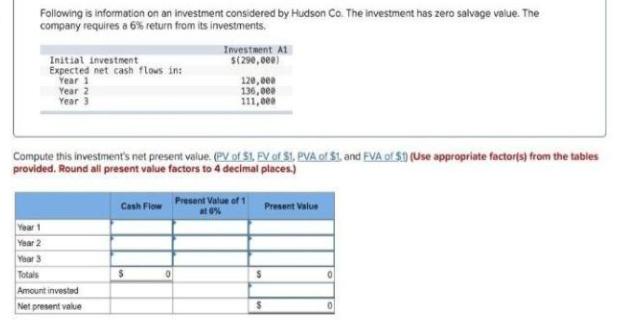

Question: Following is information on an investment considered by Hudson Co. The investment has zero salvage value. The company requires a 6% return from its

Following is information on an investment considered by Hudson Co. The investment has zero salvage value. The company requires a 6% return from its investments. Investment A1 S(290,0ee) Initial investnent Expected net cash flows in: 120,0e 136, 0ea 111,00a Year 1 Year 2 Year 3 Compute this investment's net present value. (PV of $1, EV of $1, PV of $1, and EVA of $0 (Use appropriate factor(s) from the tables provided. Round all present value factors to 4 decimal places.) Cash Flow Present Value of 1 at 0% Present Value Year 1 Year 2 Yoar 3 Totals Amount invested Net present value

Step by Step Solution

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Solution Cash Flow Present Value of 1 6 P... View full answer

Get step-by-step solutions from verified subject matter experts