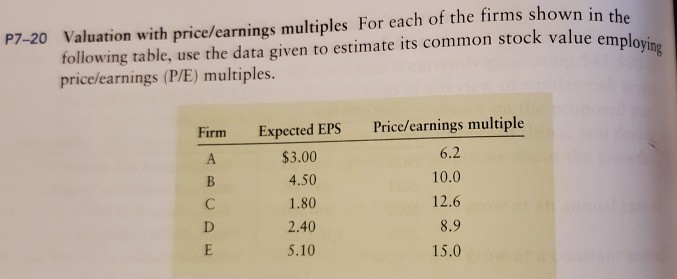

Question: following table, use the data given to estimate its common stock value employing P7-20 Valuation with price/earnings multiples for each of the firms shown in

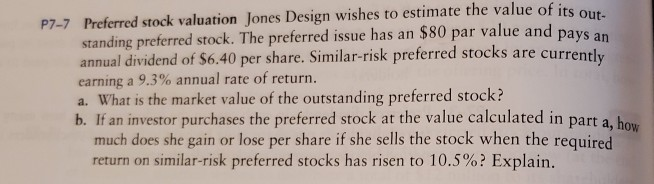

following table, use the data given to estimate its common stock value employing P7-20 Valuation with price/earnings multiples for each of the firms shown in the pricelearnings (P/E) multiples. Firm Price/earnings multiple A 6.2 10.0 B C D E Expected EPS $3.00 4.50 1.80 2.40 5.10 12.6 8.9 15.0 P7-7 Preferred stock valuation Jones Design wishes to estimate the value of its out standing preferred stock. The preferred issue has an $80 par value and pays an annual dividend of $6.40 per share. Similar-risk preferred stocks are currently earning a 9.3% annual rate of return. a. What is the market value of the outstanding preferred stock? b. If an investor purchases the preferred stock at the value calculated in part a, how much does she gain or lose per share if she sells the stock when the required return on similar-risk preferred stocks has risen to 10.5%? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts