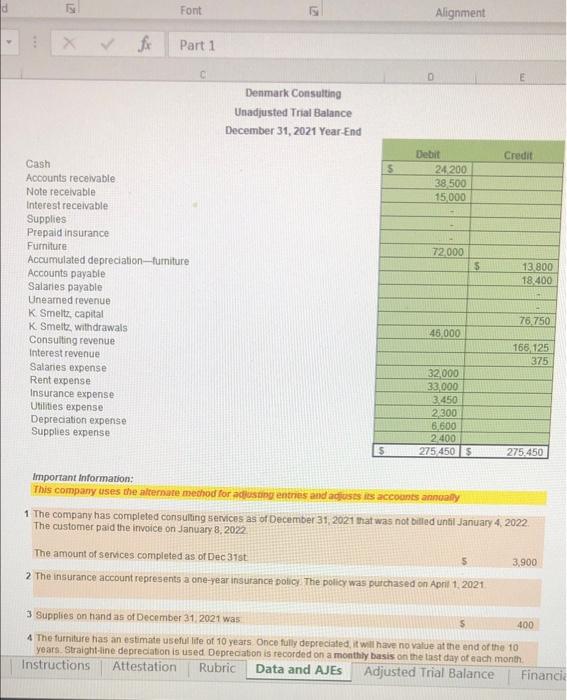

Question: Font Alignment fe Part 1 0 E Denmark Consulting Unadjusted Trial Balance December 31, 2021 Year-End Credit 5 Debit 24 200 38 500 115.000 72.000

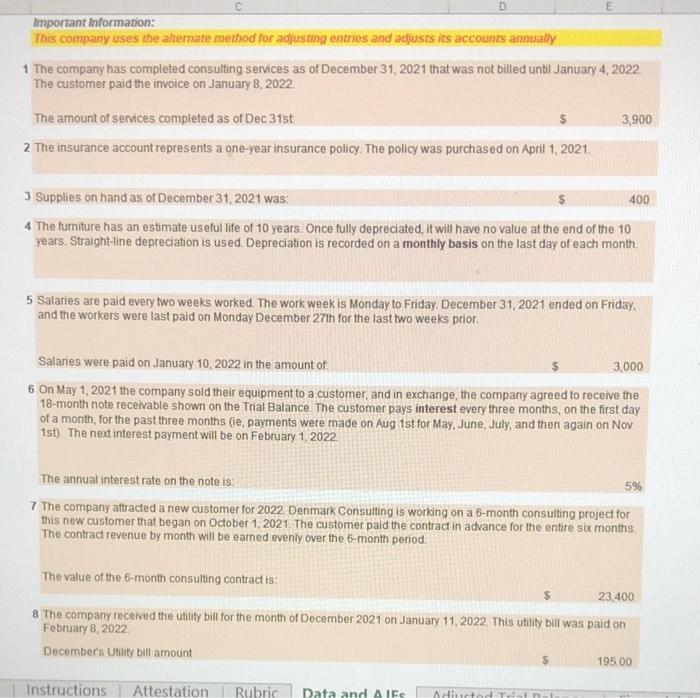

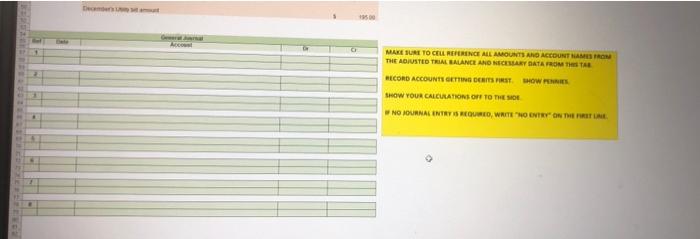

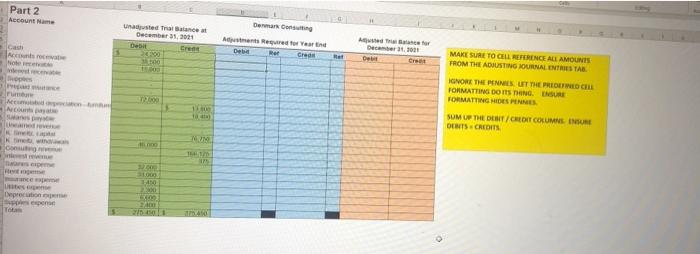

Font Alignment fe Part 1 0 E Denmark Consulting Unadjusted Trial Balance December 31, 2021 Year-End Credit 5 Debit 24 200 38 500 115.000 72.000 $ 13 800 18.400 Cash Accounts receivable Note receivable Interest receivable Supplies Prepaid insurance Furniture Accumulated depreciation-furniture Accounts payable Salaries payable Unearned revenue K Smeltz, capital K. Smeltz, withdrawals Consulting revenue Interest revenue Salaries expense Rent expense Insurance expense Utilities expense Depreciation expense Supplies expense 76,750 45,000 166.125 375 32000 33.000 3.450 2.300 6.600 2.400 275 450 $ $ 275.450 Important Information: This company uses the alternate method for adjusting entries and adjusts its accounts annually 1 The company has completed consulting services as of December 31, 2021 that was not billed until January 4, 2022. The customer paid the invoice on January 8, 2022 The amount of services completed as of Dec 31st 5 3,900 2 The insurance account represents a one-year Insurance policy The policy was purchased on April 1, 2021 3 Supplies on hand as of December 31, 2021 was 5 400 4 The furniture has an estimate useful life of 10 years. Once fully deprecated, it will have no value at the end of the 10 years. Straight-line depreciation is used Depreciation is recorded on a monthly basis on the last day of each month Instructions Attestation Rubric Data and AJES Adjusted Trial Balance Financil D C Important Information: This company uses the attemate method for adjusting entries and adjusts its accounts annually 1 The company has completed consulting services as of December 31, 2021 that was not billed until January 4, 2022 The customer paid the invoice on January 8, 2022 3.900 The amount of services completed as of Dec 31st 2 The insurance account represents a one-year insurance policy. The policy was purchased on April 1, 2021 3 Supplies on hand as of December 31, 2021 was 400 4 The furniture has an estimate useful life of 10 years Once fully depreciated, it will have no value at the end of the 10 years. Straight-line depreciation is used Depreciation is recorded on a monthly basis on the last day of each month 5 Salaries are paid every two weeks worked. The work week is Monday to Friday, December 31, 2021 ended on Friday, and the workers were last paid on Monday December 27th for the last two weeks prior Salaries were paid on January 10, 2022 in the amount of 3.000 6 On May 1, 2021 the company sold their equipment to a customer, and in exchange the company agreed to receive the 18-month note receivable shown on the Trial Balance. The customer pays interest every three months, on the first day of a month, for the past three months (le, payments were made on Aug 1st for May June July, and then again on Nov 1st). The next interest payment will be on February 1 2022 The annual interest rate on the note is: 5% 7 The company attracted a new customer for 2022 Denmark Consulting is working on a 6-month consulting project for this new customer that began on October 1, 2021. The customer paid the contract in advance for the entire six months The contract revenue by month will be earned evenly over the 6-month period. The value of the 6-month consulting contract is: 23.400 8 The company received the utility bill for the month of December 2021 on January 11, 2022. This utility bill was paid on February 8, 2022 December's Utility bill amount 195.00 Instructions Attestation Rubric Data and AIF Adi 1950 MAKE SURE TO CELL REFERENCE ALL AMOUNTS AND ACCOUNTAMS FROM THE ADJUSTED TRIAL BALANCE AND NECESARY DATA FROM THE RECORD ACCOUNTS GETTING DRITSIST HOW SHOW YOUR CALCULATIONS OFF TO THESE NO JOURNAL ENTRY SHOREO, WRITE TO TRY ON THE FRITURE Part 2 Account Name usted Trace December 31, 2011 De Cren 2000 Dermanos Anteed for year Deba Rer Gren cach Rel Dec. De Creet hole MAKE SURE TO CELL REFERENCE ALL AMOUNTS FROM THE ADJUSTING MURAL ENTRIES TAB IGNORE THE PENNES UT THE PRED FORMATTING DOING ENSURE FORMATTING MOES PENNES SUM UP THE DEBIT CREDIT COLUMNS DENTS CREDITS Acu 1 dre Gang mm 10 Deprecation pen Tota BLAME RA W MALAM Attestation Ru Data and AJES Adjusted Trial Balance Financial Statements Rewing and Sub -- - 5 TE 27 FA Date Accounts Dr 12 Cr MAKE SURE TO CELL REFERENCE ALL AMOUNTS FROM THE JOURNAL ADJUSTING ENTRIES AND ACCOUNT TITLES FROM THE ADJUSTED TRIAL BALANCE SHOW PENNIES WHERE APPLICABLE 30 11 12 13 14 15 16 17 TA 19 20 23 22 23 M 25 26 27 Subsequent Cash Entries TH Reversing and subsequent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts