Question: Fooble, Inc. has a manufacturing operation with a contribution margin of $40 per unit. The tax rate is 21% and its current income before taxes

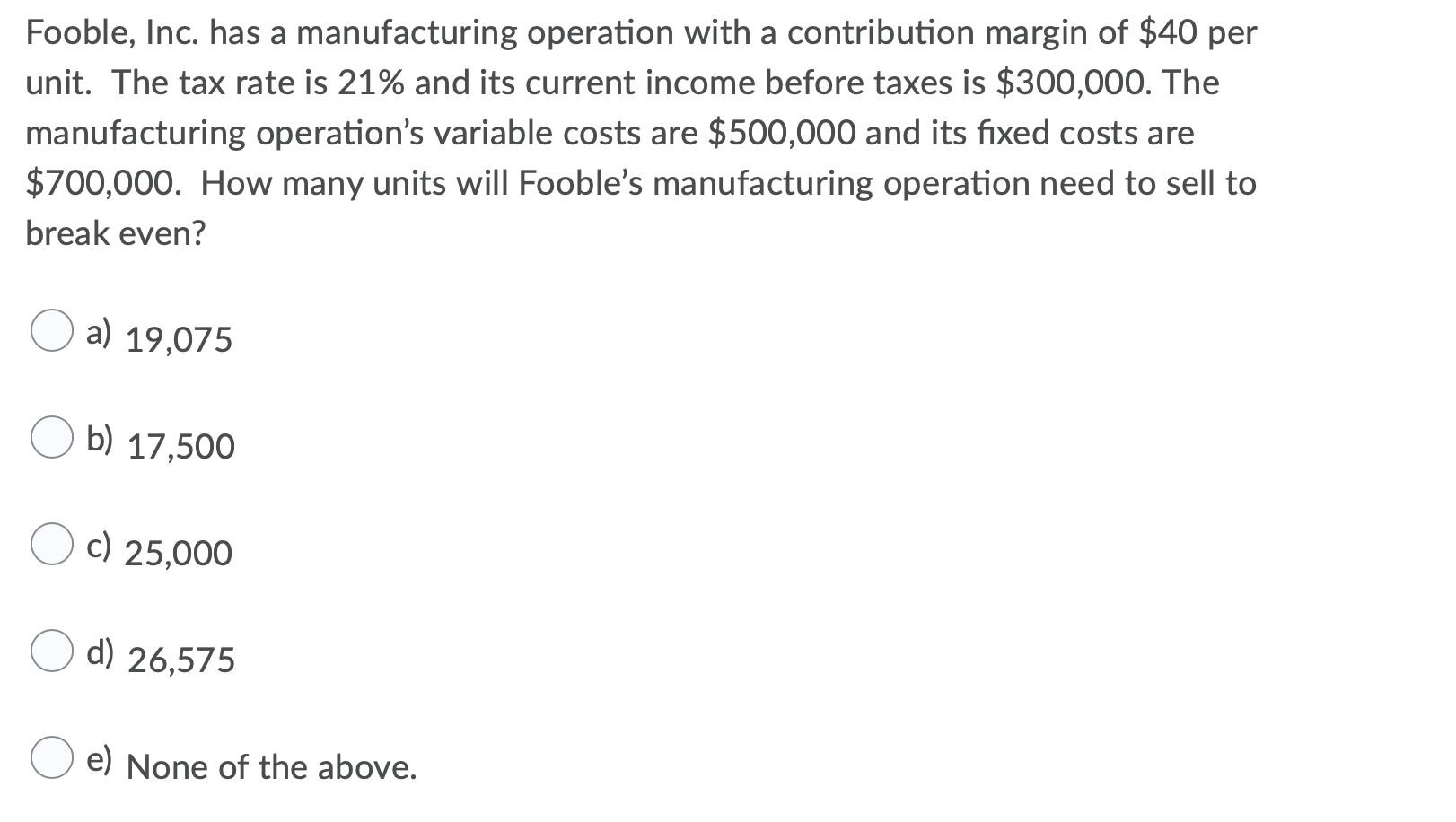

Fooble, Inc. has a manufacturing operation with a contribution margin of $40 per unit. The tax rate is 21% and its current income before taxes is $300,000. The manufacturing operation's variable costs are $500,000 and its fixed costs are $700,000. How many units will Fooble's manufacturing operation need to sell to break even? a) 19,075 b) 17,500 c) 25,000 d) 26,575 e) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts