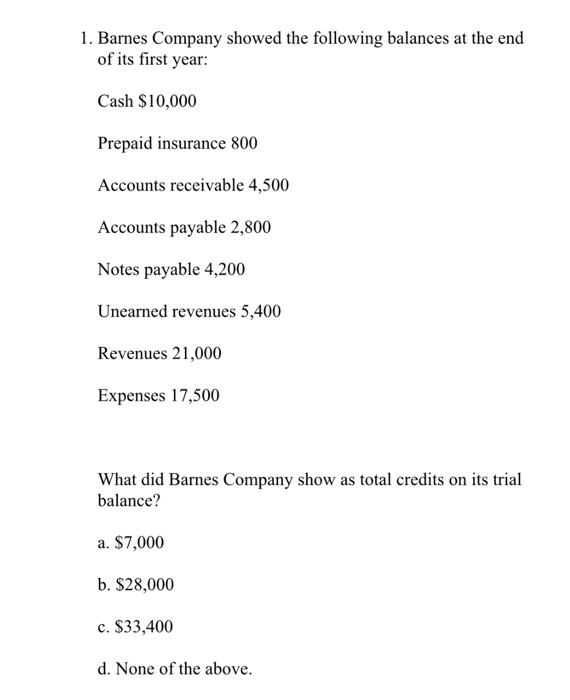

Following are the financial statement data for Jones Temporary Services at December 31, 2018. Accounts Payable 8,000 Income Taxes Payable 2,000 Accounts Receivable 70,000 Cash 31,000 Repairs Expense 1,250 Prepaid Insurance 3,000 Joe Jones, Capital, 1/1/18 53,000 Contributions by Jones 5,000 Rent Expense 24,000 Utilities Expense 1,000 Fees Eamed 63,000 Telephone Expense 750 1. Barnes Company showed the following balances at the end of its first year: Cash $10,000 Prepaid insurance 800 Accounts receivable 4,500 Accounts payable 2,800 Notes payable 4,200 Unearned revenues 5,400 Revenues 21,000 Expenses 17,500 What did Barnes Company show as total credits on its trial balance? a. $7,000 b. $28,000 c. $33,400 d. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts