Question: Font Alignment Number Styles Cells A2 ABC Company reported the following Income Statement: F G H K L M Credits 12/31/X1 Cash Receivables Investment in

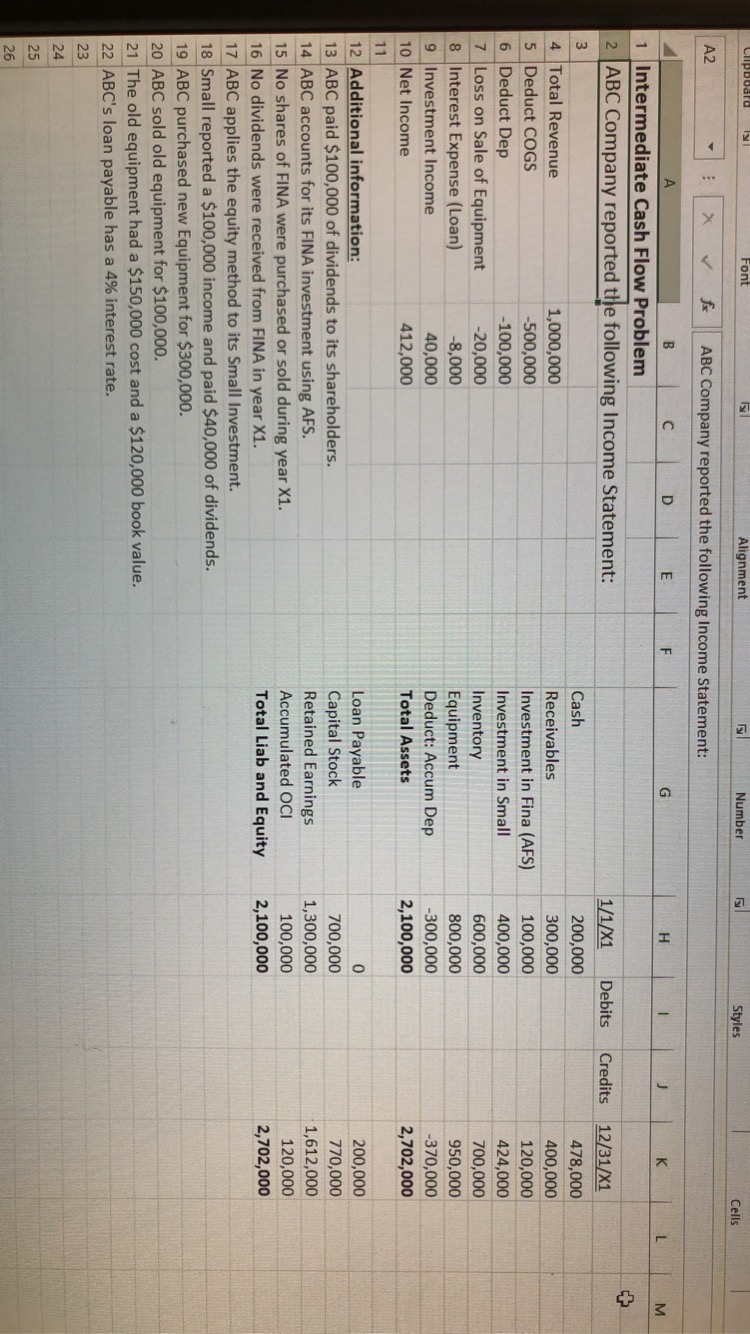

Font Alignment Number Styles Cells A2 ABC Company reported the following Income Statement: F G H K L M Credits 12/31/X1 Cash Receivables Investment in Fina (AFS) Investment in Small Inventory Equipment Deduct: Accum Dep Total Assets 1/1/X1 Debits 200,000 300,000 100,000 400,000 600,000 800,000 -300,000 2,100,000 478,000 400,000 120,000 424,000 700,000 950,000 -370,000 2,702,000 A B C D E 1 Intermediate Cash Flow Problem 2 ABC Company reported the following Income Statement: 3 4 Total Revenue 1,000,000 5 Deduct COGS -500,000 6 Deduct Dep -100,000 7 Loss on Sale of Equipment -20,000 8 Interest Expense (Loan) -8,000 9 Investment Income 40,000 10 Net Income 412,000 11 12 Additional information: 13 ABC paid $100,000 of dividends to its shareholders. 14 ABC accounts for its FINA investment using AFS. 15 No shares of FINA were purchased or sold during year X1. 16 No dividends were received from FINA in year X1. 17 ABC applies the equity method to its Small Investment. 18 Small reported a $100,000 income and paid $40,000 of dividends. 19 ABC purchased new Equipment for $300,000. 20 ABC sold old equipment for $100,000. 21 The old equipment had a $150,000 cost and a $120,000 book value. 22 ABC's loan payable has a 4% interest rate. 0 Loan Payable Capital Stock Retained Earnings Accumulate Total Liab and Equity 700,000 1,300,000 100,000 2,100,000 200,000 770,000 1,612,000 120,000 2,702,000 23 24 25 26 Font Alignment Number Styles Cells A2 ABC Company reported the following Income Statement: F G H K L M Credits 12/31/X1 Cash Receivables Investment in Fina (AFS) Investment in Small Inventory Equipment Deduct: Accum Dep Total Assets 1/1/X1 Debits 200,000 300,000 100,000 400,000 600,000 800,000 -300,000 2,100,000 478,000 400,000 120,000 424,000 700,000 950,000 -370,000 2,702,000 A B C D E 1 Intermediate Cash Flow Problem 2 ABC Company reported the following Income Statement: 3 4 Total Revenue 1,000,000 5 Deduct COGS -500,000 6 Deduct Dep -100,000 7 Loss on Sale of Equipment -20,000 8 Interest Expense (Loan) -8,000 9 Investment Income 40,000 10 Net Income 412,000 11 12 Additional information: 13 ABC paid $100,000 of dividends to its shareholders. 14 ABC accounts for its FINA investment using AFS. 15 No shares of FINA were purchased or sold during year X1. 16 No dividends were received from FINA in year X1. 17 ABC applies the equity method to its Small Investment. 18 Small reported a $100,000 income and paid $40,000 of dividends. 19 ABC purchased new Equipment for $300,000. 20 ABC sold old equipment for $100,000. 21 The old equipment had a $150,000 cost and a $120,000 book value. 22 ABC's loan payable has a 4% interest rate. 0 Loan Payable Capital Stock Retained Earnings Accumulate Total Liab and Equity 700,000 1,300,000 100,000 2,100,000 200,000 770,000 1,612,000 120,000 2,702,000 23 24 25 26

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts